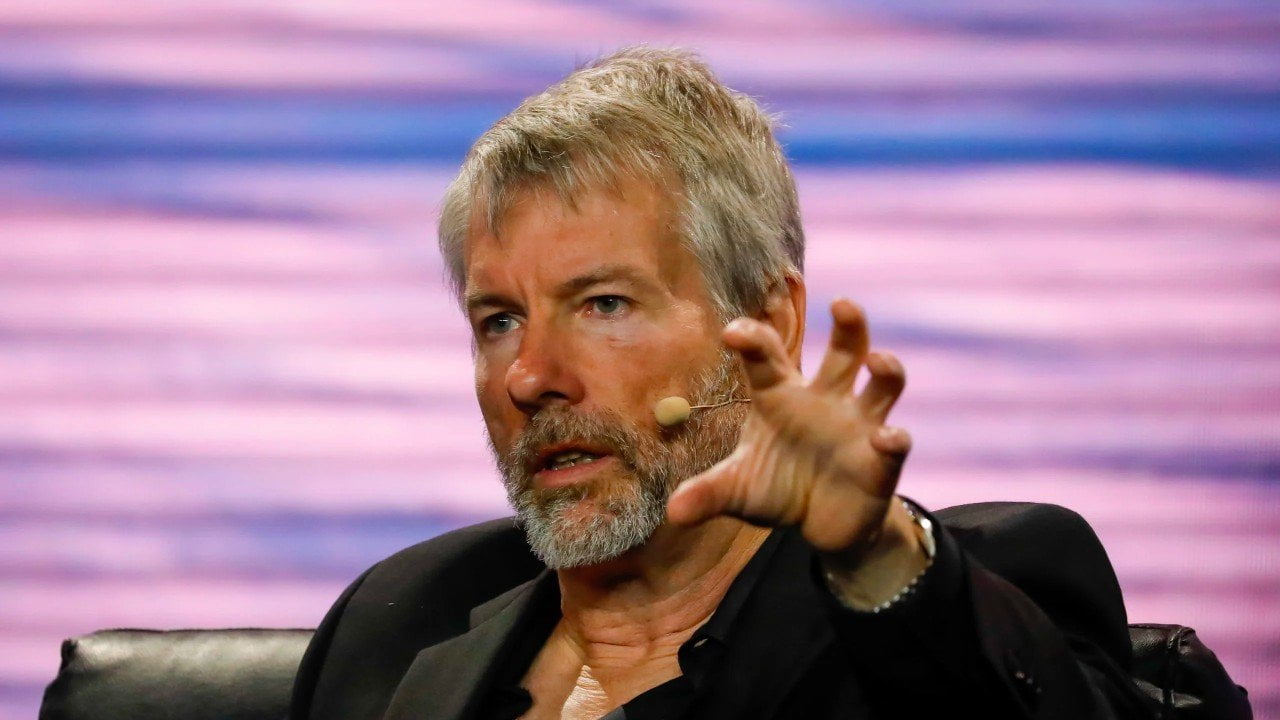

Michael Saylor, Executive Chairman of Strategy and one of the most prominent corporate Bitcoin advocates, has introduced a bold vision for nation-states: a fully regulated, Bitcoin-backed digital banking system. Speaking at the Bitcoin MENA conference in Abu Dhabi, Saylor argued that countries could attract trillions of dollars in global capital by combining Bitcoin reserves with tokenized credit markets to offer high-yield, low-volatility digital accounts.

According to Saylor, such a system could redefine global banking by delivering stronger returns than traditional deposit accounts while remaining compliant within national regulatory frameworks.

The Global Yield Problem in Traditional Banking

Saylor highlighted a growing dissatisfaction with traditional banking yields across major economies. In regions such as Japan, Europe, and Switzerland, standard bank deposits offer near-zero returns. Even euro-based money market funds provide only around 150 basis points, while US money market rates hover near 400 basis points.

This lack of attractive yield, Saylor believes, is what pushes investors toward corporate bond markets and alternative financial instruments. In his view, if conventional banking deposits were competitive, the corporate bond market would not have expanded so aggressively.

Inside the Bitcoin-Backed Digital Account Model

The structure proposed by Saylor involves a fund composition where approximately 80% consists of tokenized digital credit instruments and 20% remains in fiat currency. An additional 10% reserve buffer would be layered on top to further reduce volatility risks.

Most critically, the system would rely on Bitcoin-backed overcollateralization at a 5:1 ratio, held by a sovereign or treasury entity. If deployed through a regulated banking institution, this model could offer significantly higher yields while maintaining structural stability.

Saylor estimates that a nation adopting this framework could attract between $20 trillion and $50 trillion in capital flows, potentially becoming a global hub for digital banking.

Strategy’s Bitcoin Accumulation and STRC Experiment

Saylor’s proposal follows Strategy’s latest major Bitcoin acquisition, bringing its total holdings to 660,624 BTC. Alongside this accumulation, the company has also introduced STRC, a Bitcoin-linked preferred financial product offering variable yields near 10%. While STRC has quickly reached a multibillion-dollar valuation, it has also sparked debates around long-term liquidity and stability.

Volatility Remains the Core Debate

Despite Bitcoin’s exceptional long-term performance, its short-term price volatility continues to fuel skepticism around Bitcoin-backed high-yield products. While supporters view it as the foundation of a new digital financial era, critics warn that volatility could challenge the sustainability of such models under stress conditions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.