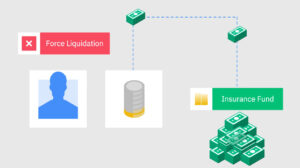

Auto-Deleveraging (ADL) is the final step in the liquidation process within the futures market. This mechanism is only activated when the Futures Insurance Fund cannot cover a bankrupt position. In other words, if an investor’s losses exceed the capacity of the insurance fund, the system automatically reduces leverage from profitable positions to fill the gap.

ADL serves as a critical safety mechanism for managing investor risk and is designed to minimize potential losses associated with highly leveraged trading.

Difference Between Coin-Margined and USD-Margined Contracts in ADL

Coin-margined contracts have a higher likelihood of being subject to Auto-Deleveraging (ADL) compared to USD-margined contracts. The reason is that all coin-margined contracts using the same cryptocurrency as collateral share a single Futures Insurance Fund. Since this fund is usually smaller, risks are balanced more quickly through ADL.

Example: In Bitcoin-margined contracts, BTC is used as collateral. If a position goes bankrupt, the fund’s limited size may not be enough to cover the loss, so profitable positions are automatically reduced (ADL) by the system to maintain balance.

Binance provides several measures to help reduce the chance of ADL, such as:

- Immediate-or-Cancel (IOC) Limit Orders: Allow investors to quickly close their orders.

- Position Management Tools: Help users assess risks in advance.

Still, due to the high volatility of crypto markets and the leverage ratios used by traders, it is impossible to completely avoid ADL risk. Binance continuously works to minimize the impact of ADL and improve user experience.

ADL Liquidation and Priority Ranking

During Auto-Deleveraging (ADL), profitable futures positions are selected for liquidation based on a priority ranking system. Each position in the system is assigned a risk indicator that reflects its likelihood of being subject to ADL. More profitable and highly leveraged positions are liquidated first. Less profitable and lower-leverage positions are further down the ranking and targeted later.

When ADL liquidation occurs, the investor immediately receives a notification detailing the quantity and liquidation price. No trading fees are charged on profitable positions that are subject to ADL liquidation.

Example:

If an investor holds a profitable position with 50x leverage, and another investor holds a smaller profit position with 10x leverage, the ADL system will target the highly leveraged position first.

Liquidation Price vs. Bankruptcy Price

- Liquidation Price: The price at which a losing position begins liquidation. This depends on factors such as leverage, maintenance margin ratio, current token price, and the investor’s account balance.

- Bankruptcy Price: The limit price at which the liquidation order is executed. It comes into effect when the investor’s losses equal the value of their collateral.

Important Note: The bankruptcy price may fall outside the contract’s market price range. Therefore, investors should monitor the ADL indicator closely and manage their risks accordingly.

Order Handling

- In cross margin mode, all open orders for all tokens are canceled.

- In isolated margin mode, only open orders for the same token are canceled.

Once the liquidation process is complete, investors can immediately open new positions for the same token.

ADL Priority Ranking Calculation

The ADL ranking is determined based on a position’s profitability and leverage ratio:

Formulas

- PNL Percentage: Unrealized PNL / |Position Notional|

- Effective Leverage: |Position Notional| / (Wallet Balance + Unrealized PNL)

Ranking Formula:

- If PNL ≥ 0: PNL % × Effective Leverage

- If PNL < 0: PNL % ÷ Effective Leverage

Leverage PNL Quantile: rank(user.ranking) / Total Number of Users

For Portfolio Margin:

- Effective Leverage = |Position Notional| / Account Equity

This calculation is used by the system to determine which positions will be subject to ADL.

Recommendations

ADL is a critical part of risk management in the futures market. Binance applies various measures to improve user experience and minimize the impact of ADL.

Investor Tips:

- Continuously monitor the ADL indicator.

- Be cautious when using high leverage.

- Understand both the liquidation price and the bankruptcy price before opening positions.

- Diversify positions using risk management tools.

Being aware of ADL helps minimize potential losses in the futures market and ensures a safer trading experience.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.