The US Department of Justice has decided not to pursue further legal action in the high-profile NFT fraud case involving a former OpenSea executive. Following the reversal of the original conviction by a federal appeals court, prosecutors have moved to fully dismiss the case, bringing an end to what had been a landmark legal battle in the digital asset space.

The decision is already reigniting broader debates around how NFTs and platform-level data should be treated under existing US financial and criminal laws.

Deferred Prosecution Marks the End of the OpenSea Case

During a hearing held on Wednesday in Manhattan federal court, prosecutors confirmed that they had entered into a one-month deferred prosecution agreement with Nathaniel Chastain, OpenSea’s former product manager. Once this short deferral period concludes, the case will be formally closed.

The move follows a July ruling by a federal appeals court that overturned Chastain’s earlier convictions. According to prosecutors, reopening the case and pursuing a retrial would not serve the public interest under the current circumstances.

Prosecutors Cite Time Served and Asset Forfeiture

In a written submission to the court, Manhattan US Attorney Jay Clayton explained that several factors influenced the government’s decision. Notably, Chastain has already served part of his original sentence, including three months in prison, and has complied with financial penalties imposed at the time.

As part of the agreement, Chastain also agreed not to challenge the forfeiture of 15.98 Ether, valued at approximately $47,330, which authorities allege was obtained through the disputed trading activity. Clayton stated that, taken together, these conditions made further prosecution unnecessary.

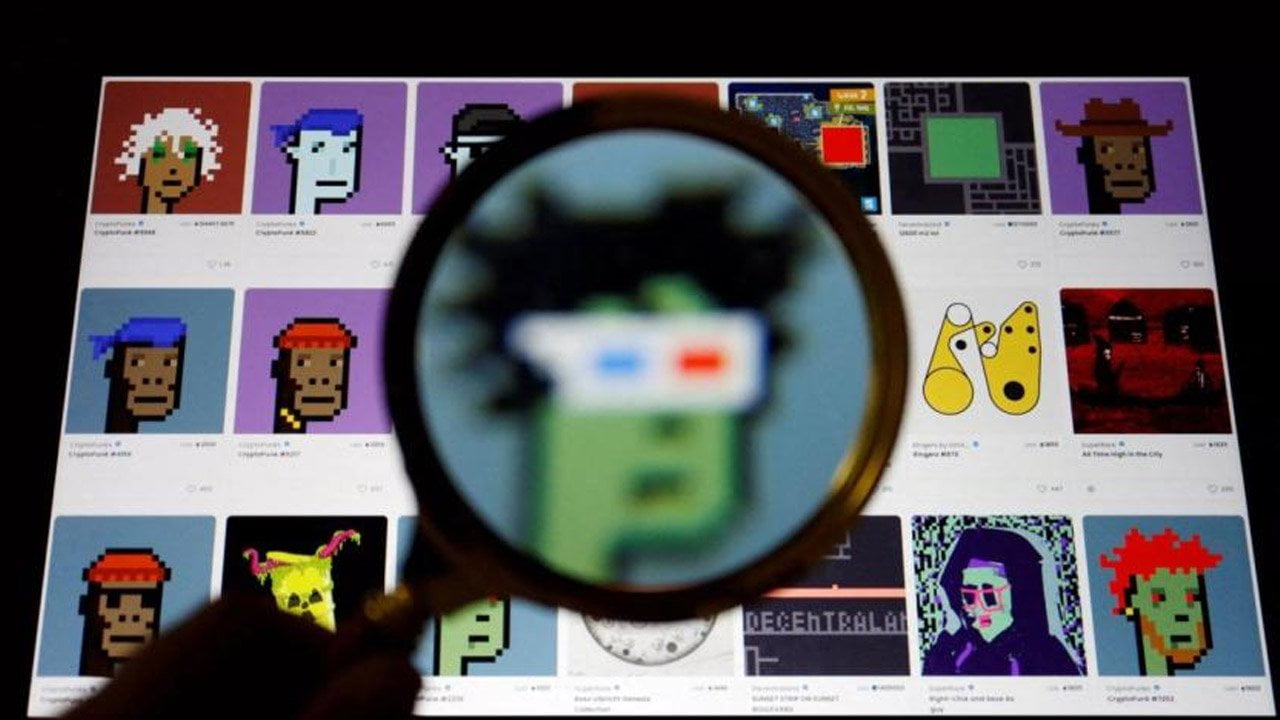

A First-of-Its-Kind OpenSea NFT Insider Trading Case

The case initially drew widespread attention when Chastain was convicted in 2023 of wire fraud and money laundering. Prosecutors alleged that he exploited confidential knowledge from his role at OpenSea, purchasing NFTs that he knew would soon be featured on the platform’s homepage and selling them after prices rose.

At the time, the case was widely described as the first insider trading prosecution involving digital assets in US history, setting a potential precedent for how NFT-related misconduct could be addressed by regulators.

Appeals Court Challenges the Legal Foundation

That precedent was significantly weakened in July, when a federal appeals court overturned the convictions. The court ruled that jurors had received flawed instructions and concluded that OpenSea homepage placement data did not constitute “property” under federal wire fraud statutes because it lacked independent commercial value.

This interpretation raised fundamental questions about whether certain types of digital information fall within the scope of existing fraud laws.

Financial Penalties May Be Recovered

With the case now effectively resolved, Chastain will no longer be subject to supervision by US Pretrial Services. He is also eligible to seek the return of the $50,000 fine and $200 special assessment he paid following his conviction in May 2023.

These developments further underscore the impact of the appeals court ruling on the overall outcome of the case.

Broader Implications for Crypto and NFT Regulation

The OpenSea case adds to a growing list of crypto-related investigations and prosecutions that US authorities have abandoned due to procedural flaws or evidentiary challenges. For industry participants, the dismissal reinforces concerns about the lack of legal clarity surrounding NFTs, platform data, and emerging digital asset categories.

Legal and crypto policy advocates argue that the outcome highlights the need for clearer legislative definitions that explain how digital assets fit within existing frameworks for fraud, property rights, and market abuse.

As regulators continue to grapple with these issues, the conclusion of the OpenSea case is likely to remain a reference point in future discussions on NFT regulation and crypto enforcement in the United States.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.