Stablecoins, which have long been symbols of stability in the crypto world, are now entering a new phase. Although major players like USDT and USDC continue to lead, the market is still maturing. This still presents significant opportunities for projects that move quickly, integrate with new networks, and embark on the right strategies.

The first part of the comprehensive analysis series prepared by Sonic SVM Research covers the infrastructure of this transformation in full detail. In this article, we will summarize the research and prepare readers for both the current landscape and future scenarios.

Transformation Driven by Regulation and Institutional Winds

The year 2025 marked a turning point for stablecoins. The GENIUS Act passed in the U.S. provided the first comprehensive regulatory framework for fiat-backed stablecoins. Hong Kong’s “Stablecoin Ordinance” law and the European Union’s MiCA regulation made these assets more legitimate and accessible globally.

If you want to read the full article by Sonic SVM Research on this topic, click here.

On the institutional side, momentum is also remarkable. Alongside giants like PayPal, Santander, and Deutsche Bank, Visa and Stripe are adapting their infrastructures to be stablecoin-compatible. In China, tech giants like JD.com and Ant Group have started licensing processes. One of the most notable developments is the stablecoin initiative called USD1, launched through World Liberty Financial Inc., owned by U.S. President Donald Trump’s family.

Market Is Not Yet Saturated, Competition Intensifies

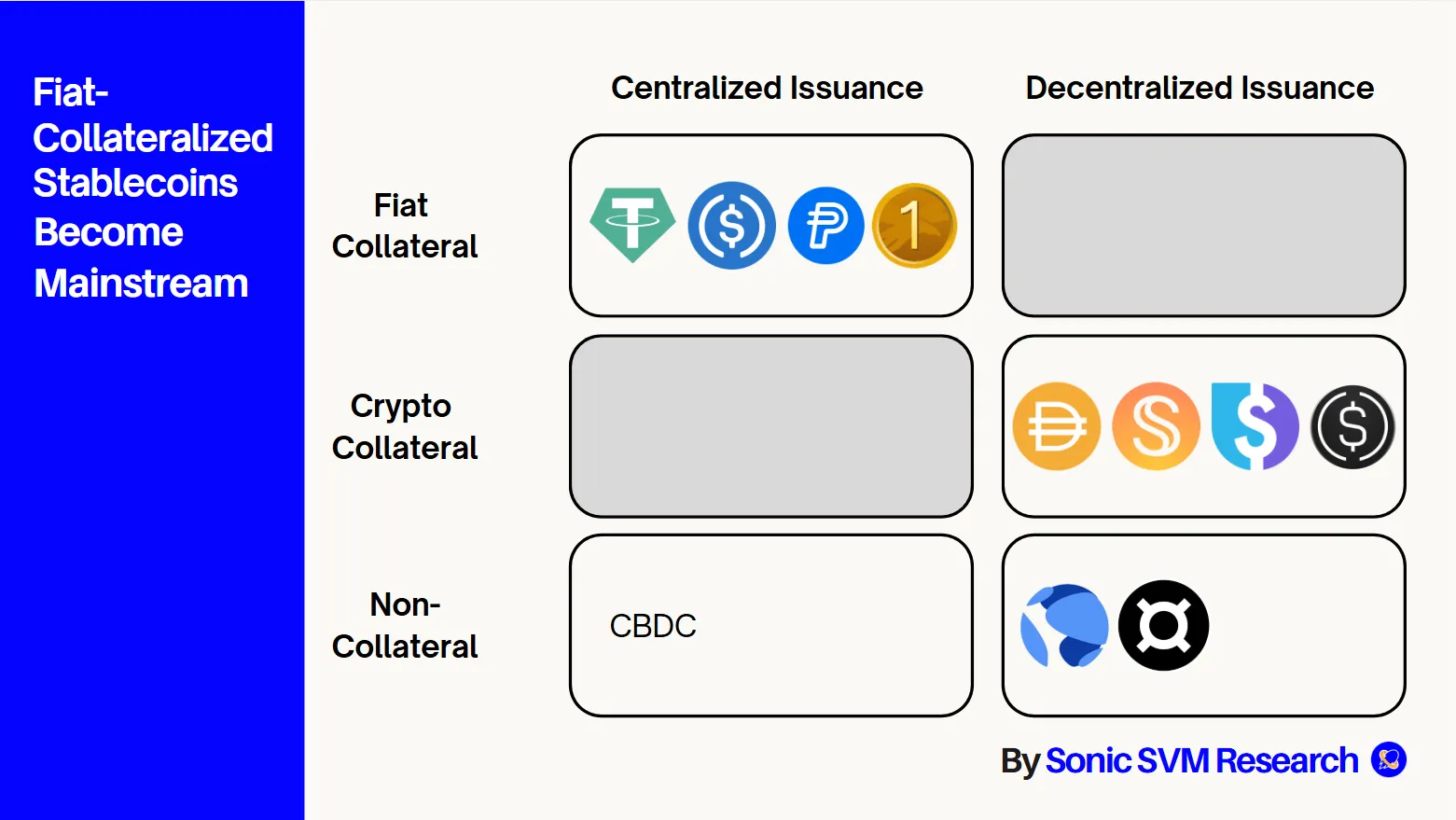

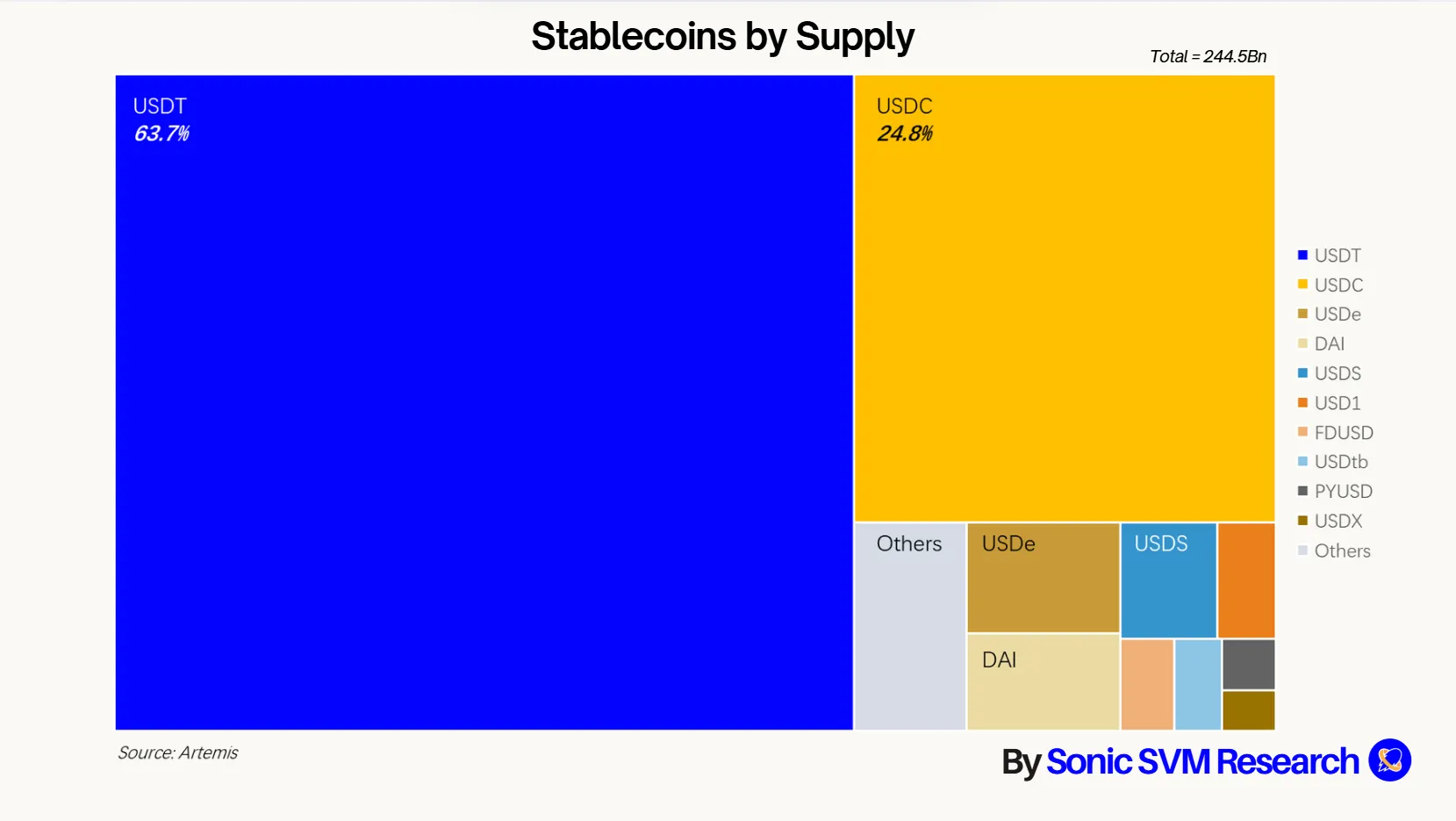

Today, there are over 150 stablecoins, but USDT and USDC dominate 88.5% of the total market. Still, new projects like USDe, USDtb, USD1, and USDS are seeking market share through on-chain integrations and differentiated distribution strategies.

The research reveals with data how Ethereum and Tron networks stand out in this race and where stablecoin distribution is concentrated across ecosystems. While Ethereum serves as the heart of decentralized finance, Tron has become dominant in the daily transactions of USDT.

The most striking takeaway from Sonic SVM Research is this: for new players to succeed, merely creating supply is not enough. They must also be strong in real volume, transaction density, and user trust metrics. This is possible not only through chain integration but also with user experience, regulatory compliance, and innovative distribution strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.