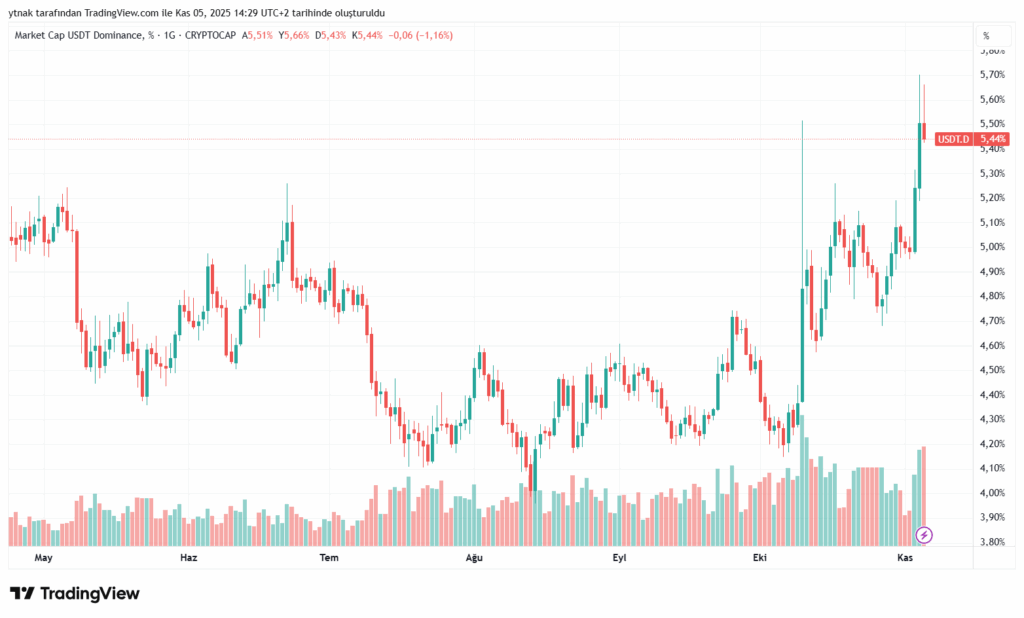

USDT dominance (USDT.D) surged by 20% in October, reflecting investors’ flight to stablecoins amid a cautious market. The index is now approaching a long-term resistance, marking a critical turning point for the crypto market. Analysts suggest short-term volatility may occur before risk appetite returns.

The recent spike in USDT.D signals that investors are shifting funds from risky assets to stablecoins, creating a potential inflection point for Bitcoin and altcoins.

Resistance Level and Technical Outlook

USDT dominance is nearing a descending long-term trend line, historically acting as a resistance zone. A rejection at this level could indicate that Bitcoin has reached or is close to a market bottom. Conversely, breaking this resistance could trigger further outflows from risky assets, deepening price corrections across cryptocurrencies.

Technical analysts are closely monitoring the head-and-shoulders pattern and trading volume. These indicators are critical to gauge investor sentiment and anticipate potential short-term volatility.

Implications for Bitcoin and Altcoins

When USDT.D rises, it shows that investors are moving into cash and stablecoins, signaling risk aversion. Conversely, a drop in USDT.D often leads funds back into risky assets, with Bitcoin typically leading the recovery followed by altcoins.

Therefore, USDT dominance is a key liquidity indicator for the entire crypto market. If the resistance holds, smaller-cap altcoins could outperform, while a decisive breakout may trigger a short-term sell-off, especially among lower-cap assets.

Investors should prioritize risk management and monitor USDT.D alongside Bitcoin price movements. Confirming a sustainable recovery requires additional signals, such as declining trading volume or clear reversal candlesticks.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates