Frax USD (frxUSD) is a USD-pegged, fully collateralized stablecoin offered by the Frax Finance ecosystem. The Frax Protocol issues frxUSD alongside other stablecoins like FPI and frxETH, as well as various non-stablecoin tokens. It integrates these assets through multiple subprotocols to deliver utility and stability. This article dives into what Frax USD is, how it functions, and the opportunities it presents.

What is Frax USD (FRXUSD)?

Frax USD (frxUSD) is a stablecoin issued by the Frax Protocol, pegged 1:1 to the USD. Each frxUSD is backed by cash-equivalent reserves, such as tokenized U.S. Treasury funds (e.g., BUIDL, USTB, JTRSY, WTGXX, AUSD), managed by Frax Inc under delegation from the Frax DAO. The Frax ecosystem includes frxUSD, FPI (pegged to a basket of consumer goods), frxETH (an ETH-pegged liquid staking derivative), and sfrxUSD (a yield-generating stablecoin). Subprotocols like Fraxswap, Borrow AMM (BAMM), Fraxlend, AMOs, and Fraxtal enhance the ecosystem’s functionality.

Purpose of Frax USD (FRXUSD)

Frax USD serves as a stable store of value, pegged to the USD. The Frax Protocol strengthens its ecosystem by managing stablecoin collateral and generating yield. sfrxUSD targets the highest risk-adjusted returns through strategies like carry-trade, AMOs, or IORB/T-Bill. Fraxtal, a Layer-2 chain, uses FRAX as its gas token. Frax Bonds (FXB) stabilize frxUSD supply and lock liquidity. The protocol builds trust through decentralized governance and transparency.

How Does Frax USD (FRXUSD) Work?

Frax USD is backed 1:1 by cash-equivalent reserves. Frax Inc handles reserve management, KYC/KYB compliance, audits, and fiat redemptions. frxUSD operates permissionlessly; users interact with frxUSDCustodian contracts, though reserve tokens may have additional requirements (e.g., whitelists).

Key Features:

-

Market Registry: Betting markets are created with details like sport, league, team names, bet type (Moneyline, Spread, Total), and game time. A market hash is stored in the Registry.

-

Escrow Contract: When a bet is offered and accepted, funds are atomically transferred to the Escrow Contract, held until the outcome is reported (Outcome1, Outcome2, or Void). Void bets are refunded without fees.

-

Market Makers: Provide diverse, deep liquidity to support competitive odds.

-

Whale and Syndicate VIP Service: Average bet size is ~$345, far larger than traditional platforms; VIP managers offer tailored opportunities.

-

Low Latency: Fast order book and reliable data reporting.

Core Components:

-

sfrxUSD: An ERC4626-like yield vault distributing weekly profits from staked frxUSD. The Benchmark Yield Strategy (BYS) selects the highest yield among carry-trade, AMOs, or IORB/T-Bill.

-

Frax Bonds (FXB): Zero-coupon bond-like tokens that reduce frxUSD supply and stabilize the peg. Sold at a discount via Dutch auction, they convert 1:1 to LFRAX at maturity.

-

Fraxlend: A permissionless lending market offering frxUSD and other Frax tokens for borrowing.

-

Fraxswap: A TWAMM-enabled AMM for executing large trades over time.

-

BAMM: A borrowing/lending module built on Fraxswap, requiring no external oracle or liquidity.

-

Fraxtal: An Optimism-based Layer-2 chain using FRAX as its gas token.

Frax USD (FRXUSD) Use Cases

Frax USD is utilized as a stablecoin in DeFi:

-

DeFi Transactions: Payments, lending, and liquidity provision.

-

sfrxUSD Staking: Earning yield in the vault.

-

Fraxlend: Borrowing and lending.

-

Fraxswap: Large trades via TWAMM.

-

Fraxtal: Using FRAX as a gas token.

Usage Steps:

-

Connect a wallet like MetaMask.

-

Acquire frxUSD (via exchanges or frxUSDCustodian).

-

Stake in the sfrxUSD vault or use in Fraxlend/Fraxswap.

-

Transact on Fraxtal.

Advantages of Frax USD (FRXUSD)

-

Stability: 1:1 USD backing with transparent reserves.

-

Yield: sfrxUSD offers top risk-adjusted returns.

-

Decentralization: Frax DAO governance and permissionless operations.

-

Ecosystem: Integration with Fraxswap, Fraxlend, and Fraxtal.

Risks of Frax USD (FRXUSD)

-

Regulation: Stablecoin regulatory risks.

-

Market Volatility: Crypto market fluctuations.

-

Collateral Risk: Performance of reserve assets.

Frax USD (FRXUSD) Tokenomics

-

frxUSD: USD-pegged, collateralized stablecoin.

-

FRAX: Fraxtal’s gas token with a fixed emission schedule (8% initial inflation, reducing to 3% over 6 years).

-

sfrxUSD: Yield vault distributing weekly profits to frxUSD stakers.

-

FXB: Zero-coupon bonds converting 1:1 to LFRAX at maturity.

-

veFRAX: Staked FRAX granting voting rights and farming boosts.

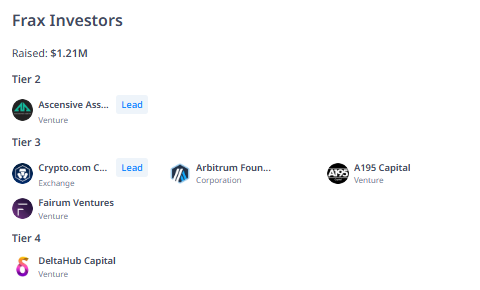

Frax USD (FRXUSD) Investors

Raised $1.21 million:

-

Tier 2: Ascensive Assets.

-

Tier 3: Crypto.com Capital, Arbitrum Foundation, A195 Capital, Fairum Ventures.

-

Tier 4: DeltaHub Capital.

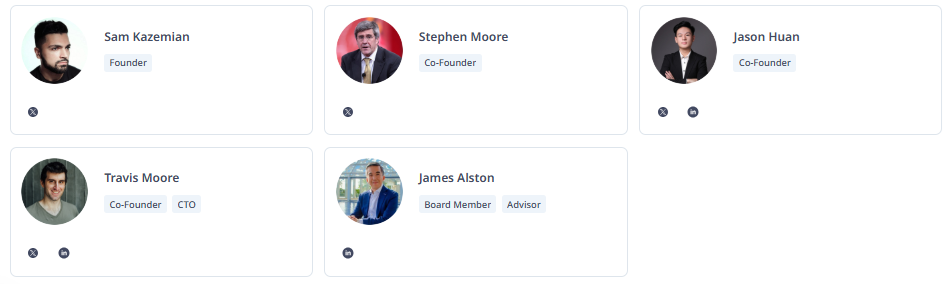

Frax USD (FRXUSD) Team

-

Sam Kazemian (Founder): Visionary behind Frax Protocol.

-

Stephen Moore (Co-Founder): Strategy and development.

-

Jason Huan (Co-Founder): Technical leadership.

-

Travis Moore (Co-Founder & CTO): Technology and infrastructure.

-

James Alston (Advisor): Board member.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.