In recent days, growing suspicion surrounding Tether (USDT) has resurfaced across social media, especially regarding the company’s reserve structure and asset allocation. Claims suggesting that Tether holds substantial amounts of gold and Bitcoin and that a sharp decline in the value of these assets could weaken USDT’s 1:1 backing have intensified FUD-driven panic. Tether CEO Paolo Ardoino has broken his silence and responded to the allegations.

Tether’s Reserves and Equity Structure at the Center of the Debate

Several social media posts argued that Tether’s reserve structure is fragile and that significant volatility in gold and Bitcoin prices could destabilize USDT’s peg. These comments quickly escalated into a widespread FUD wave.

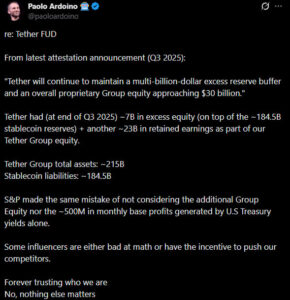

CEO Paolo Ardoino, addressing the issue, emphasized that critics were overlooking not only Tether’s reserves but also the company’s strong consolidated equity position. Referring to Tether’s Q3 2025 attestation report, Ardoino shared the following figures:

- Tether Group equity: approximately $7 billion

- Total stablecoin reserves: $184.5 billion

- Accumulated group profits: around $23 billion

Based on these numbers, Tether Group’s total assets amount to roughly $215 billion, while stablecoin liabilities stand at $184.5 billion. According to Ardoino, many social media commentators focused solely on reserve line items without accounting for this additional equity — resulting in a distorted picture of the company’s overall strength.

“We Earn $500 Million per Month From U.S. Treasuries”

Another key point highlighted by the CEO was Tether’s revenue streams. Ardoino stated that the company earns approximately $500 million in base monthly profit from U.S. Treasury holdings alone, which significantly strengthens its reserve balance. He noted that some analysts made assessments without including these revenue sources, leading to incorrect calculations and unnecessary FUD.

S&P Also Draws Criticism

Ardoino also criticized international credit rating agency S&P, stating that the institution made similar mistakes by failing to consider the consolidated equity position of Tether Group in its evaluations. The CEO added that some claims circulating on social media may not be “mathematical errors” but rather narratives driven by competitive motivations.

Ardoino stated:

“Some commentators look only at reserve items but ignore Tether Group’s total asset structure, accumulated equity, and stable revenue streams from Treasuries. Tether’s balance sheet strength is far greater than what is portrayed.”

Conclusion

The latest wave of FUD surrounding Tether highlights how incomplete or misleading assessments about reserve structures can rapidly spread across social media. The data provided by Tether shows that the company is supported not only by reserves but also by strong equity and robust revenue flows. CEO Paolo Ardoino’s statements indicate that most doubts surrounding USDT’s 1:1 peg are unfounded and that systemic liquidity risks remain low. However, given increasing competition in the stablecoin sector and rising regulatory pressure, debates around Tether are likely to continue in the near term.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.