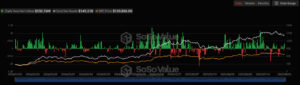

On September 2, notable activity was observed in the crypto markets. Spot Bitcoin ETFs recorded a total net inflow of $332.76 million. The largest inflow came from Fidelity’s Bitcoin ETF (FBTC), which saw $133 million.

This indicates that investors have confidence in the potential upward movement of BTC’s price, with institutional interest in Bitcoin continuing to grow. Recently, demand for crypto ETFs in the U.S. has been rising, and these strong inflows into Bitcoin are being seen as a positive signal for the market.

Headwinds for Ethereum ETFs

In contrast, Ethereum spot ETFs recorded a net outflow of $135.37 million on the same day, reflecting a lack of investor interest. Among the nine different Ethereum ETFs, none saw net inflows, with the largest outflow coming from Fidelity’s FETH ETF at $99.23 million.

Analysts suggest that this reflects investors’ cautious stance toward Ethereum’s short-term price performance. In particular, Ethereum’s network upgrades and staking yields may have fallen short of expectations, weakening investor interest.

Market Commentary

Experts note that the strong inflows into Bitcoin ETFs, despite outflows on the Ethereum side, demonstrate that institutional confidence is leaning more heavily toward BTC. This dynamic signals that Bitcoin could further strengthen its market dominance over Ethereum in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.