UK-based banking giant Standard Chartered has significantly lowered its year-end forecast for XRP following the sharp downturn in crypto markets in February. The bank revised its 2026 price target from $8 to $2.80, marking a roughly 65% downward adjustment.

The revision reflects a broader reassessment of risk across the digital asset sector as volatility reshapes institutional expectations.

Short-Term Pressure May Persist

Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, described recent price action across crypto markets as particularly challenging in a note to investors. According to Kendrick, downside risks have increased not only for XRP but for the asset class as a whole.

He indicated that further near-term weakness cannot be ruled out, prompting the bank to adopt a more conservative outlook across major cryptocurrencies. The recalibration signals a shift toward caution as liquidity conditions and investor sentiment evolve.

Sharp Pullback in XRP ETFs

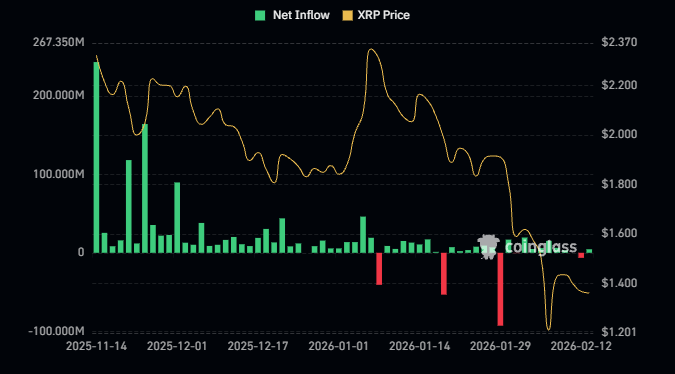

XRP, which holds a market capitalization of approximately $90 billion, entered 2026 with strong momentum. In the first week of the year alone, the asset gained around 25%, supported by inflows into XRP-focused exchange-traded funds and favorable regulatory developments.

On January 5, total assets locked in XRP ETFs reached a record $1.6 billion. However, by February 13, that figure had fallen to just over $1 billion, representing an approximate 40% decline. The contraction in ETF exposure appears to have played a role in the bank’s more cautious price outlook.

Targets Lowered Across Major Cryptocurrencies

The downward revisions extend beyond XRP. Standard Chartered also cut its year-end Bitcoin forecast from $150,000 to $100,000. Ethereum’s target was reduced from $7,000 to $4,000, while Solana’s projection was lowered from $250 to $135.

Kendrick noted that XRP could track performance patterns similar to Ethereum. Both assets, he suggested, may benefit over time from growth in the stablecoin ecosystem and the tokenization of real-world assets.

Overall, the updated projections underscore a more measured institutional stance toward digital assets amid heightened volatility and shifting macro conditions.

This content is for informational purposes only and does not constitute investment advice. Cryptocurrency markets carry significant risk, and individuals should conduct their own research before making financial decisions.

You can present your own thoughts as comments about the topic. Moreover, you can follow us on Telegram and YouTube channels for this kind of news.