While the Bitcoin ecosystem has long positioned itself as a secure store of value, it has remained limited in terms of programmability and financial flexibility. Innovations in areas such as smart contracts, lending, yield strategies, and real-world assets have largely developed on Ethereum and other EVM-based chains. Bitway (BTW) emerges as a completely new-generation Layer-1 blockchain protocol that is Bitcoin-compatible, aiming to eliminate this separation.

Bitway offers a permissionless and fully on-chain infrastructure that enables Bitcoin holders to access on-chain financial products using their existing wallets and addresses. The goal is to build the missing layer that bridges Bitcoin liquidity between decentralized finance and traditional finance.

What is Bitway (BTW)?

Bitway positions itself as an “Internet Capital Gateway.” At the core of this approach lies the fact that a large portion of on-chain capital remains idle. Today, billions of dollars in digital assets are fragmented across blockchains, wallets, and exchanges, unable to directly access real yield sources in the global financial system.

Traditional finance offers institutional-level risk management and sustainable yields but is restrictive in terms of access. DeFi provides global access and transparency but often lacks stable and audited yield mechanisms. Bitway aims to create a neutral and reliable infrastructure layer between these two worlds.

Through this infrastructure, on-chain capital can be directed toward transparent and risk-managed strategies sourced from both DeFi and TradFi.

How Does Bitway Work?

Bitway is built on the Bitway Ledger, a fully Bitcoin-compatible Layer-1 blockchain. The protocol is designed to be directly compatible with Bitcoin addresses, Bitcoin wallets, and Bitcoin’s UTXO structure. Users do not need to create an EVM wallet, use a bridge, or deal with different address formats.

The system consists of multiple integrated components: Bitway Ledger, Bitway Lending, Bitway Earn, and the ɃTCT Bitcoin bridge.

Bitway Ledger: Bitcoin-Compatible L1 Appchain

Bitway Ledger is an appchain built on Cosmos-SDK and CometBFT, offering high transaction capacity and fast finality. Its most important difference is its support for fully Bitcoin-compatible address and signature structures.

Bitcoin Compatibility

- Supports Taproot and Native SegWit addresses

- Uses Bech32 and Bech32m address formats

- Transactions can be directly signed with Bitcoin wallets such as OKX Wallet, Unisat, and Ledger

- No need for MetaMask or EVM wallets

Additionally, Bitway Ledger includes a built-in SPV (Simple Payment Verification) client. This allows transactions on the Bitcoin mainnet to be verified with 6 confirmations.

Gas-Free Payment Experience

One of Bitway’s standout features is its gas-free payment mechanism. When users transact with Bitway’s native wrapped Bitcoin asset, BTCT, they do not need to hold a separate gas token. Transaction fees are managed through the protocol’s internal sponsorship mechanism.

This structure:

- Enables micro-payments

- Supports subscription-based payment models

- Provides instant settlement without intermediaries

- Offers suitable infrastructure for commercial integrations

Bitway Lending: Borrowing with Native BTC

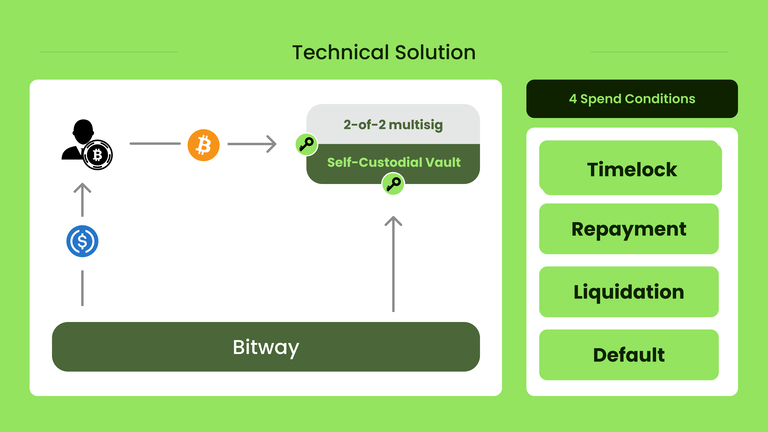

Bitway Lending is a fully non-custodial lending protocol that allows Bitcoin holders to access liquidity without selling their assets. The system is built on Bitcoin’s UTXO model and Discreet Log Contracts (DLC).

Key Features

- BTC collateral is locked on the Bitcoin mainnet

- Loans are issued on the Bitway Ledger

- Loan approval and distribution are instant

- No credit score, KYC, or permission required

Collateralized BTC is held in 2-of-2 multisig vaults and can only be released under pre-signed conditions. The liquidation process occurs through oracle verification and pre-authorized CETs (Contract Execution Transactions).

Liquidation and Trust Model

In Bitway Lending, BTC collateral can only be released in four cases:

- Loan repayment

- Price-based liquidation

- Default at maturity

- Failsafe timeout

When liquidation occurs, third-party liquidators can purchase the collateral at a discount. After the debt is closed, any remaining BTC is returned to the user. The system minimizes trust assumptions by separating roles among oracles, validators, and the Distributed Collateral Manager (DCM).

Bitway Earn and the DeTraFi Approach

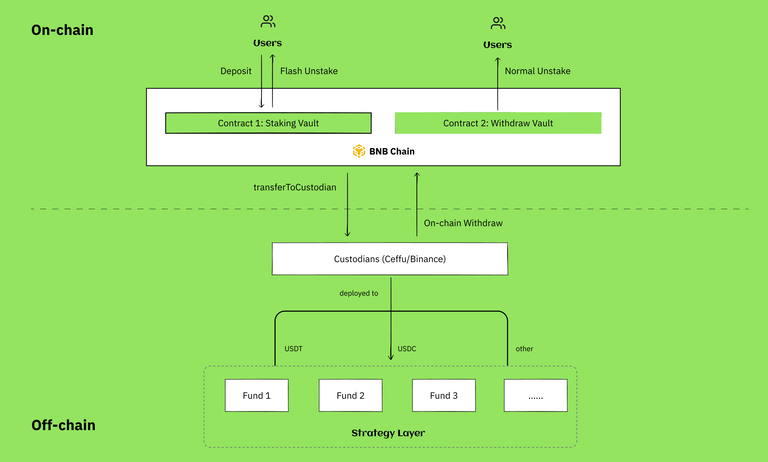

Bitway Earn is a practical implementation of the DeTraFi (Decentralized + Traditional Finance) model. Users can deposit assets into staking vaults on BNB Chain and other EVM networks to access institutional-level yield strategies.

Core Structure of Bitway Earn

- Audited staking vaults

- Market-neutral (delta-neutral) strategies

- Institutional custody solutions

- Normal and Flash Unstake options

Yields are regularly reflected in the vault, and users can close their positions at any time.

Tokenized Real-World Assets (RWA)

Bitway provides access to institutional-level RWAs such as tokenized treasury bills, commodities, and trade finance products. Yields can be calculated in Bitcoin terms and collected as BTC or fiat.

This structure aims to transform Bitcoin from merely a store of value into a productive capital asset.

BTCT: Bitway Bitcoin Bridge

BTCT is a validator-operated, FROST-based Bitcoin bridge embedded in the Bitway Ledger. Its main features:

- Gas-free BTC transfers

- Key refresh support

- No need for manual bridging steps

- Multi-chain liquidity routing

Bitway (BTW) Tokenomics

The native token of the Bitway ecosystem is Bitway (BTW).

- Ticker: BTW

- Total Supply: 1,000,000,000 BTW

The BTW token has various use cases, including on-chain incentives, governance mechanisms, protocol fees, and supporting ecosystem growth. Token-based incentive models are expected to be introduced in the long term for Bitway Earn and Lending products.

Additionally, Bitway Earn users earn BW Points on a time basis for every 1 USD deposited. These points are planned to be converted to BTW tokens in the future.

Bitway Investors

Bitway is backed by strong investors from various stages. These investors have deep expertise in both blockchain infrastructure and financial products.

Tier 1

- HashKey Capital

- YZi Labs (formerly Binance Labs)

Tier 3

- Symbolic Capital

- KR1

- Continue Capital

Tier 4

- Injective

- DECOM

Bitway Team

Bitway is developed by a team experienced in Bitcoin and on-chain finance. The team focuses on the long-term potential of Bitcoin-compatible financial infrastructures.

- Shane Qiu – Co-Founder

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.