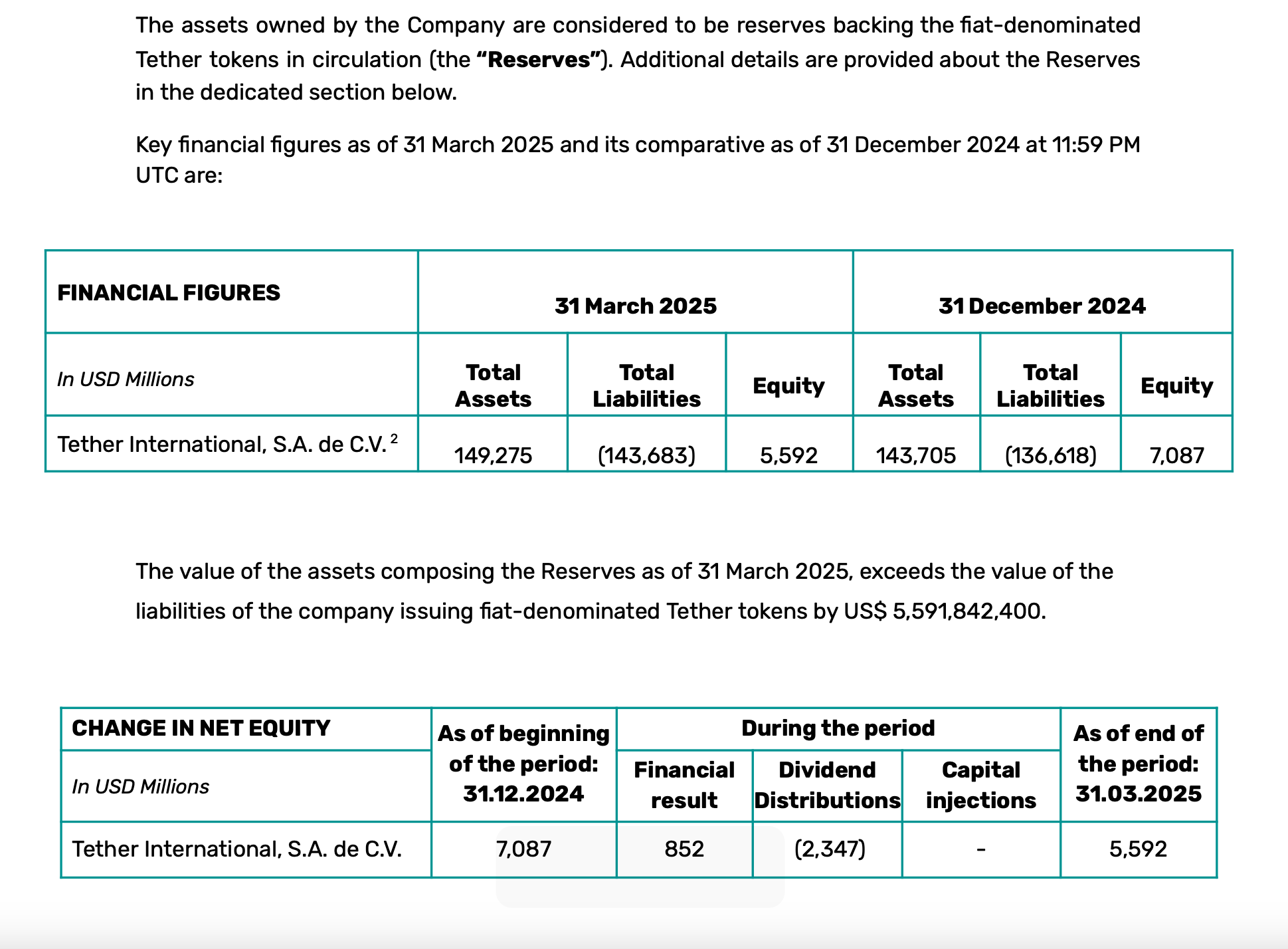

Tether, the issuer of the world’s largest stablecoin USDT, has reported over $1 billion in operating profit for Q1 2025, alongside $5.6 billion in excess reserves.

Massive Treasury Exposure

According to its Q1 2025 report, Tether holds around $98.5 billion in direct U.S. Treasury bills and another $23 billion in similar short-term instruments through repos and cash equivalents, bringing its total exposure to nearly $120 billion.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Its excess reserves dropped from $7.1 billion in Q4 2024 to $5.6 billion, the lowest level since Q2 2024.

USDT Demand on the Rise

USDT supply expanded by $7 billion during the quarter, with a 46 million increase in active wallet addresses. The stablecoin’s market cap now stands at $149 billion.

Tether is using a portion of its reserves for strategic investments, committing over $2 billion to areas such as renewable energy, artificial intelligence, peer-to-peer communications, and data infrastructure.

Despite its dominance, concerns are growing in Europe over reliance on dollar-pegged stablecoins. The Bank of Italy warned that any disruption in stablecoin markets or related assets could ripple across the broader financial system.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.