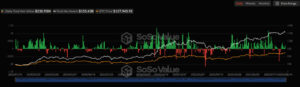

On August 14, 2025, U.S.-listed Spot Bitcoin ETFs recorded a total net inflow of $230.93 million. The majority of this inflow came from BlackRock’s iShares Bitcoin Trust (IBIT) fund, contributing $524 million.

These strong inflows led by BlackRock once again highlighted the rapidly growing appetite of institutional investors for Bitcoin. Analysts note that this demand not only strengthens price stability but also supports long-term bullish expectations. Spot ETFs provide investors with regulated and reliable access to Bitcoin, thereby increasing market depth.

Record Inflows in Spot Ethereum ETFs

On the same day, Ethereum saw a historic inflow. Spot Ethereum ETFs recorded a total net inflow of $639.61 million, with $520 million of that coming from BlackRock’s iShares Ethereum Trust (ETHA) fund.

This strong demand for Ethereum ETFs indicates that the asset is positioned among institutional investors not just as an “alternative to Bitcoin,” but also as a strong leader with its own ecosystem and use cases. Experts believe that these inflows could have a significant upward impact on the price in the medium and long term.

Institutional Investor Interest on the Rise

Experts indicate that these data show institutional investor interest in crypto assets is rapidly increasing. Especially following the approval of spot ETFs in the U.S., pension funds, hedge funds, and large capital groups have been turning to these products.

BlackRock’s aggressive ETF strategy has boosted investor confidence and strengthened expectations of a “institutional rally” in the market. Investors believe that continued high inflows could drive Bitcoin and Ethereum prices to new highs in the medium to long term.