A notable movement occurred today in wallets belonging to Mt. Gox, once the largest crypto exchange in history. Closely monitored due to its long-running bankruptcy process, the exchange transferred a total of 10,608 BTC (approximately $956 million) to an unknown wallet. Shortly afterward, 185 BTC was moved from Mt. Gox’s cold wallet to its hot wallet. Transfers of this scale have once again fueled speculation that a new repayment wave to creditors may be approaching.

Details of the 10,608 BTC Mega Transfer

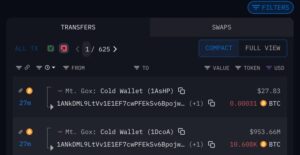

According to data from Arkham Intelligence, Mt. Gox carried out two separate transfers late Monday night:

- 10,422 BTC was sent to an untagged wallet.

- 5 BTC was transferred to the exchange’s own hot wallet.

The large transaction made to the unlabelled wallet starting with address “1ANkD…” created uncertainty in the market, as it reveals no information about the recipient or purpose. Historically, Mt. Gox’s Bitcoin movements often occurred shortly before repayment distributions. For this reason, the community is debating whether this transfer is part of preparations for a new payout cycle. However, it has not yet been confirmed whether this transaction is related to creditor repayments.

Why Is Mt. Gox Still a Critical Factor?

Mt. Gox once processed nearly 70% of all global Bitcoin transactions in the early 2010s. However, after a massive hack in 2014 resulted in the loss of 850,000 BTC, the company filed for bankruptcy protection.

Since then, the rehabilitation plan has included:

- 142,000 BTC

- 143,000 BCH

- approximately 69 billion yen to be repaid to creditors.

Although partial repayments began in July 2024, the process has been delayed multiple times. The rehabilitation trustee’s most recent update postponed the repayment deadline to October 2026, marking the third major delay since 2023. While some creditors confirmed receiving payouts through Kraken and Bitstamp, the overall distribution continues to progress slowly.

Mt. Gox Still Holds 34,689 BTC

Arkham data shows that the bankrupt exchange still controls 34,689 BTC (worth around $3.1 billion). To continue the repayment process, these assets are expected to be moved into different wallets or sent to exchanges.

For this reason, every move made by Mt. Gox is closely watched by the market. Especially during periods of heightened Bitcoin volatility, such large transfers can significantly influence investor sentiment.

What Could Be the Market Impact?

Historically, large BTC transfers from Mt. Gox have triggered short-term volatility in Bitcoin’s price. There are two main reasons for this:

- Concerns that creditors may sell once they receive payouts

- The possibility of Mt. Gox transferring assets to exchanges

It remains unclear whether today’s transfers will continue or whether they signal preparations for upcoming creditor payments. However, the $956 million transaction stands as a significant warning signal for the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.