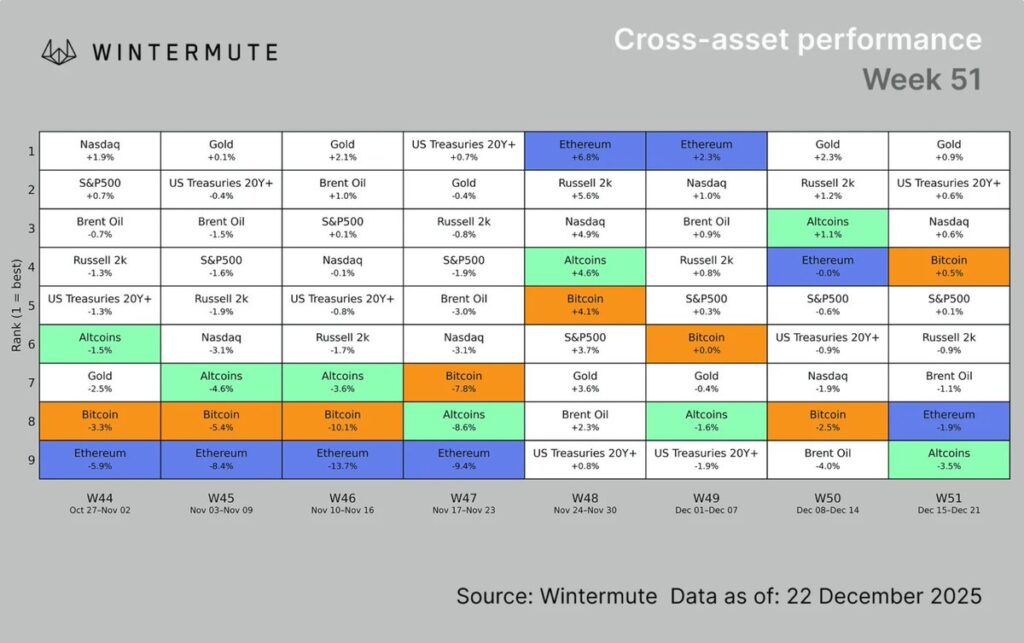

The crypto market is entering the final weeks of the year with a choppy and narrowing structure. According to Wintermute’s latest macro market analysis, weak liquidity and rising supply pressures continue to challenge altcoins, while capital is refocusing on Bitcoin (BTC) and Ethereum (ETH). Retail investors, in particular, are showing a clear trend of exiting altcoins.

Early last week, selling pressure intensified. Bitcoin fell below $85,000 midweek, and Ethereum dropped below $3,000. This triggered renewed liquidations: around $600 million on Monday and $400 million each on Wednesday and Thursday. Strong buying was met with quick selling, highlighting market fragility.

Liquidations Increased, Market Structure Narrowed

Later in the week, volatility eased, and Bitcoin gradually recovered toward $90,000 on low-volume trades. However, Wintermute noted that this recovery reflects technical balance in thin liquidity rather than a strong trend reversal.

As the holiday period approaches, market structure is narrowing. Bitcoin dominance is rising again, reaffirming trends seen in the second half of the year. Altcoins remain weak due to a busy token unlock schedule and ongoing supply pressures.

“Altcoins continue to underperform due to supply pressures and token unlocks. Retail investors are exiting altcoins, while capital is returning to Bitcoin and Ethereum, where buying pressure is increasing.”

Institutional Buying Continues as Retail Shifts

Wintermute’s internal flow data sheds more light on market movements:

-

Institutional investors have steadily continued buying Bitcoin and Ethereum since summer.

-

Ethereum has also seen stronger inflows toward year-end.

-

Retail investors are reducing altcoin exposure and returning to major cryptocurrencies.

Current conditions indicate that this leadership is not yet strong enough to open space for altcoins.

Medium-Term Impact of Traditional Finance

Wintermute’s report emphasizes that institutional and traditional finance interest in the crypto ecosystem persists. Recently, banks and large financial institutions have entered the market cautiously but with lasting steps.

These entries generally create durable capital flows, which could support prices in the medium term.

Market Enters Year-End Consolidation

Overall, Wintermute notes that the crypto market remains choppy with thin liquidity and lower trading volumes. Downward moves can be sharp, but rapid clearing of leveraged positions limits their impact.

Bitcoin and Ethereum continue to absorb most market risk, while altcoins struggle under supply pressures and low risk appetite. In the absence of a clear macro or regulatory catalyst, the market is expected to trade sideways and selectively during year-end and the holiday period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.