In the world of cryptocurrency and blockchain, decentralized finance (DeFi) protocols continue to transform financial systems with innovative approaches. One standout in this space is Euler (EUL), a DeFi protocol designed for modular, secure, and capital-efficient lending and borrowing operations. So, what exactly is Euler, how does it work, and why is it gaining attention? Let’s dive in and explore in detail!

What is Euler (EUL)?

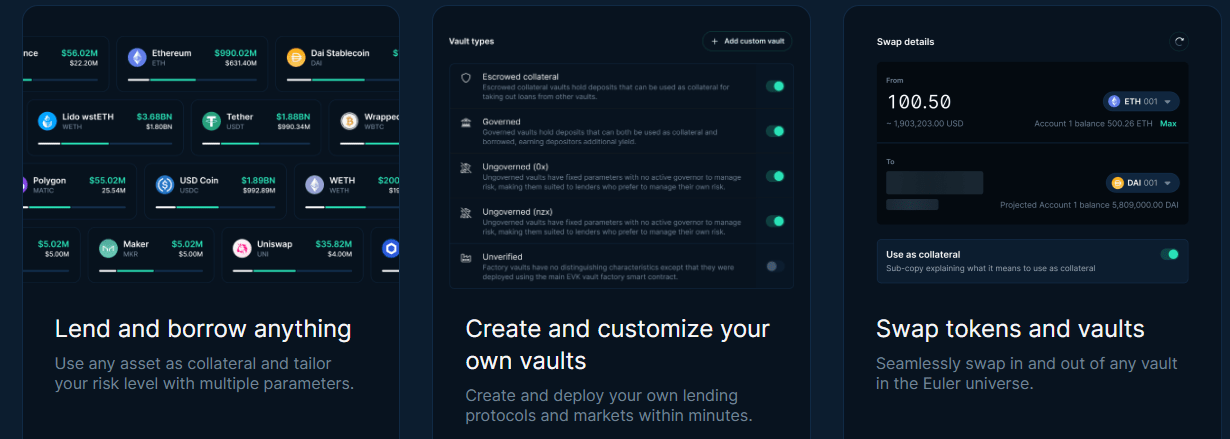

Euler is a decentralized and permissionless lending protocol operating on Ethereum and other EVM-compatible networks. Redesigned with Euler V2, the protocol is built around an innovative architecture called the Euler Vault Kit (EVK). This system enables the creation of isolated, customizable lending and borrowing markets for any ERC20 token. Moving away from traditional pool-based structures, it uses modular vaults to isolate the risk of each asset. This provides flexibility and security for both users and developers.

Euler is designed to enhance capital efficiency, isolate risks, and enable developers to create innovative financial products. The $EUL token serves as the protocol’s governance token, allowing users to vote on protocol changes and treasury management. Additionally, it incentivizes users through the Fee Flow system for distributing protocol fees and reward mechanisms.

Euler’s Key Features

Euler stands out in the DeFi world with its modular structure and innovative features. Here are the protocol’s core components and characteristics:

1. Permissionless Vault Creation with Euler Vault Kit (EVK)

The cornerstone of Euler V2, the EVK, allows anyone to create lending or borrowing vaults for any ERC20 token. Each vault focuses on a specific asset and creates isolated risk pools. Some vaults can only be used as collateral (non-borrowable), strengthening risk management. Vaults are compliant with the ERC4626 standard and tokenize lending markets.

2. Modular Architecture

Euler consists of separate, replaceable components such as vaults, price oracles, interest rate models (IRMs), and hook targets. This modular structure ensures that each vault is customizable. For instance, different price oracles (Chainlink, Pyth, Redstone, etc.) or interest rate models can be selected for a vault.

3. Isolated Risk Management

Each vault operates as an independent market, preventing risks in one market from directly affecting others. This reduces systemic risks and enhances the protocol’s resilience. The Ethereum Vault Connector (EVC) coordinates interactions between vaults, securely managing collateral and borrowing operations.

4. Advanced Features

-

Hook Targets (Hooks): Used to add custom logic to vaults. For example, a vault can perform specific checks (access control, security audits, etc.) before deposits or borrowing.

-

EVC: A smart contract that facilitates interactions between vaults, offering features like batch calls, sub-accounts, and permission-based execution.

-

Price Oracles: Integrates with various providers (Chainlink, Pyth, Redstone, Chronicle, etc.) to provide customizable price data for vaults.

-

Interest Rate Models (IRM): Dynamically determines lending and borrowing interest rates for each vault based on its utilization rate.

5. Integrated DEX with EulerSwap

EulerSwap offers a decentralized exchange (DEX) integrated with Uniswap v4’s hook architecture. Users can swap assets, earn lending yield, and use the same assets as collateral simultaneously. This enhances capital efficiency and prevents liquidity fragmentation. The single-owner pool model gives liquidity providers full control.

6. Reward System

Euler incentivizes users through both on-chain and off-chain reward mechanisms:

-

Reward Streams: Distributes multiple reward tokens in a permissionless and trustless manner. Users can earn rewards without locking their assets.

-

Merkl Integration: Off-chain rewards are distributed with updates every 8-12 hours, and users can claim them via the Euler app or Merkl dashboard.

7. Risk Management

Euler strengthens risk management with isolated markets, vault-specific loan-to-value (LTV) ratios, and liquidation mechanisms. Risk Curators manage risks through collateral selection, LTV ratios, and oracle choices. Earn Vaults offer optimized strategies for passive yields and are actively managed by risk curators.

How Euler (EUL) Works

Euler enables users to perform lending, borrowing, and swapping operations. The workflow is as follows:

-

Vault Creation: Users or developers can create vaults for any ERC20 token using the EVK.

-

Deposits and Borrowing: Users deposit assets into vaults to earn yield and use these assets as collateral to borrow from other vaults.

-

EVC Interaction: The EVC coordinates inter-vault operations, performs batch transactions, and provides risk isolation through sub-accounts.

-

Rewards and Governance: Users participate in reward programs to earn $EUL or other tokens. $EUL holders vote to guide the protocol’s direction.

-

Swapping with EulerSwap: Users can swap assets via EulerSwap while benefiting from lending yield and collateral advantages.

Euler (EUL) Tokenomics

$EUL is the native governance token of the Euler protocol, with a total supply of 27,182,818 (in homage to Euler’s number). The token distribution is as follows:

-

Euler DAO: 34% (approximately 9.24 million EUL) for treasury and user rewards.

-

Euler Foundation: 3.7% (approximately 1 million EUL) for ecosystem growth.

-

Strategic Partners: 39.5% (approximately 10.74 million EUL) to partners like Encode, Lemniscap, and Paradigm.

-

Euler Labs: 26.5% (approximately 7.2 million EUL) for founders and contributors.

-

Protocol-Owned Liquidity: Provided on Balancer v2, Aera, Arrakis, and Uniswap v3.

Token Utility:

-

Governance: Voting on protocol changes and treasury management.

-

Fee Flow Auction: Exchanging protocol fees for $EUL.

-

Rewards: Incentivizing users (e.g., rEUL rewards convert 1:1 to EUL over six months).

Euler Investors

Euler is backed by strong investor support. It raised funds in Series A and seed rounds led by Paradigm and Coinbase Ventures. Other notable investors include CMT Digital, Jump Crypto, Wintermute, Divergence Ventures, Jane Street Capital, Lemniscap, Haun Ventures, Morningstar Ventures, Uniswap Labs Ventures, Ryan Sean Adams, DOUBLETOP, Cluster Capital, Block0, LAUNCHub Ventures, M31 Capital, FTX Ventures, Kain Warwick, Anthony Sassano, David Hoffman, Hasu, Josh Buckley, Luke Youngblood, Ric Burton, Danilo S. Carlucci, Supriyo Roy, and Xin Wang. These investors reflect confidence in Euler’s innovative vision in the DeFi space.

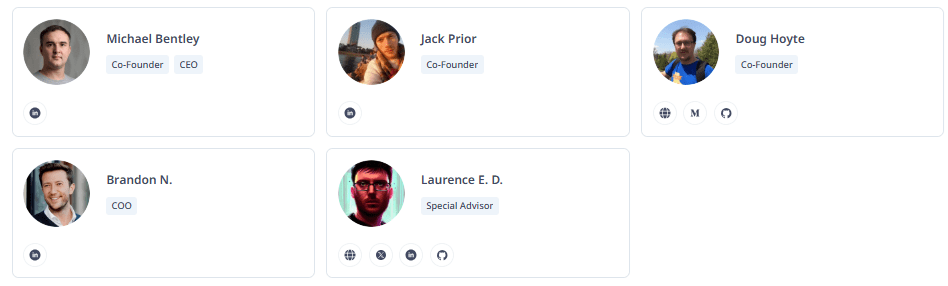

Euler Team

Euler was founded in 2021 by Michael Bentley, Jack Prior, and Doug Hoyte. Michael Bentley (CEO) drives the protocol’s vision, while Jack Prior and Doug Hoyte strengthen its technical infrastructure. Brandon N. (COO) manages operations, and Laurence E. D. (Special Advisor) provides strategic guidance. The team consists of experienced experts in DeFi and blockchain.

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.