As the decentralized finance (DeFi) ecosystem develops, not only lending or swapping protocols but also structures that bring professional asset management on-chain are gaining increasing importance. dHedge DAO (DHT) stands out in this field and is among the first protocols aiming to bring on-chain asset management closer to institutional standards.

dHedge offers a decentralized asset management infrastructure that allows users to access automated and structured investment strategies through professional strategy managers without losing control of their assets. The governance and economic backbone of the protocol is formed by the DHT token.

How Does dHedge DAO (DHT) Work?

dHedge is a non-custodial and tokenized vault architecture protocol operating on Ethereum and various EVM-compatible Layer-2 networks.

This structure allows users to:

- Fully retain ownership of their assets

- Not hand over their funds to a central intermediary

- Buy and sell vault tokens at any time

- Join strategies without lock-up periods

Vaults are created on-chain with smart contracts and each operates as an independent contract. This way, the performance, risk profile, and transaction history of each vault are clearly separated.

Non-Custodial and Censorship-Resistant Structure

One of the most important differences of dHedge is that the relationship between the user and the strategy manager is established entirely through smart contracts. Vault managers cannot directly access user funds or move these funds outside the protocol.

This structure provides the following advantages:

- The risk of fund misuse is eliminated

- Vault managers do not have the authority to “run away” or withdraw funds

- The protocol is censorship-resistant and operates permissionlessly

All transactions are permanently and immutably recorded on the Ethereum Virtual Machine (EVM).

Transparency and Verifiability

Every transaction in the dHedge protocol is recorded on-chain. Deposits into vaults:

- Trades

- Investments

- Withdrawals

can be viewed and verified by anyone.

Users can track how strategies are implemented not only through the dHedge interface but also by directly examining the vault contract address. This transparency offers a level of trust rarely seen in traditional fund management.

Vault Structure and Multi-Chain Support

dHedge vaults operate on multiple Ethereum-based Layer-2 networks. Vaults operating on each network:

- With specific whitelisted assets

- Through approved protocols and DEXs

- Within a predefined risk framework

can trade.

This structure allows each vault to work with different strategy sets and instruments. Users can invest in the desired vault type by connecting their wallet to the relevant network.

Deposit Process to a Vault

Investing in a vault means purchasing vault tokens. These transactions are performed based on Net Asset Value (NAV).

NAV is calculated briefly as follows:

- Total assets in the vault

- Minus liabilities

- Divided by the total circulating vault token count

The resulting value represents the unit price of the vault token.

When a user invests, the invested amount is divided by the dollar-based NAV to receive the corresponding vault tokens.

Withdrawal Mechanism

To increase security, new deposits are locked from withdrawal for the first 24 hours. This measure aims to prevent flash loan and arbitrage attacks.

During withdrawal, users can choose between two different methods:

- Single Asset Withdrawal In this method:

- Positions in the vault are automatically closed proportional to the user’s share

- All assets are converted to a single selected token

- Sent to the user as a single asset

This process is completed with a single on-chain transaction.

- Underlying Assets Withdrawal In this method, the user:

- Receives their proportional share of the assets in the vault

- As separate tokens

For example, if the vault holds 50% BTC and 50% ETH; a user with 10% share directly receives 5% of these assets.

What is dHedge DAO (DHT) Token?

DHT is the governance and incentive token of the dHedge ecosystem. It has multiple critical roles:

- Executing decentralized governance processes

- Incentivizing capital allocation to top-performing managers

- Receiving a share of protocol revenues

The total supply of DHT is capped at 100,000,000 tokens, and the TGE took place in September 2020.

DHT Tokenomics and Revenue Model

In the dHedge protocol, 10% of the fees from vaults are transferred to protocol revenue. These revenues are collected in a smart contract called the Protocol Treasury.

DHT holders:

- Can participate in governance decisions through staking

- Can vote on the redistribution or liquidation of treasury assets

This structure is designed to support the protocol’s long-term sustainability.

DHT Allocation (Token Distribution)

The total 100,000,000 DHT is distributed as follows:

- Mesa Auction & Other Incentives – 6.68%

- Seed – 13.01%

- Strategic – 5.44%

- Exchange Partner – 3.75%

- Core Team – 18.50%

- Advisors – 1.50%

- Unallocated – 51.12%

Vesting:

DHT Staking Mechanism

The DHT staking model differs from classic single-token locking systems. Users must stake:

- DHT token

- dHedge Vault Token (DHVT)

together. As a result of this pairing:

- A “staked position” is created

- This position is given to the user as an ERC-721 NFT

This NFT represents the user’s staked position and voting power.

vDHT and Governance

Users who stake receive vDHT (Voting Power). vDHT:

- Is used in DAO votes conducted via Snapshot

- Is automatically recognized through the wallet holding the NFT

Users can create multiple staking positions with different vault tokens, each represented by a separate NFT.

What is Protocol Treasury?

Protocol Treasury is the decentralized treasury where protocol revenues are collected. This treasury:

- Holds tokens from vault fees

- Holds top-performing vault tokens

and is managed by the DAO.

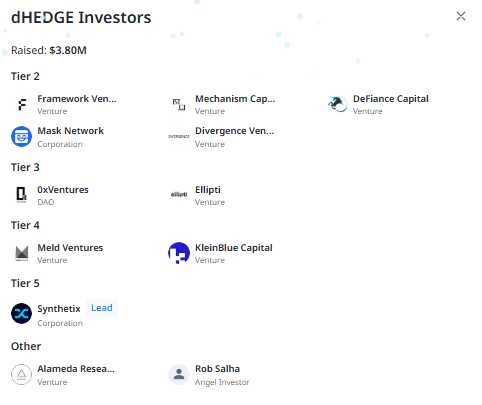

dHedge DAO Investors

dHedge has raised $3.80 million to date.

Prominent investors include:

- Framework Ventures

- Mechanism Capital

- DeFiance Capital

- Mask Network

- Divergence Ventures

- Synthetix

- Alameda Research

dHedge Team

The core team behind dHedge consists of three members:

- Henrik Andersson – An experienced asset manager from traditional finance and CIO of Apollo Capital

- Radek Ostrowski – Expert in data engineering and blockchain development

- Ermin Nurovic – Systems engineer and team member contributing to technical infrastructure

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.