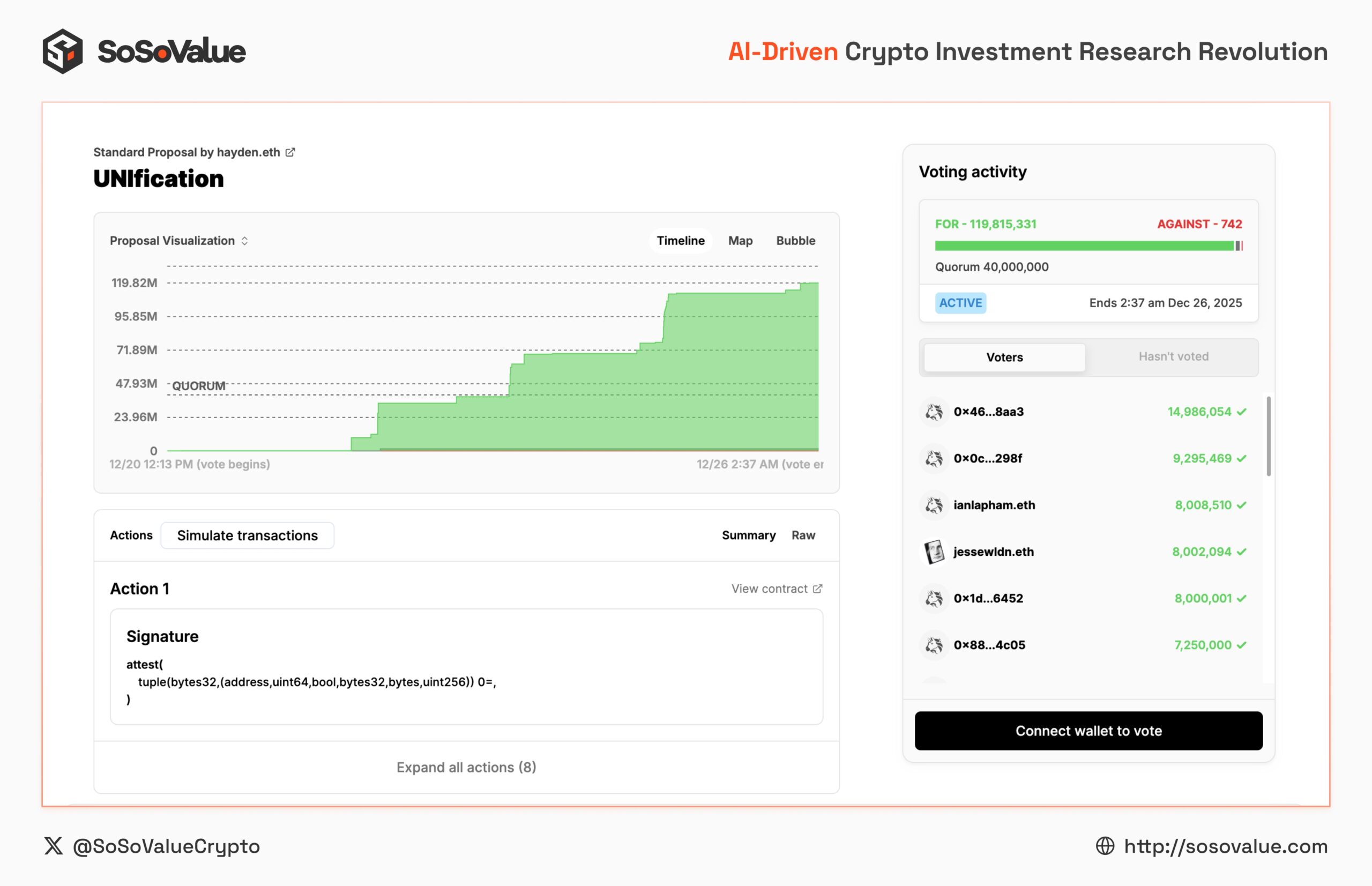

One of the most anticipated governance decisions in the decentralized finance (DeFi) space has officially concluded. Uniswap, a cornerstone of the DeFi ecosystem, has approved the UNIfication proposal through a community vote with overwhelming support. This milestone decision introduces structural changes that directly impact the protocol’s economic model, governance framework, and long-term sustainability. Among the most notable outcomes are the burning of 100 million UNI tokens and the activation of protocol fees.

What Does the Uniswap Token Burn Mean?

Token burning is commonly used in crypto markets as a mechanism to reduce supply and rebalance token economics. In Uniswap’s case, permanently removing 100 million UNI from circulation represents a meaningful contraction of total supply. From a theoretical standpoint, a lower circulating supply—if paired with steady or growing demand—can strengthen long-term value dynamics for the UNI token.

That said, token burns alone do not guarantee price appreciation. Their effectiveness largely depends on whether they are supported by real protocol usage, revenue generation, and ecosystem growth. This is where the broader scope of the UNIfication proposal becomes particularly relevant.

Protocol Fees Go Live

With the proposal now approved, Uniswap is moving forward with the activation of protocol fees. This mechanism allows a portion of trading activity on the platform to generate revenue at the protocol level, creating a direct link between usage and economic output.

This shift marks an important evolution for Uniswap. Rather than functioning solely as a high-volume decentralized exchange, the protocol is taking a step toward becoming a revenue-generating DeFi infrastructure layer, reinforcing the long-term utility of the UNI token within the ecosystem.

Organizational Changes and Long-Term Funding

The UNIfication package extends beyond token mechanics. It also outlines a leaner organizational structure and a clearer framework for long-term development funding. These adjustments are designed to improve operational efficiency while ensuring consistent resources for protocol upgrades, research, and developer incentives.

By aligning governance, funding, and protocol economics, Uniswap aims to strengthen its competitive position in an increasingly crowded DeFi landscape.

What Is Uniswap (UNI)?

Uniswap is a decentralized exchange built on the automated market maker (AMM) model, originally developed on the Ethereum blockchain. It enables users to swap tokens directly from their wallets without intermediaries. Over time, Uniswap has expanded beyond Ethereum, supporting networks such as BNB Chain and Polygon, increasing accessibility and liquidity across ecosystems.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.