Camelot Token (GRAIL) is a fully permissionless and decentralized cryptocurrency exchange at the heart of the Arbitrum ecosystem, offering highly efficient liquidity infrastructure. Having generated over $30 billion in trading volume on Arbitrum to date and directly integrated with more than 75 projects, Camelot is not just a DEX — it has become the liquidity backbone of the entire ecosystem.

What is Camelot Token (GRAIL)?

Camelot’s vision extends beyond Arbitrum One alone; it aims to build a multi-chain liquidity network that also encompasses chains built on Arbitrum Orbit infrastructure. This forms the foundation of Camelot’s new architecture called the “Orbital Liquidity Network.” Through this network, different Orbit chains are connected to a single liquidity hub, eliminating fragmentation.

Core Objectives of Camelot Token (GRAIL)

Camelot protocol was built with strategic goals serving the Arbitrum ecosystem:

- Provide battle-tested, robust spot liquidity infrastructure for the Arbitrum network

- Create an integrated liquidity network connecting Orbit chains

- Offer users broad token variety and deep liquidity

- Support Arbitrum developers and establish a centralized DeFi hub

- Build a sustainable economic model based on real yield

- Maintain a community-focused, permissionless, and decentralized structure

With these goals, Camelot has become not only an exchange but one of the main growth engines of Arbitrum.

How Did Camelot Emerge?

Camelot was launched in 2022 as a project fully funded by the Arbitrum community. Initially developed without any external investment or VC backing, the protocol achieved organic user growth. By onboarding both small and large projects, it rose to become the largest native DEX in the ecosystem.

Today, Camelot stands as the biggest protocol operating exclusively on Arbitrum, having directly supported the launch of over 10 protocols and established close collaborations with more than 65 projects.

What is Orbital Liquidity Network?

One of Camelot’s most important structural transformations is the Orbital Liquidity Network vision. This vision aims to unite all chains using Arbitrum Orbit infrastructure under a single liquidity center.

While Orbit chains normally operate in isolation, Camelot creates network effects between them by:

- Accelerating liquidity flow across chains

- Enabling users to trade seamlessly between different chains

- Increasing total volume, liquidity, and user count

Camelot is currently the first and only protocol integrated with 8 different Orbit chains.

What Are Orbit Chains?

Orbit chains are custom blockchain networks that use Arbitrum’s technical stack. They can be tailored for specific use cases such as:

- DeFi

- Gaming

- NFTs

- Application-specific chains

They give developers the flexibility to build and operate their own independent chains. Camelot serves as the primary liquidity provider that connects all these chains from a single hub.

Camelot Token (GRAIL) Vision

Camelot’s long-term vision can be summarized as:

- Become the centralized liquidity infrastructure across all Orbit chains

- Offer users swap, bridging, and discovery capabilities from a single interface

- Generate sustainable real yield for xGRAIL holders

- Become a foundational building block in Arbitrum’s multi-chain future

Upcoming Orbital Integrations

New features planned for the Camelot ecosystem include:

- Cross-Chain Swap – Direct asset swapping between Orbit chains

- Gauges System – Incentive direction voting system where xGRAIL holders decide which pools receive liquidity incentives

- Accelerator – Incubator structure that supports new projects and integrates them into the Arbitrum-Orbit ecosystem

Camelot Token (GRAIL)

- Name: Camelot Token

- Ticker: GRAIL

- Network: Arbitrum

- Maximum Supply: 100,000 GRAIL

GRAIL is Camelot protocol’s primary value-accrual token and is designed to be deflationary — supply will gradually decrease over time through various mechanisms.

What is xGRAIL?

xGRAIL is the locked, governance-oriented version of GRAIL.

- Non-transferable

- Used in staking and incentive systems

- 1:1 peg (1 GRAIL = 1 xGRAIL)

xGRAIL is used to receive a share of protocol revenue, boost liquidity positions, and participate in governance.

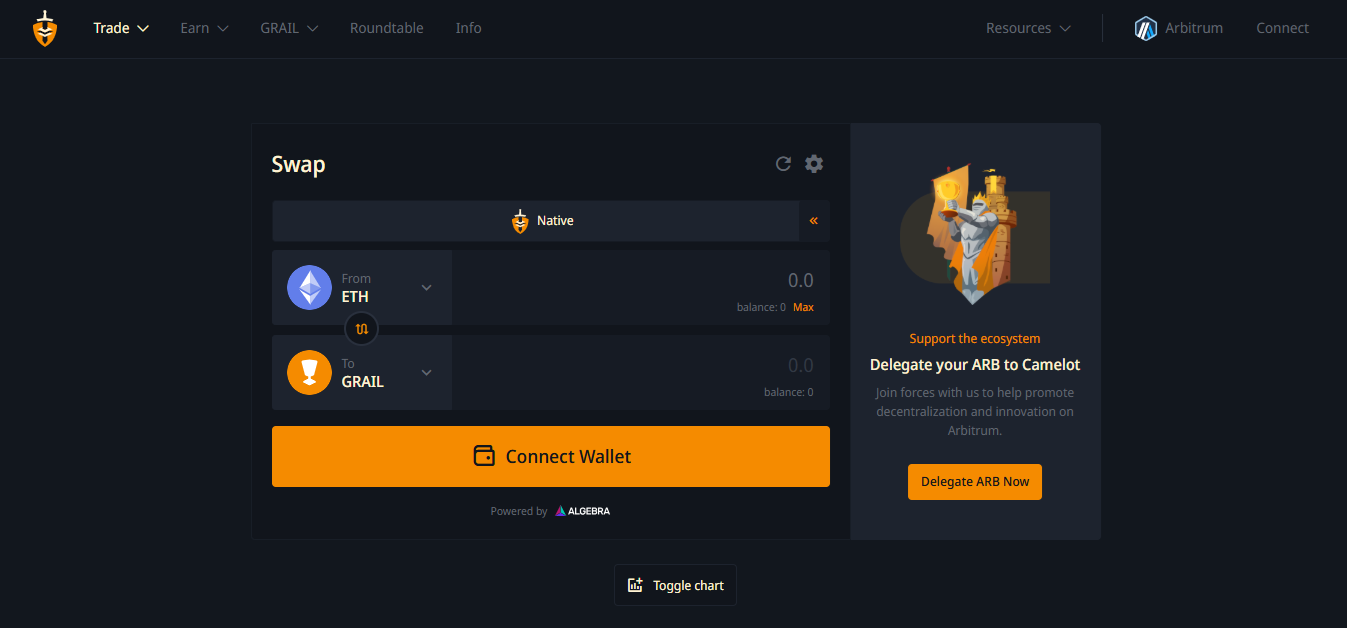

How to Acquire GRAIL?

- Purchase on Camelot DEX

- Earn through liquidity mining

GRAIL can be converted to xGRAIL and used across various plugins to generate yield.

Public Sale & Launch Process

Camelot’s GRAIL sale was conducted in a fully transparent and fair manner:

- Date: November 29 – December 5, 2022

- Amount Offered: 15% of supply

- No pre-sale or VC allocation

- Total Raised: $3.79 million

- GRAIL Price: $254.21

Genesis Pools

Genesis pools were the first liquidity pools that rewarded early participants with xGRAIL:

- Rewards distributed over 6 months

- Withdrawals allowed anytime

- Fully ended on May 23, 2023

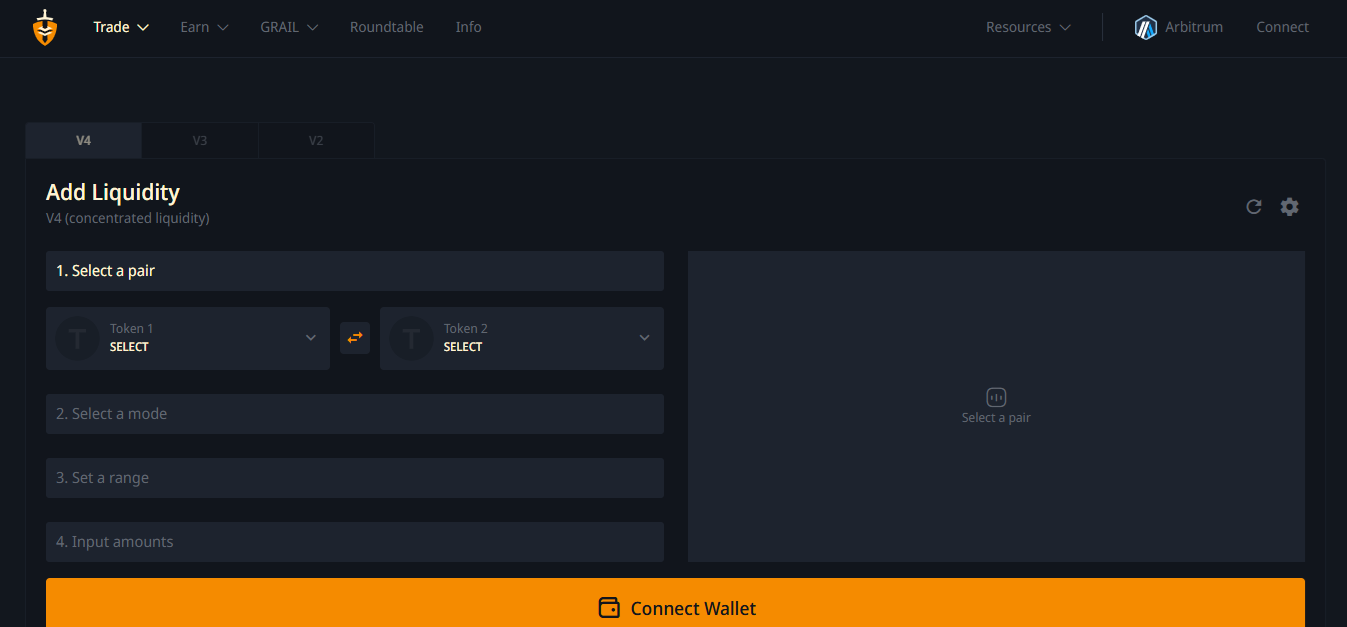

V2 and V3 Liquidity System

Camelot supports both the classic V2 model and the advanced V3 concentrated liquidity model.

V2:

- 50%/50% asset ratio

- Passive LP model

V3:

- Custom price range selection

- Higher returns with less capital

- Lower slippage

- Manual & automatic mode options

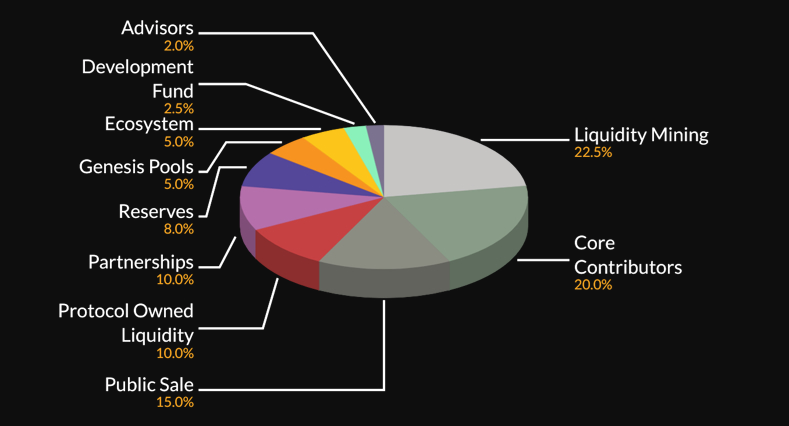

GRAIL Token Distribution

- 22.5% Liquidity Mining

- 20% Core Team

- 15% Public Sale

- 10% Protocol Liquidity

- 10% Partnerships

- 8% Reserve

- 5% Ecosystem

- 2.5% Development Fund

- 2% Advisors

GRAIL Vesting

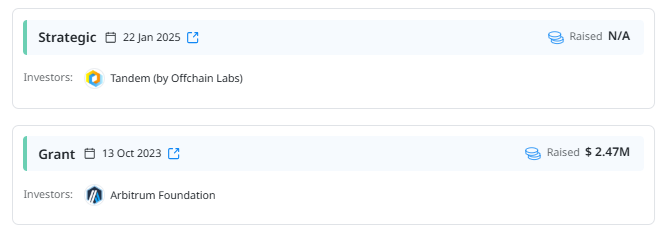

Camelot Investors & Strategic Support

- Strategic Support: Tandem (Offchain Labs) – January 22, 2025

- Grant Support: Arbitrum Foundation – October 13, 2023 – $2.47 million

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.