Dolomite (DOLO) is a cutting-edge decentralized money market protocol and DEX that delivers extensive token support and capital efficiency through its virtual liquidity system.

What Is Dolomite (DOLO)?

In the realm of DeFi, Dolomite stands out by merging the strengths of a decentralized exchange and a lending protocol, creating one of the most capital-efficient and modular platforms to date. It offers over-collateralized loans, margin trading, spot trading, and various financial instruments. Dolomite simplifies portfolio hedging, leveraging, or unlocking idle capital through its broad token support, capital efficiency, and a non-profit-seeking model that passes DeFi rewards directly to users. The platform aims to become a central hub for DeFi activities, enabling protocols, yield aggregators, DAOs, market makers, hedge funds, and others to manage portfolios and execute on-chain strategies.

Why is Dolomite’s Architecture Unique?

Dolomite boasts a highly modular architecture, divided into two layers: the immutable core layer and the mutable module layer. Designed to embody the spirit of DeFi, the protocol features an unchangeable base layer that can only adjust specific configuration parameters while maintaining essential modularity to adapt to evolving DeFi trends, environments, and paradigms. This modularity ensures a clear upgrade path, preserving Dolomite’s core functionality while integrating new features without conflicting with existing modules.

The platform introduces innovative portfolio management options by embedding features into its core margin protocol. Operations are executed through the immutable layer via a sequence of actions, with notable ones including Transfer (with internal liquidity) and two Trade actions. Transfers allow movement of funds between subaccounts or different wallets, while trading enables users to utilize liquidity with external systems (using free flash loans on Dolomite) or other virtual liquidity sources.

What is DOLO?

DOLO serves as the governance token for the Dolomite protocol, designed to align incentives and promote sustainable growth. Issued as an ERC20 token on Berachain, Ethereum, and Arbitrum, DOLO employs a burn-and-mint model for transparency and interoperability. An API endpoint aggregates DOLO across all networks, reporting to platforms like CoinMarketCap and CoinGecko. Cross-chain compatibility is enabled through Chainlink’s Cross-Chain Interoperability Protocol (CCIP), ensuring seamless integration with other Layer 2s and alternative Layer 1 networks.

Token Mechanics

DOLO, veDOLO, and oDOLO form the backbone of the Dolomite ecosystem. With a fixed total supply of 1,000,000,000 tokens, DOLO integrates mechanisms inspired by successful DeFi models while introducing tailored innovations. Its distribution is structured to encourage community participation, protocol growth, and alignment with long-term stakeholders.

Virtuous Cycle

DOLO’s tokenomics create a self-sustaining cycle aligning all stakeholders:

-

oDOLO generates buy pressure as users must hold DOLO for pairing and purchasing discounted veDOLO.

-

veDOLO purchases increase protocol-owned liquidity (POL), enhancing stability, deepening borrow liquidity, and boosting platform appeal.

-

Increased liquidity attracts users, raising protocol revenue.

-

When mature, the DAO can distribute protocol fees to veDOLO stakers, further incentivizing DOLO staking.

This cycle ensures participants benefit proportionally from the protocol’s growth, fostering long-term ecosystem alignment.

Dolomite (DOLO) Tokenomics

DOLO is a standard ERC-20 token without the additional functionalities of veDOLO or oDOLO. It plays a foundational role in the Dolomite ecosystem by enabling exchange liquidity, transferability, lending, and serving as an entry point for new users.

Key Features:

-

Liquidity Provision: DOLO powers initial exchange pools, ensuring a robust trading environment.

-

Governance Flexibility: Converts to veDOLO for governance participation.

-

Future-Proof Utility: Supports long-term growth with an inflation mechanism funding ecosystem expansion and strategic initiatives.

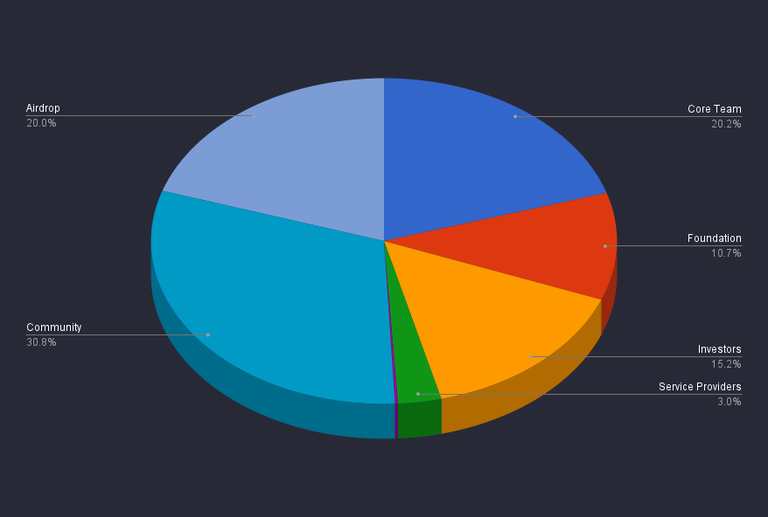

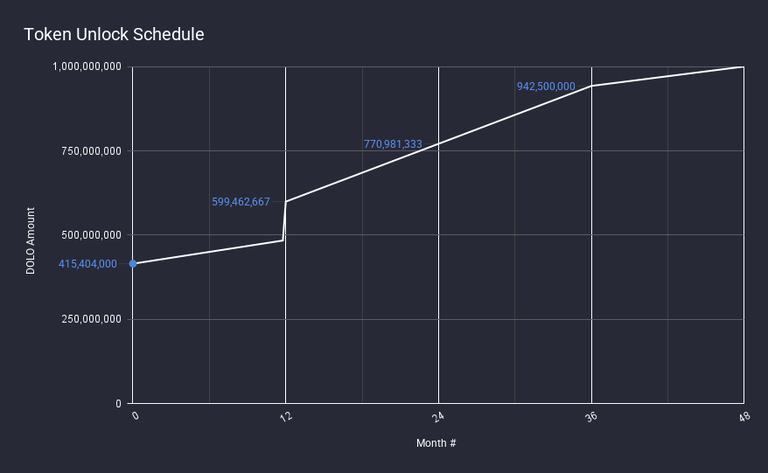

Distribution

DOLO’s total supply is capped at 1,000,000,000 tokens, allocated to promote long-term protocol alignment, sustainable liquidity, and decentralized governance.

Key Points:

-

Total Supply: 1,000,000,000

-

Total Unlocked at TGE: 415,404,000

-

Circulating DOLO at TGE: 326,650,000

-

Circulating veDOLO at TGE: 79,050,000

Token Distribution Overview:

-

Community: 50.75%

-

Liquidity Mining: 20% (oDOLO emissions over time)

-

Protocol-Owned Liquidity (POL): 2% (seeded on Kodiak and Uniswap)

-

Boyco Incentives: 3% (emitted as veDOLO)

-

Future Partner Rewards: 5.75%

-

Airdrop: 20%

-

Minerals Claimers: 10% (call options with $0.045 strike)

-

Retroactive Usage: 9% (50% DOLO, 50% veDOLO)

-

Early Contributors: 1% (mix of DOLO and veDOLO)

-

-

-

Core Team: 20.2075% (3-year vesting with 1-year cliff)

-

Foundation: 10.6511%

-

Investors: 15.1846%

-

1.3933% (13,933,333 DOLO) vests over the first 12 months

-

13.7913% (137,913,000 DOLO) vests over 3 years with a 1-year cliff

-

-

Service Providers: 3%

-

Advisors: 0.2068% (vested over 2-3 years with a 1-year cliff)

Long-Term Inflation

Starting in year 4, a 3% annual inflation rate applies (modifiable by governance). The DAO can vote to use, burn, or allocate tokens to new incentive programs. Burning tokens disables inflation for that year.

Dolomite Governance

Dolomite’s governance empowers veDOLO holders to shape the protocol’s future, focusing on key areas like asset listing/delisting, tokenomics changes, risk parameter updates, treasury allocations, and incentive program changes. The DAO is a legal entity in the Marshall Islands, with Dolomite Ltd (BVI) as the token issuer and the Dolomite Foundation (Cayman Islands) as a steward. Leavitt Innovations is contracted for protocol development and maintenance.

Voting Process

Governance flows from community discussion to execution, with veDOLO vote weight determining participation:

-

Proposal Drafting: Community members or DAO participants with sufficient veDOLO prepare proposals.

-

Discussion: Proposals are posted in the Discord Governance Forum for feedback.

-

Temp Check: Discord conducts temperature checks on proposals.

-

Quarterly Compilation: Proposals passing the temp check are bundled for a quarterly vote.

-

On-Chain Voting (BeraVote): Voting occurs quarterly on BeraVote.

-

Execution: Approved proposals are implemented by Leavitt Innovations, LLC.

Governance Forum Access and Roles

The Governance Forum, hosted on Discord and integrated with Galxe for wallet verification, assigns roles based on veDOLO balance:

-

1M+ veDOLO: Create proposals.

-

10k+ veDOLO: Comment on proposals.

-

1k+ veDOLO: Upvote/react to proposals.

-

No veDOLO: Read-only access.

Wallet Linking and Role Assignment:

-

Join the Dolomite Discord.

-

Verify your identity.

-

Link your Galxe account in the Bot Commands channel.

-

Wallet ownership is verified via Galxe.

-

Roles update automatically based on veDOLO holdings.

Future Roadmap

Dolomite’s community-driven roadmap focuses on cooperative integrations with other protocols and enhancing its core experience with the richest feature set in DeFi.

What is Dolomite XP?

Dolomite XP rewards active community members in a fun way, encouraging engagement with the platform’s features. Completing campaigns earns XP, which leads to levels and benefits. Participants gain opportunities for increased liquidity rewards and veDOLO governance participation. The XP system is powered by Galxe, a web3 community-building platform.

How to Earn XP?

Complete campaigns to earn 10, 20, or 30 XP. Each campaign includes an XP amount, description, and tasks. XP is claimed as a Galxe OAT upon completion, announced on Dolomite’s Twitter, Discord, and Achievements page.

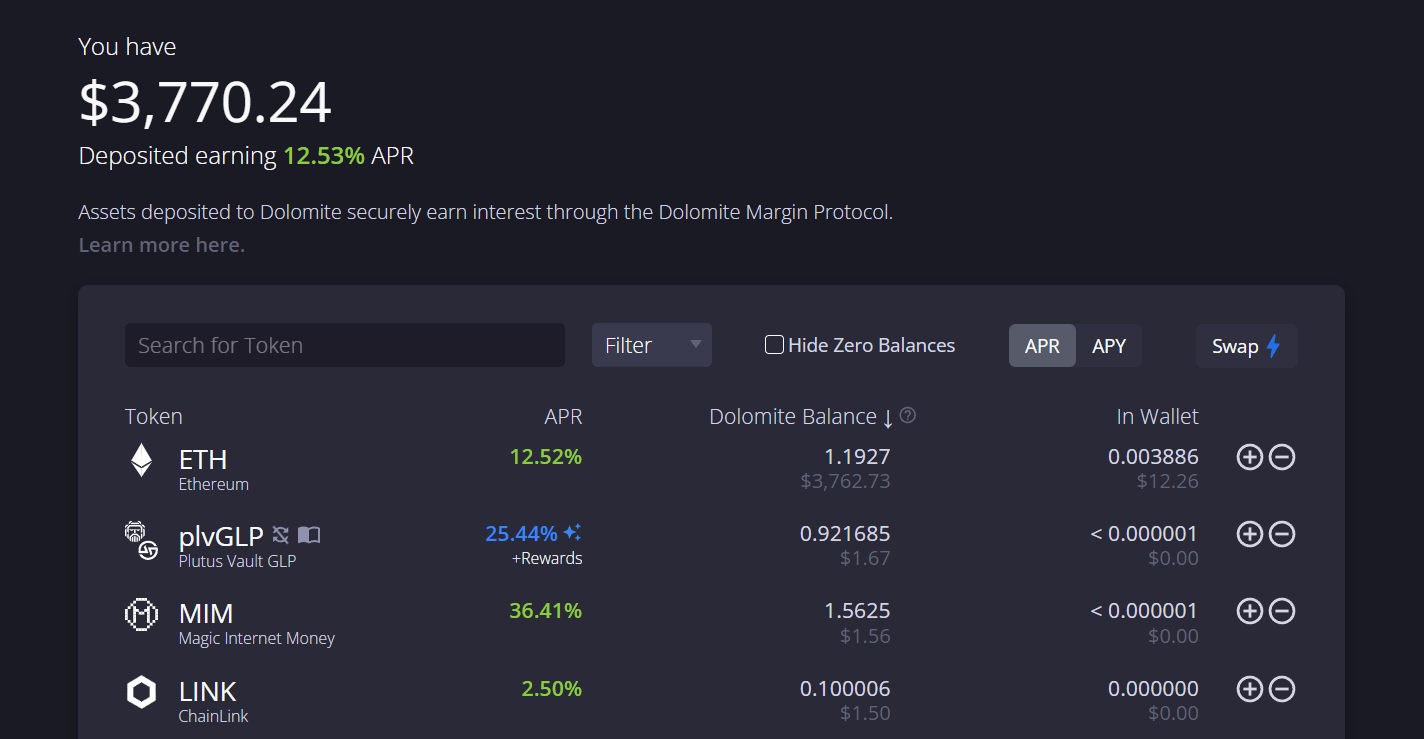

Dolomite Balances

Your Dolomite Balance represents virtual liquidity usable across all platform services, including trading, borrowing, and pooling. Deposited assets aggregate into this balance, managed via internal ledger changes in the DolomiteMargin smart contract, enhancing capital efficiency.

Dolomite Integrations

Dolomite’s modular infrastructure enables seamless integrations with DeFi protocols, allowing users to retain control over rewards. Examples include GMX’s GLP, Camelot’s spNFTs, Sushi’s staked LP tokens, and Lyra’s cash-collateralized vaults.

Dolomite Investors and Backers

Dolomite is backed by prominent investors like Coinbase Ventures, Sandeep Nailwal, 6th Man Ventures, NGC Ventures, Arbitrum Foundation, RR2 Capital, Draper Goren Holm, WWVentures, Optic Capital, DCF God, DeFi Dad, Pentoshi, Altcoin Sherpa, Marc Boiron, SobyLife, CLBera, Ishan B, and Richard Seiler, strengthening its position in the DeFi ecosystem.

Dolomite (DOLO) Team

Led by Adam Knuckey (COO and Co-Founder) and Corey Caplan (Co-Founder and President), Dolomite’s team is dedicated to building innovative financial solutions, aiming to make the platform a global DeFi hub.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.