Finance is evolving, and the latest milestone comes from a bold step in asset tokenization. Digital transformation is reshaping traditional investments — and now, Kraken, in collaboration with xStocks, is bringing this innovation directly to investors.

DeFi Development Corp., a Nasdaq-listed crypto treasury firm, has announced it will tokenize its shares on the Solana network. This move positions the company as the first U.S.-listed treasury firm to fully integrate on-chain equity with the help of Kraken and tokenization specialist Backed.

Solana Welcomes Tokenized Equities

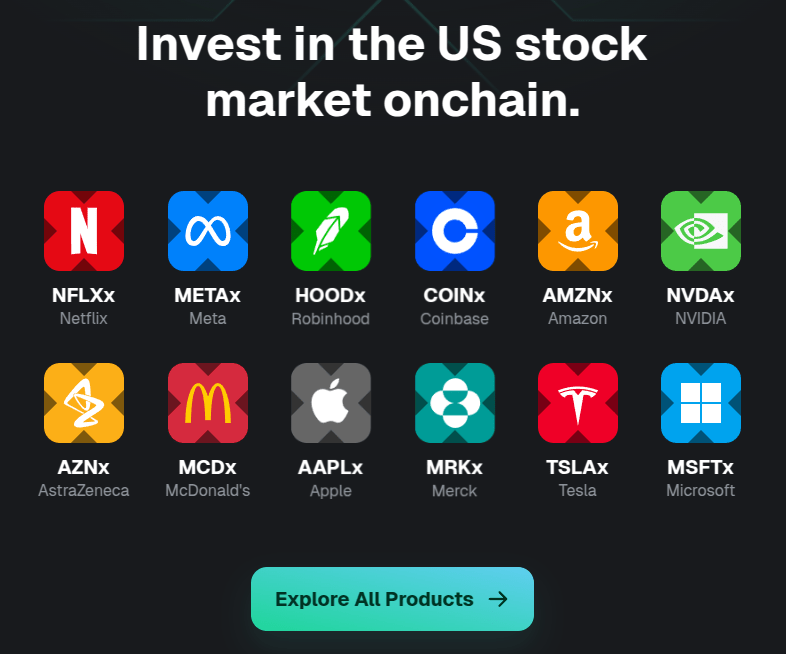

Under the ticker DFDVx, DeFi Development Corp. shares will join a growing list of tokenized stocks — including Apple and Tesla — on the xStocks platform. The goal is not only symbolic. It represents the increasing integration between traditional finance and decentralized technologies.

You Might Be Interested In: Sonic SVM Research: Can New Stablecoins Shake Up the Old Order?

CEO Joseph Onorati likened this initiative to creating a DeFi “Lego block,” encouraging developers and institutions to build upon this foundation. As tokenization becomes more mainstream, such steps pave the way for seamless crossover between markets.

Massive Growth Expected in Tokenized Assets

Real-world assets (RWAs) such as equities, funds, and real estate are rapidly entering the world of tokenization. These assets offer advantages like 24/7 trading, faster settlements, and expanded use in DeFi platforms.

According to a joint report by BCG and Ripple, the total market for tokenized RWAs could reach $18.9 trillion by 2033. As this sector heats up, rival exchange Coinbase is also reportedly seeking regulatory approval to launch its own tokenized stock service.

Val Gui, general manager of xStocks at Kraken, noted strong demand for on-chain access to U.S. equities, especially from the crypto community. The integration of firms like DeFi Development Corp. signals a broader shift toward blockchain-native financial instruments.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.