This week, the crypto market was shaken by unusual developments. Rumors about Donald Trump’s death caused a sudden drop in Bitcoin prices. Additionally, the SEC postponed crypto ETF decisions until October, increasing market uncertainty and making investors cautious. Meanwhile, El Salvador moved its Bitcoin holdings to enhance security, ensuring both transparency and risk management.

This Week’s Top Crypto News

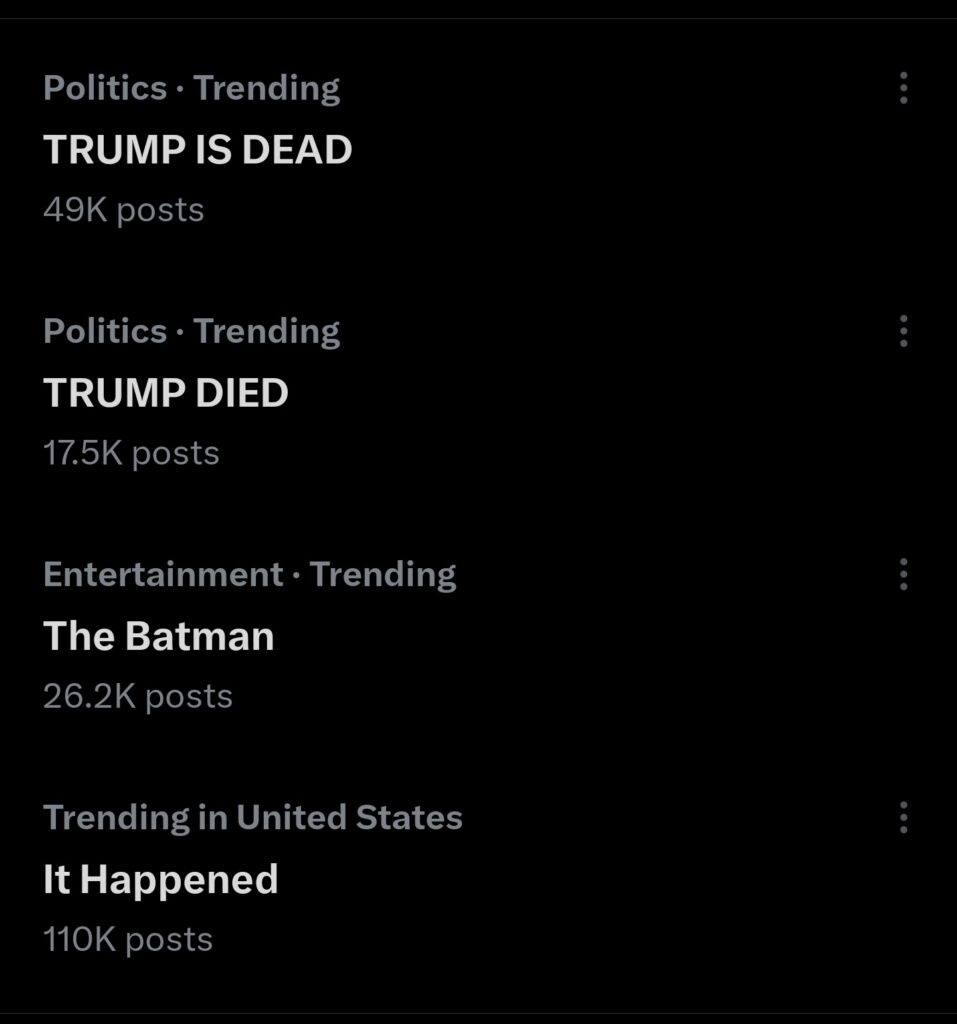

Rumors about Trump’s death spread on August 30 via X channel. Edited The Simpsons videos and statements by Vice President JD Vance supported these claims. The market panicked quickly, recalling Trump’s crypto-friendly stance, negatively affecting both Bitcoin and altcoin prices.

The SEC again postponed crypto ETF evaluations until October. WisdomTree’s XRP ETF and other applications were delayed until the year-end. Bloomberg analysts predict that despite the delay, XRP, SOL, and some applications have a 95% approval chance.

Gemini launched an XRP credit card offering up to 4% rewards. The card is exempt from annual and overseas transaction fees and operates in connection with the RLUSD stablecoin. This move draws attention as a Ripple-backed product in US spot markets.

Rumors of a Cristiano Ronaldo meme coin and fake tokens misled investors. Ronaldo and his team confirmed no token launch, so caution is advised.

Bitcoin experienced significant volatility this week. Dutch firm Amdax created a $23M Bitcoin treasury, yet BTC fell below $109K. Spot Bitcoin ETFs recorded $126.6M outflows.

Corporate and Regulatory Developments

El Salvador moved a total of 6,274 BTC into 14 new wallets, enhancing security against quantum computer attacks. A new general control panel also increased transparency.

Elon Musk’s lawyer, Alex Spiro, proposed a $200M DOGE treasury offer with Dogecoin Assembly approval. Dogecoin prices recovered following this news, with experts predicting upward momentum.

The CFTC granted American investors legal access to offshore crypto exchanges, expanding market access and investment opportunities. Disputes between Donald Trump and Fed Chair Lisa Cook regarding mortgage fraud drew investor attention. Polymarket data indicates Cook has a 73% chance of voting in the September FOMC meeting.

The US Department of Commerce released GDP data via Bitcoin, Ethereum, and Solana blockchains. Chainlink and Pyth Network played key roles in this process. PYTH price surged 100%, supporting the ecosystem.

This week’s developments led to high volatility in Bitcoin and altcoin markets. Investors are closely monitoring potential interest rate cuts and regulatory updates in September.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.