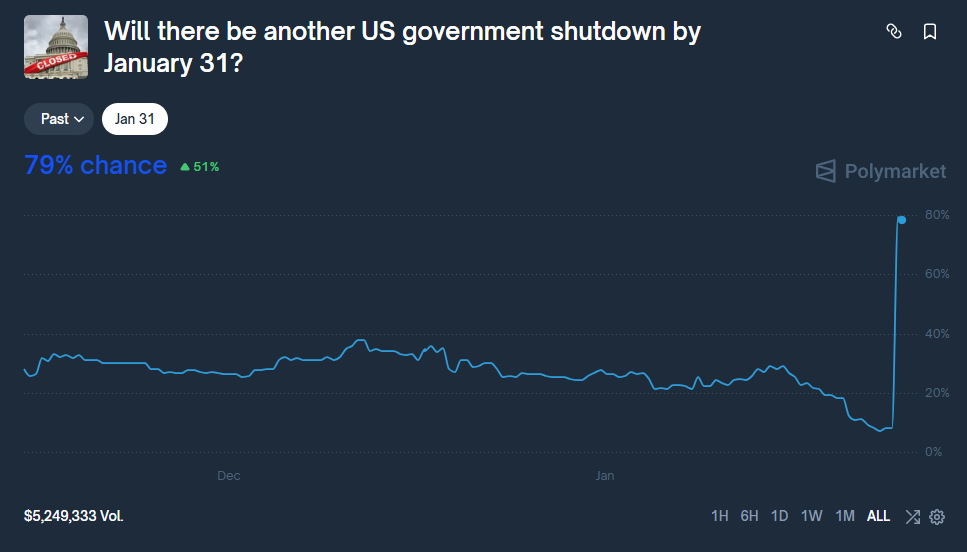

Polymarket traders are sharply repricing the risk of another US government shutdown. According to the prediction market, the probability of a shutdown before the end of January has climbed to 77%, marking a 67-point surge in just 24 hours. The move reflects mounting concern over stalled budget negotiations in Washington.

The spike comes days after US President Donald Trump suggested that another shutdown remains likely, stating that the country could “end up in another Democrat shutdown.” The timing has reinforced market expectations that political gridlock is once again becoming a near-term risk.

Budget Standoff Clouds Regulatory Timelines

The renewed shutdown threat is not limited to fiscal politics. It also casts uncertainty over the CLARITY Act, a major crypto bill designed to bring regulatory clarity to digital assets. Previous delays to the bill were widely linked to the record 43-day US government shutdown in October and November, making the current risk particularly sensitive for the crypto industry.

Senate Tensions Intensify

Political pressure increased after Senate Majority Leader Chuck Schumer said Democrats would not support advancing an appropriations bill that includes funding for the Department of Homeland Security. The statement underscored how fragile negotiations remain, with key funding issues still unresolved.

US officials have not ruled out a shutdown scenario, adding to the sense that negotiations could break down rather than move forward quickly.

Crypto Industry Support Remains Fragile

The uncertainty has already affected sentiment around the CLARITY Act. Coinbase CEO Brian Armstrong and several industry executives have withdrawn support, arguing that the current draft could be worse than maintaining the status quo.

Galaxy Digital research head Alex Thorn has also flagged unresolved disagreements, particularly around stablecoin yield structures. According to Thorn, these issues remain one of the most divisive points, with no clear compromise yet in sight.

As Polymarket odds continue to price in a shutdown, the risk is no longer theoretical. Political deadlock now threatens to delay both fiscal decisions and crypto regulation timelines, keeping markets on edge heading into the final days of January.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.