SharpLink Gaming, as one of the largest institutional Ether (ETH) treasuries, announced the approval of a $1.5 billion share buyback program. The company described this step as part of its “disciplined capital markets strategy.” No buybacks have yet taken place.

Statement from the CEO

Co-CEO Joseph Chalom stated that buybacks would be considered particularly when the company’s shares are trading at or below the net asset value of its ETH holdings. Chalom said:

“This program gives us the flexibility to act quickly and decisively when these conditions arise.”

SharpLink’s strategy focuses on accumulating and staking ETH in order to increase the ETH ratio per share.

Ethereum-Centered Treasury Strategy

The betting platform SharpLink recently transitioned to an Ethereum-based institutional treasury model. In May, Ethereum co-founder Joseph Lubin was nominated as the company’s chairman. Lubin emphasized that ETH treasuries are critical for the ecosystem:

“Adopting ETH as a primary treasury reserve asset is vital for maintaining the supply-demand balance.”

Market Position

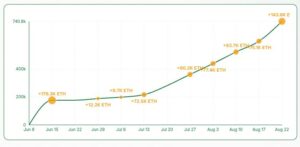

Although SharpLink holds 740,800 ETH (around $3.14 billion), it has not yet reached the largest Ether treasury in the sector. BitMine tops the list with 1.5 million ETH (around $6.47 billion).

Meanwhile, SharpLink currently holds approximately $600 million in unrealized gains thanks to ETH’s price appreciation.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.