AI-driven analytics in digital asset markets continues to accelerate, and Surf has emerged as one of the most notable players in this domain. The company recently closed a 15-million-dollar funding round led by Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group. The investment will support the development of Surf 2.0 and expand the company’s institutional-grade product suite, underscoring growing demand for domain-specific intelligence in crypto research.

A Purpose-Built AI Model for Digital Asset Analysis

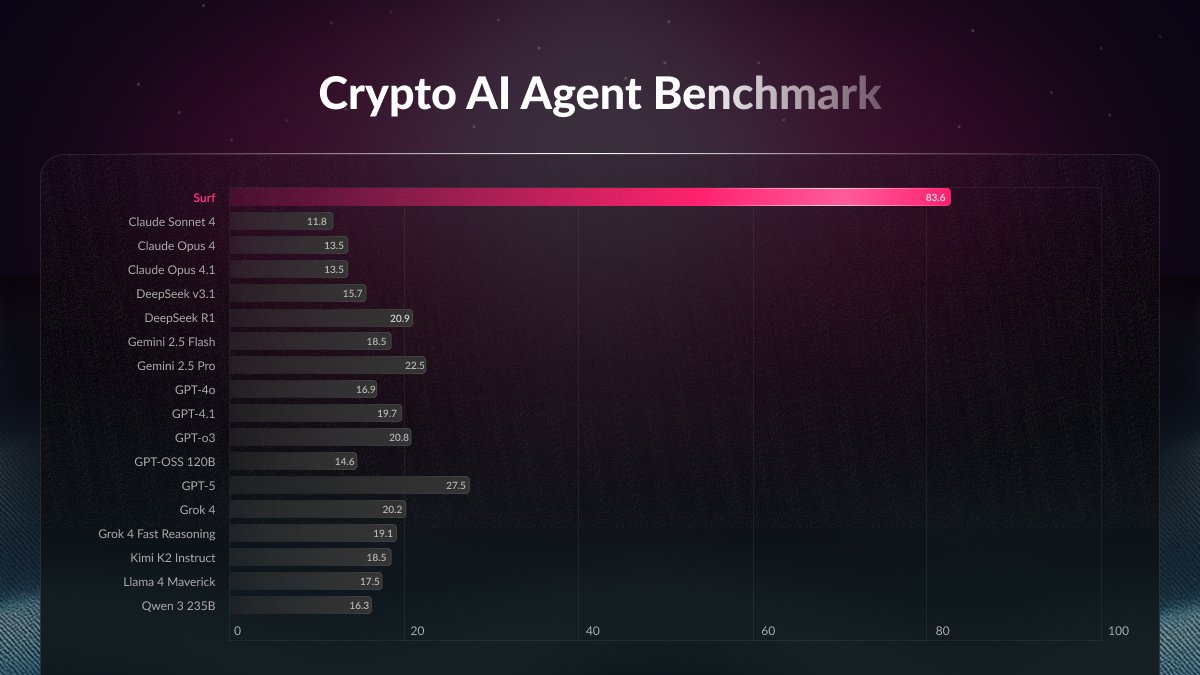

Surf’s first-generation system, Surf 1.0, was engineered specifically for digital asset evaluation—an approach that sets it apart from general-purpose models. Its performance, measured through the CAIA benchmark, demonstrates how effectively the model handles research tasks normally assigned to human analysts. According to internal assessments, Surf 1.0 delivers results up to four times more accurate than mainstream models such as GPT or Grok when applied to financial and blockchain-specific contexts.

These outcomes highlight a critical gap in the industry: broad AI models often struggle to interpret the financial reasoning and contextual nuance required in crypto markets, prompting analysts and institutions to seek out models built exclusively for this domain.

Multi-Agent Framework and Deep Data Integration

Surf’s architecture incorporates a multi-agent system that merges on-chain activity, market intelligence, social sentiment, and other high-velocity data sources into a unified analytical layer. This structure allows users to interact with complex datasets through a simple conversational interface, eliminating the friction typically associated with advanced market research.

Since its launch in July, Surf has achieved millions in annual recurring revenue, produced over one million research outputs, and maintained a monthly growth rate of fifty percent. Major exchanges, research firms, and institutional desks are already adopting the platform as a core analytical tool.

Surf 2.0 and Enterprise-Grade Expansion

The new funding will accelerate the rollout of Surf 2.0, which introduces enhanced models, expanded proprietary datasets, and automated agents capable of replicating multi-step analyst workflows. The company is also preparing the release of “Surf Enterprise,” a package designed to meet SOC 2 security and compliance requirements for institutional clients.

Redefining Trustworthy Intelligence in Crypto Markets

Demand for precise, context-aware analytics is rising across both retail and institutional segments. Surf’s co-founder Ryan Li emphasizes that the platform was designed to address the market’s urgent need for reliable insight in an environment where information moves rapidly. Pantera Capital has echoed this view, noting that specialized intelligence—not general AI—is what digital asset research truly requires.

What Is Surf?

Surf is an AI-driven analytics platform built for the digital asset ecosystem. Instead of navigating complex charts or datasets, users can obtain clear and accurate insights through Surf’s conversational interface.

Powered by custom data pipelines and domain-optimized models, the platform helps investors and institutions assess projects, monitor trends, identify risks, and make more informed decisions. By transforming fragmented market data into actionable intelligence, Surf establishes itself as a dependable analytical partner in the evolving crypto landscape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.