On June 18, 2025, spot Bitcoin ETFs saw a net inflow of $390.4 million, while spot Ethereum ETFs recorded $19.1 million in net inflows.

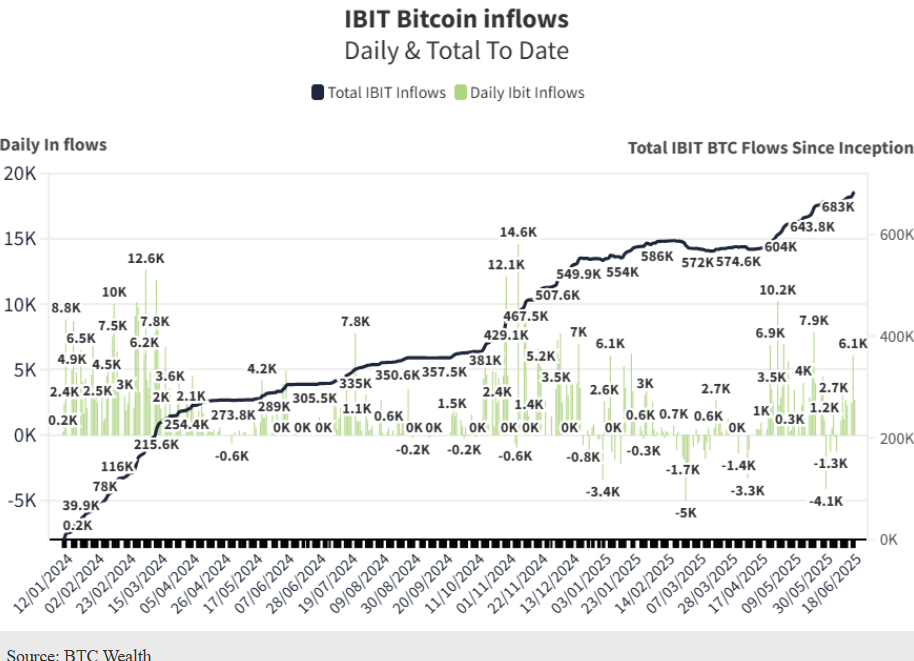

Institutional interest in U.S.-based spot Bitcoin ETFs gained renewed momentum on Wednesday, with a total net inflow of $390.4 million — nearly double the previous day’s amount. BlackRock’s iShares Bitcoin Trust (IBIT) led the way with a single-day inflow of $280 million, further cementing its dominance.

Robust Institutional Demand for Spot Bitcoin ETFs

Fidelity’s FBTC product also drew attention with over $100 million in inflows, signaling growing investor confidence and a stabilizing market. During this period, BlackRock added 2,861 new Bitcoins to its portfolio, bringing its total BTC holdings to 680,336.

Since the beginning of 2025, total net inflows into U.S. spot Bitcoin ETFs have reached $11.25 billion, underlining the continuing rise in institutional demand. Notably, Bitcoin ETF products have posted positive net inflows for eight consecutive trading days.

Bitcoin and Gold Strengthen Amid Geopolitical Tensions

Rising tensions between Iran and Israel have heightened risk perception in global markets. With potential interventions from the U.S. and the U.K., investors have turned to safe-haven assets. This climate has seen an uptick in both BTC ETF inflows and gold prices.

At the same time, BTC’s price held steady at the $104,000 level, maintaining its resilience. According to on-chain data, the STH/LTH Supply Ratio dropped to 15.7%, indicating reduced activity among short-term holders and continued confidence from long-term investors.

Federal Reserve Chairman Jerome Powell’s decision to maintain interest rates following the recent FOMC meeting has also reinforced a “wait-and-see” sentiment in the markets. Despite geopolitical risks, crypto assets continue to attract solid institutional interest.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.