Crypto analytics firm CryptoQuant has shared market-critical support and resistance zones for Bitcoin (BTC) with investors. Analyst Darkfost evaluated Bitcoin’s current price action and highlighted key technical levels that could be important for short-term traders as well as medium- and long-term investors. According to Darkfost, these levels play a decisive role in guiding trading decisions, planning risk management strategies, and anticipating potential price movements. He also noted that these zones are closely tied to market psychology and liquidity levels.

Critical Support and Resistance Levels

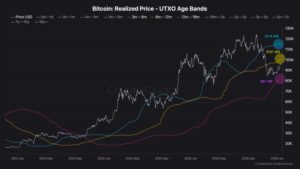

According to Darkfost, a major support level for Bitcoin stands at $81,700, while a strong resistance level is observed at $101,000. He emphasized that $101,000 represents Bitcoin’s next major test. This level corresponds to the average cost basis of Bitcoin held for 6–12 months, making it a strong resistance both technically and psychologically. A decisive break above this zone could be interpreted as a significant bullish signal for the market.

On the downside, long-term investors who have held Bitcoin for 12–18 months have an average cost basis around $81,700. This suggests that if Bitcoin were to retrace toward this support zone, many investors would be more inclined to hold their positions rather than sell. According to Darkfost, this support level could help stabilize market liquidity and prevent short-term panic selling.

Investor Positioning and Additional Resistance Levels

Darkfost noted that the majority of investors who bought near the January 2025 peak are still holding their positions. In a bullish scenario, the $114,650 level stands out as an additional resistance. This price corresponds to the average cost basis of short-term holders in the 3–6 month range. If prices return to this area, some investors may choose to sell at break-even, potentially creating temporary resistance pressure.

Bitcoin Technical Levels Are Critical for Investors

To accurately track Bitcoin’s short- and medium-term price movements, the $81,700 support and $101,000 resistance levels are of critical importance. These zones serve as key reference points for both long-term investors and short-term traders when shaping trading decisions and risk management strategies. Additionally, the $114,650 level represents a psychological resistance area due to its alignment with short-term investors’ average cost basis, making price action around this zone particularly important to monitor.

Approaches toward—or breakouts beyond—these critical levels can provide important signals about market direction and volatility, offering strategic decision-making opportunities for investors looking to protect or adjust their positions.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.