The recent governance vote held within the Injective ecosystem has officially approved the launch of a new deflationary process aimed at reducing the supply of the INJ token. Receiving support from nearly all participants, the proposal highlights the strength of community consensus and signals a long-term, permanent, and more disciplined structural transformation in Injective’s token economics.

Overwhelming Support in the Governance Vote

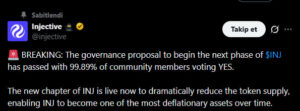

The proposal put forward by the Injective community was approved with an overwhelming support rate of approximately 99.9%, reaching the required quorum. With this outcome, the protocol’s inflation parameters have now been officially updated on-chain. The newly accepted framework permanently tightens INJ token issuance while strengthening existing burn mechanisms, increasing pressure on the circulating supply.

The approved model aims for a faster contraction of INJ supply over time. Compared to the previous structure, a significant increase in the pace of deflation is expected, with the goal of better aligning token supply with network usage and protocol revenues. This approach is designed to create a tokenomic structure that supports long-term supply-demand balance. Injective’s existing Community BuyBack program remains a key component of this process. The protocol regularly repurchases INJ tokens using ecosystem revenues and removes them from circulation. Under the new model, the combination of reduced issuance and buyback-and-burn mechanisms further intensifies supply pressure.

Amount of INJ Burned to Date

Since the launch of its mainnet, Injective has removed approximately 6.85 million INJ tokens from circulation, gradually reducing the overall supply. With the new deflationary framework, this approach has become a central and permanent element of the token economy. By positioning long-term supply reduction as a sustainable, revenue-backed policy, the protocol aims to strengthen the economic balance of the ecosystem.

On the market side, the initial reaction to the governance result was limited. Following the approval of the proposal, the INJ price briefly increased by around 2% before pulling back. Influenced by the broader crypto market downturn, INJ has declined by approximately 10% over the past 24 hours and is trading around the $4.7 level at the time of writing.

Assessment

Injective’s new deflationary phase aims to establish a more disciplined, controlled, and revenue-driven structure for INJ supply. In the long term, this approach could create a more robust and predictable economic foundation capable of supporting token value. However, short-term price movements are expected to remain closely tied to overall market trends and macroeconomic conditions.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.