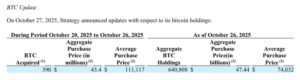

Michael Saylor-led Strategy is steadfastly continuing its Bitcoin accumulation strategy. The company added approximately 45 million USD worth of new Bitcoin to its portfolio by purchasing 390 BTC at an average price of 117,111 USD.

A New Bitcoin Move from MicroStrategy

Strategy well-known among institutional investors as a symbol of confidence in Bitcoin — is once again in the crypto spotlight. The company announced last week that it had bought 390 Bitcoin, with the total value at about 45 million USD. This purchase took place during a period of Bitcoin price volatility and underscores the company’s long-term belief in the asset.

This latest purchase is part of Michael Saylor’s long-standing strategy that positions Bitcoin as a treasury reserve asset. With this addition, the company’s total Bitcoin holdings have now surpassed 190,000 BTC, reinforcing its status as the public company with the largest Bitcoin portfolio in the world.

The average purchase price for this round was $117,111 per BTC, while the company’s overall average cost basis remains around $36,000. This suggests a strong long-term profitability potential if Bitcoin continues its upward trajectory.

Institutional Adoption Continues

This move by Strategy further strengthens institutional confidence in Bitcoin. Saylor’s approach aims to convert excess corporate capital into BTC as a hedge against inflation and a long-term store of value.

Analysts note that such large-scale corporate purchases can improve market sentiment in the short term and potentially trigger brief upward corrections in Bitcoin’s price.

Macro Outlook and 2025 Perspective

At the macro level, institutional accumulation of this scale provides a stabilizing effect for the crypto market amid increasing regulatory pressure and global economic uncertainty heading into 2025.

MicroStrategy’s ongoing acquisitions reinforce Bitcoin’s reputation as a “safe-haven asset” and strengthen its status as a digital reserve within traditional finance. At the time of writing, Bitcoin was trading around $115,300, with Saylor’s strategy remaining firmly focused on long-term accumulation despite market volatility.

Assessment

Strategy’s latest purchase once again demonstrates the company’s unwavering confidence in Bitcoin. This move highlights the continued interest of institutional investors and reinforces the view that Bitcoin has become a permanent fixture in the global financial system.

While short-term price volatility may persist, steady accumulation by major institutions like Strategy continues to lay the groundwork for long-term bullish momentum in the Bitcoin market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.