The world of cryptocurrency is constantly evolving, with innovative projects reshaping the landscape of decentralized finance (DeFi). Hyperion (RION) emerges as a high-performance DeFi platform built on the Aptos blockchain, capturing attention with its unique approach. By integrating swap aggregation, market-making mechanisms (CLMM and the upcoming DLMM), and vault strategies into a seamless on-chain experience, Hyperion aims to become the unified liquidity and trading layer of Aptos. In this article, we’ll explore what Hyperion is, the role of the RION token, its tokenomics, and the innovative features driving this platform forward.

What Is Hyperion?

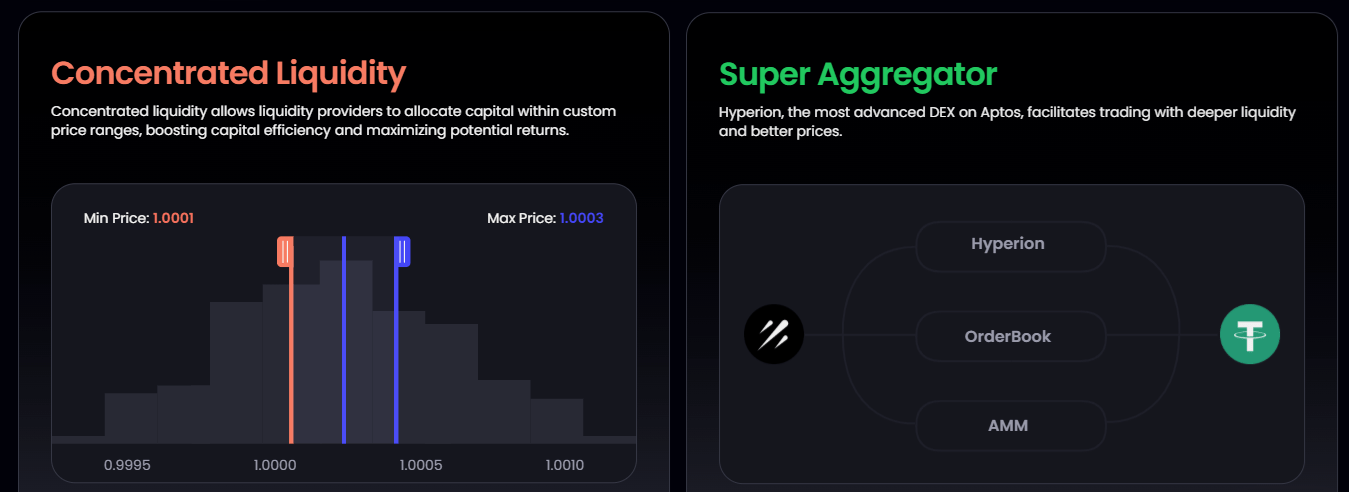

Hyperion is a decentralized exchange (DEX) platform developed on the Aptos blockchain, leveraging its high-performance parallel execution engine. Designed to deliver a user-friendly experience, Hyperion enhances the traditional automated market maker (AMM) model with its Concentrated Liquidity Market Maker (CLMM) system. This allows liquidity providers to allocate funds within specific price ranges, boosting capital efficiency and enabling traders to execute transactions with lower slippage. Looking ahead, Hyperion’s forthcoming Dynamic Liquidity Market Maker (DLMM) model promises to further revolutionize liquidity management.

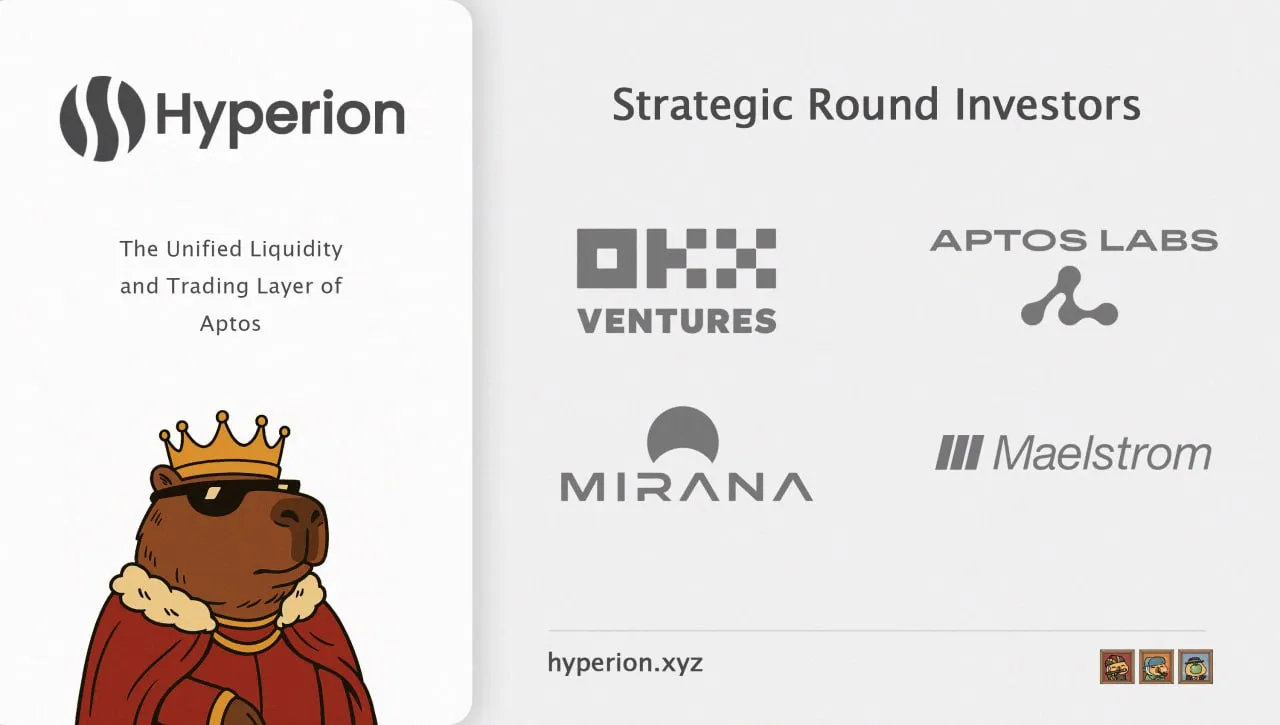

Hyperion combines swap operations, liquidity provision, and vault strategies to establish itself as a leading liquidity hub within the Aptos ecosystem. Catering to both individual users and developers, the platform offers a flexible and secure DeFi experience. Incubated by BlockBooster and part of the Ankaa Accelerator Program, Hyperion is backed by prominent investors like OKX Ventures, Aptos Labs, Mirana Ventures, and Maelstrom, fueling its growth and potential.

RION Token and Tokenomics

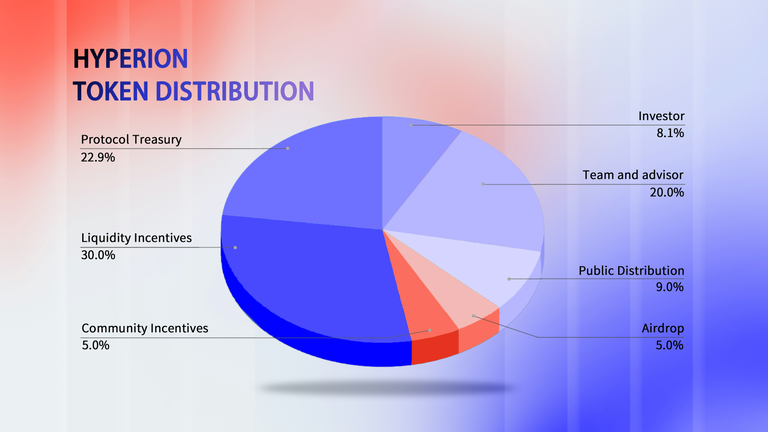

At the core of the Hyperion platform is the RION token, which powers transactions, incentives, and future governance functions. Operating on the Aptos blockchain, RION has a total supply of 100 million tokens, distributed as follows:

-

Liquidity Incentives: 30.0%

-

Protocol Treasury: 22.9%

-

Team and Advisors: 20.0%

-

Public Distribution: 9.0%

-

Investors: 8.1%

-

Community Incentives: 5.0%

-

Airdrop: 5.0%

This distribution model reflects a community-centric approach while allocating significant resources to the protocol treasury for long-term development. RION serves as an economic incentive, rewarding users for active participation in the platform. Inactive users do not qualify for these rewards, encouraging engagement and contribution.

Additionally, Hyperion introduces xRION, a non-transferable governance token obtained by locking RION for a specified period (up to 52 weeks). xRION grants holders voting rights in the platform’s governance processes once the Hyperion DAO is established. The amount of xRION received is calculated based on the number of RION tokens locked and the lock-up duration. For example, locking 1 RION for 52 weeks yields 52 xRION, while the original RION is returned upon lock-up expiration, resetting the xRION balance to zero.

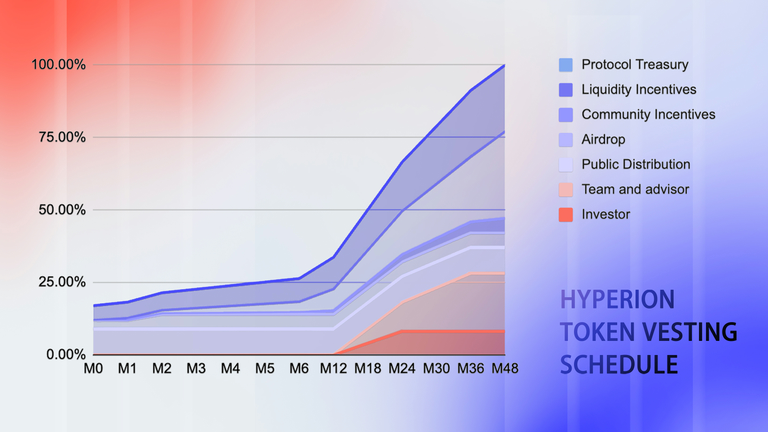

Hyperion Vesting

Hyperion’s Key Features

1. Concentrated Liquidity

Hyperion’s standout feature is its concentrated liquidity model. Unlike traditional AMMs, where liquidity is spread across the entire price range, Hyperion allows liquidity providers (LPs) to focus their capital within specific price bands. This is particularly effective for low-volatility assets like stablecoins, maximizing capital efficiency. For instance, an LP can concentrate liquidity in a 0.995–1.005 price range for a stablecoin pool, optimizing fee earnings from active trades.

2. Fee-Based Liquidity Mining

Hyperion redefines liquidity mining with a fee-based model. Instead of distributing rewards based on liquidity volume, Hyperion allocates rewards according to the transaction fees generated by a liquidity position. This approach incentivizes active and effective liquidity provision, enhancing the platform’s overall efficiency.

3. Range Orders

Leveraging its concentrated liquidity algorithm, Hyperion enables advanced trading strategies through range orders. Similar to limit orders, range orders allow LPs to provide single-sided liquidity within specific price ranges for buying or selling. For example, in a BTC-USDC pool with a price of 20,000 USDC/BTC, a user can set a 19,000–19,001 range to buy BTC when the price drops, mimicking professional trading strategies.

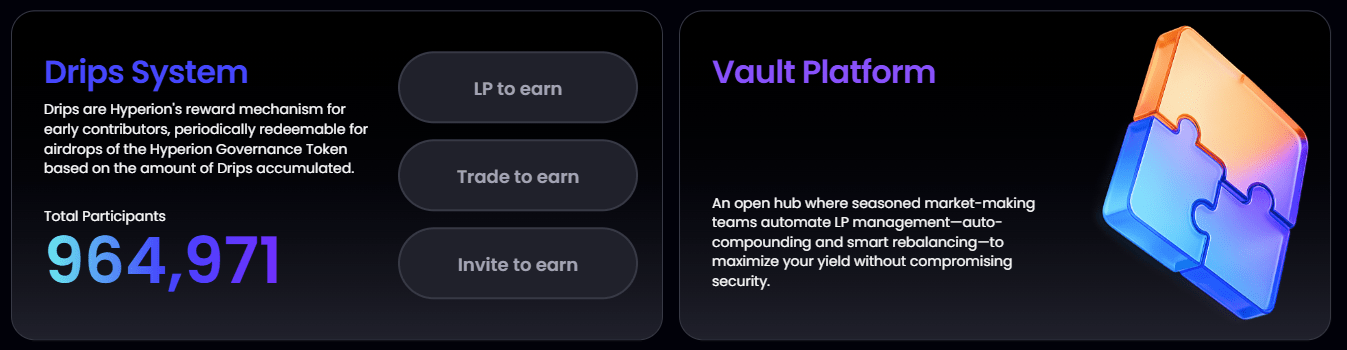

4. Drips System

Hyperion’s Drips system rewards users for active participation in liquidity provision, trading, and community growth through referrals. Drips points, calculated daily, are earned based on liquidity provision and trading volume. The referral system further incentivizes engagement, granting users 20% of direct invitees’ points and 10% of second-level invitees’ points. This system fosters a vibrant ecosystem with exclusive benefits for active contributors.

Hyperion’s Roadmap

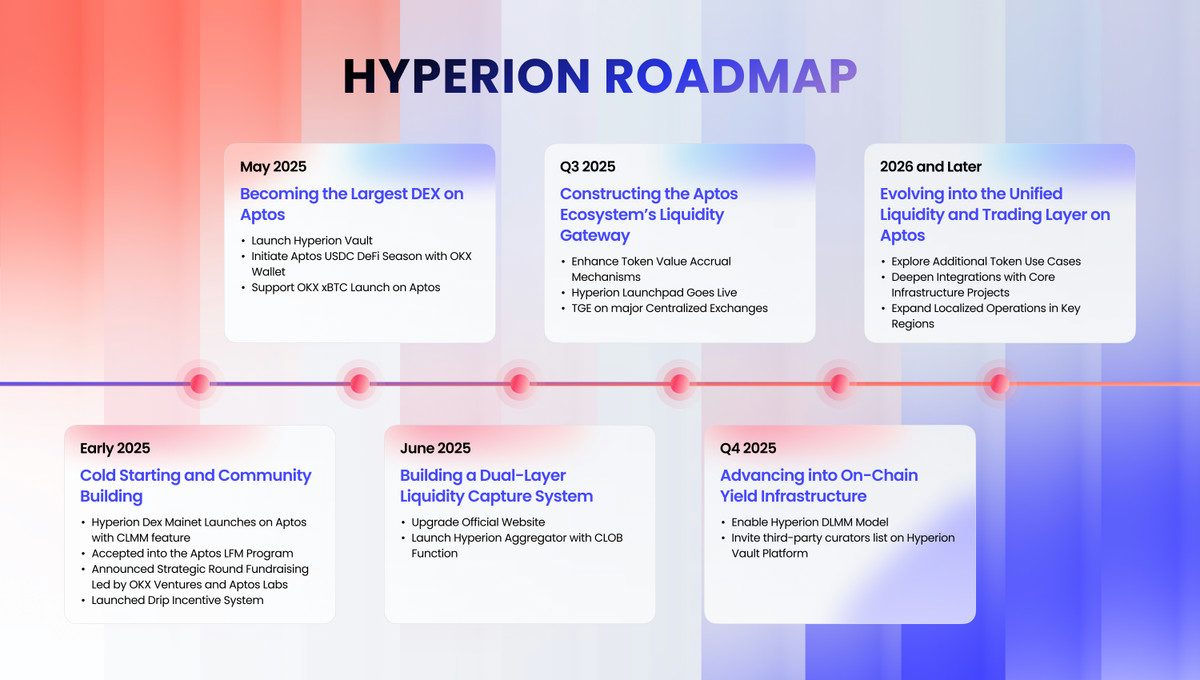

Hyperion has outlined an ambitious roadmap for 2025 and beyond:

-

Early 2025: Launch of the Hyperion DEX mainnet with CLMM features on Aptos, acceptance into the Aptos LFM program, and strategic fundraising led by OKX Ventures.

-

May 2025: Aiming to become the largest DEX on Aptos, launching Hyperion Vault, and initiating the Aptos USDC DeFi season with OKX Wallet.

-

June 2025: Introducing a dual-layer liquidity capture system and launching the Hyperion Aggregator with CLOB functionality.

-

Q3 2025: Launching the Hyperion Launchpad and conducting a token generation event (TGE) on major centralized exchanges.

-

Q4 2025: Activating the DLMM model and integrating third-party curators into the Hyperion Vault platform.

-

2026 and Beyond: Exploring additional token use cases, deepening integrations with core infrastructure projects, and expanding localized operations in key regions.

Investors and Support

Hyperion is supported by a robust lineup of investors, including OKX Ventures, Aptos Labs, Mirana Ventures, Maelstrom, BlockBooster, and Ankaa. These partnerships bolster Hyperion’s potential to lead the Aptos ecosystem as a premier DeFi platform.

Founding Team

Hyperion’s founder and CEO, 0xcsk, is the driving force behind the platform’s vision. As an experienced leader, 0xcsk guides Hyperion’s technological innovation and community-focused growth.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.