ETF data from November 20 shows a clear shift in crypto market sentiment. Solana ETFs attracted strong inflows, while Bitcoin and Ethereum faced heavy outflows. This trend highlights the rapid change in investor preferences.

Strong Inflow Momentum in Solana ETFs

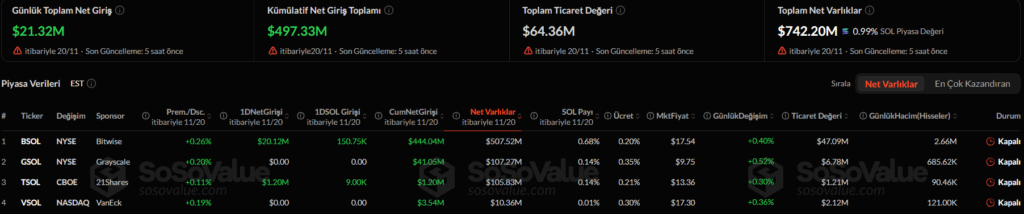

Solana ETFs started the day with a notable rise in demand and recorded a total net inflow of 21.32 million dollars. This inflow represented the strongest positive performance across the crypto ETF landscape. Additionally, Bitwise’s BSOL product led the segment with 20.12 million dollars in daily inflows. On the other hand, Grayscale and 21Shares products showed limited movement, yet the recovery trend in SOL products continued. This allowed Solana ETFs to reach a cumulative net inflow of 497.33 million dollars. Investors continue to view this segment as a compelling alternative in the blockchain ecosystem.

Furthermore, total SOL ETF assets climbing to 742.20 million dollars signals the potential continuation of this trend. Although the crypto market remains volatile, Solana ETF flows show a more stable direction.

Bitcoin ETFs Face a Sharp Wave of Outflows

Bitcoin ETFs experienced heavy outflows on November 20. The total net outflow of 903.11 million dollars reflected investors’ increasingly cautious stance. However, significant movements in IBIT, FBTC, and GBTC widened the scale of the selloff. On the other hand, these data indicate that appetite for BTC exposure weakened across crypto ETFs. Meanwhile, total Bitcoin ETF assets stand at 113.02 billion dollars.

Key outflows in Bitcoin ETFs included:

• 355.50 million dollars from BlackRock’s IBIT

• 190.37 million dollars from Fidelity’s FBTC

• 199.35 million dollars from Grayscale’s GBTC

Following these outflows, investors shifted their focus toward short-term correction risks. Additionally, the movement signals a rise in hedging strategies across institutional desks.

Ethereum ETFs Under Continued Selling Pressure

Ethereum ETFs also ended the day with a 261.59 million-dollar net outflow. BlackRock’s ETHA product recorded the largest move with a 122.60 million-dollar outflow. Furthermore, Fidelity and VanEck products remained in negative territory. Meanwhile, ETH market dynamics have faced renewed pressure as ETF flows turned downward in recent weeks.

Although cumulative net inflows in Ethereum ETFs stand at 12.58 billion dollars, daily outflows highlight investors’ short-term defensive positioning. The contrast between segments underscores how fast rotations now occur inside the crypto ETF market.

Overall Outlook

The ETF data from November 20 shows Solana standing out with strong inflows, while Bitcoin and Ethereum came under heavy selling pressure. Additionally, investor interest appears to be shifting toward alternative blockchain assets, hinting at a new potential trend in the crypto ETF market. On the other hand, the acceleration of institutional activity suggests that ETF flows will play an even more decisive role in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.