Tether has minted $2 billion worth of new USDT on the TRC-20 network. With this move, the total USDT supply on the Tron blockchain has exceeded $80 billion, marking a significant milestone. Tron, known for its fast and low-cost transactions, is becoming increasingly dominant in the stablecoin market.

Tether Strengthens USDT Reserves on Tron

Tether regularly reinforces its reserves to maintain the peg of USDT to the US dollar. By holding the newly minted tokens in reserve, it ensures users can redeem their USDT for dollars when needed. Every USDT in circulation is backed one-to-one by assets held by Tether.

The recent $2 billion issuance was conducted exclusively on the Tron network, highlighting Tron’s advantages in transaction speed and low fees. This network offers a favorable environment for users handling large transfers. Additionally, Tether distributes USDT across multiple blockchains, including Tron and Ethereum, enhancing flexibility for both users and crypto exchanges.

USDT Supply on Tron Exceeds $80 Billion

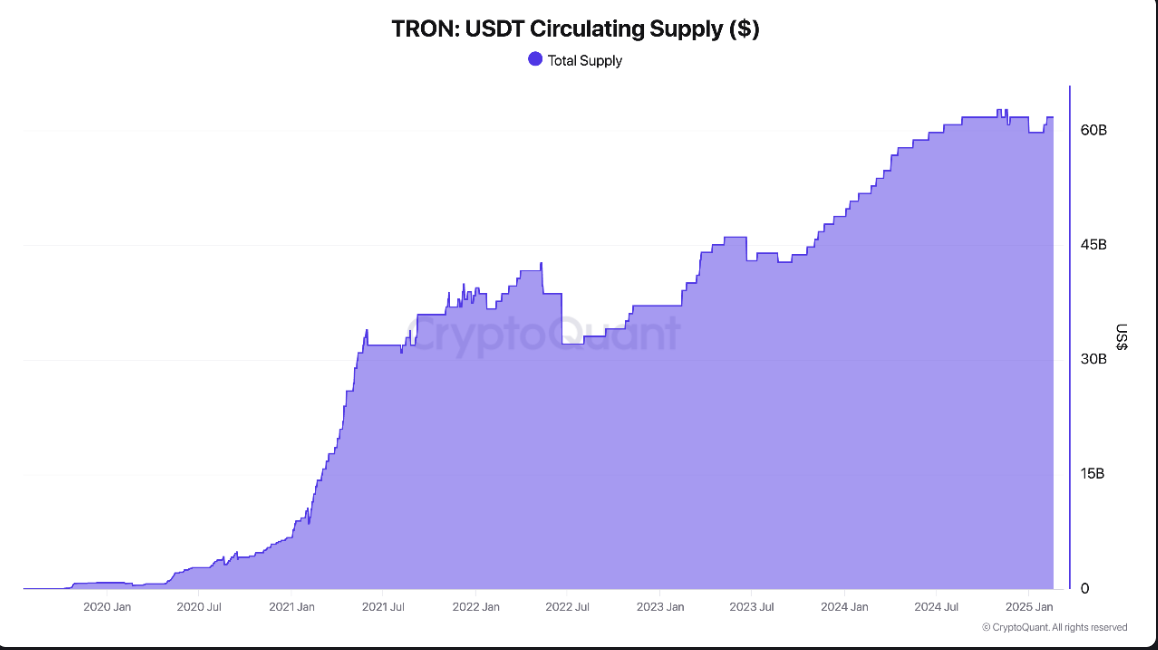

According to CryptoQuant, the total USDT supply on the TRC-20 network has surpassed $80 billion. This figure demonstrates ongoing growth on Tron, even during the slow market periods of 2022 and 2023. Tron’s USDT supply grew from $6.71 billion in 2021 to $39.41 billion, and from $59.76 billion in early 2025 to $80.76 billion recently.

On November 13, 2024, Tron surpassed Ethereum in total circulating USDT for the first time. This milestone shows investors prefer Tron for faster and cheaper transactions. The latest $2 billion issuance further underscores Tether’s confidence and strategic focus on Tron.

PSA: 1B USDt inventory replenish on Tron Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.

— Paolo Ardoino 🤖 (@paoloardoino) June 22, 2025

According to Paolo Ardoino, these USDT tokens are held in Tether’s treasury as inventory. This stockpile is prepared for future issuances and cross-chain swaps, enabling quick responses when users or exchanges want to swap USDT across networks.

Significant USDT Inflows to Exchanges

Following the new issuance, stablecoin inflows to centralized exchanges have surged. Notably, HTX Global received $1.24 billion in net stablecoin inflows within hours. CryptoQuant notes such inflows typically trigger increases in spot and derivatives markets, possibly signaling short-term price volatility in the crypto market. In conclusion, the timing of this large issuance strengthens expectations of an upward market movement. Increased stablecoin liquidity points to potential capital flows into cryptocurrencies like Bitcoin.

Tether has acquired a 10.7% stake in Juventus, one of Italy’s leading football clubs. This investment, valued at approximately 128 million euros, highlights Tether’s aim to gain a seat on the club’s board of directors and participate in future capital increases. This move is seen as a significant indicator of Tether’s strategic ventures into the sports industry, particularly the world of football.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.