As the digital economy expands, traditional legal systems increasingly struggle to address online and cross-border disputes. This gap has accelerated the search for blockchain-based alternatives. Kleros (PNK) positions itself at this intersection by formalizing the concept of decentralized justice, combining smart contracts with game theory–driven incentives.

Rather than relying on centralized courts or costly arbitration firms, Kleros proposes a system where disputes are resolved by economically motivated human juries operating entirely on-chain.

Kleros as a Digital Arbitration Mechanism

Kleros is an open-source dispute resolution protocol designed to deliver neutral, fast, and low-cost rulings. Built on Ethereum, the system replaces centralized decision-makers with anonymous jurors selected through a token-based mechanism.

Its primary use cases include e-commerce escrow disputes, freelancer payment conflicts, DAO governance issues, and content moderation decisions—areas where trust between parties is often fragile.

Launched in July 2018, Kleros aims to resolve smart contract disputes through human judgment, while ensuring honesty through cryptoeconomic incentives rather than authority.

The core promise is simple:

a dispute resolution system that is efficient, censorship-resistant, and difficult to manipulate.

Why Kleros Exists

As escrow contracts, DAO conflicts, NFT copyright issues, and oracle disputes became more common, one limitation stood out clearly: smart contracts cannot anticipate every edge case.

Rules can be enforced on-chain, but interpretation still requires human judgment. Kleros fills this gap by letting humans decide—while ensuring they are financially incentivized to act honestly.

Funding and Strategic Partnerships

Kleros has received backing from notable crypto-focused investors such as Monday Capital and Moonrock Capital. More notably, its collaboration with Thomson Reuters Labs signals interest from traditional legal institutions exploring decentralized alternatives.

That said, institutional interest alone does not eliminate risk. Adoption and sustained usage remain the key variables.

Founding Team

Federico Ast – Founder & CEO

With a background in law and political science, Federico Ast previously worked on Crowdjury, an early community-based arbitration project. He also teaches online courses and focuses primarily on governance and long-term vision at Kleros.

Clément Lesaege – CTO

An expert in smart contract security and cryptography, Lesaege has conducted independent audits and has prior research experience in machine learning.

Nicolas Wagner – Lead Developer

Responsible for Kleros’ technical architecture, Wagner previously worked on blockchain projects such as Dether.io.

Overall, the team emphasizes protocol design and incentives rather than short-term hype.

How the Kleros Protocol Works

The system operates across three core layers:

-

The dispute-generating smart contract

-

The Kleros arbitration protocol

-

A pool of jurors staking PNK tokens

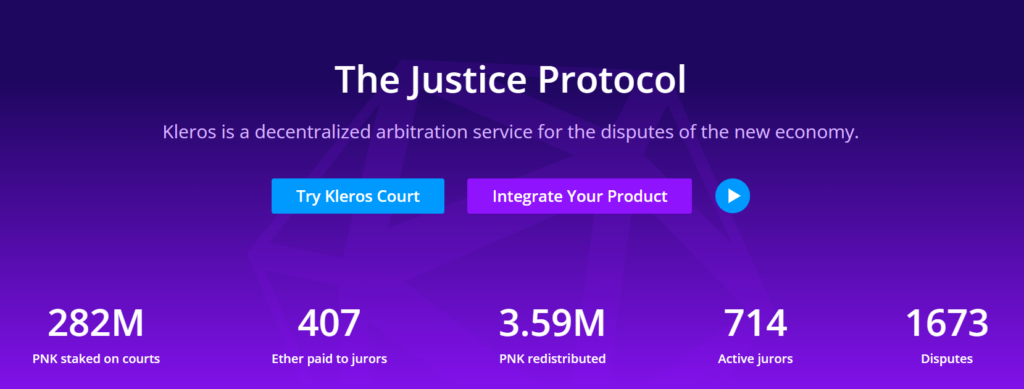

When a dispute arises, jurors are randomly selected from those who have staked PNK in the relevant court. These jurors review the evidence and vote on the outcome.

Jurors who vote with the majority:

-

Earn arbitration fees paid in ETH

Jurors in the minority:

-

Lose part of their staked PNK

If the decision is appealed, a larger jury is selected, increasing the cost and complexity of manipulation.

This structure makes dishonest voting economically irrational over time.

Incentives, Penalties, and Honest Behavior

At the heart of Kleros lies a simple but powerful idea: honesty should be profitable.

When a case concludes, arbitration fees paid by the losing party are distributed among jurors who voted coherently. In addition, the PNK tokens forfeited by incoherent jurors are redistributed to the majority.

As a result, jurors are rewarded twice for honest behavior—and penalized directly for careless or malicious decisions.

The Role of the PNK Token

PNK is not merely a governance token; it functions as Kleros’ primary security layer.

PNK is used to:

-

Stake eligibility as a juror

-

Participate in governance votes

-

Defend against Sybil and 51% attacks

-

Enable specialization across different courts

Higher stakes increase selection probability and potential rewards, while also raising the cost of dishonest behavior.

Why Not Use ETH Instead?

Using ETH for staking would expose the system to liquidity-based attacks. A well-capitalized actor could quickly acquire enough ETH to dominate jury selection and later exit with minimal losses.

PNK, by contrast:

-

Has limited liquidity

-

Becomes increasingly expensive to acquire in large quantities

-

Loses value if the system’s integrity is compromised

In extreme scenarios, the protocol can even be forked to exclude malicious holdings—an option unavailable without a native token.

Governance Structure

Kleros operates entirely as a DAO.

PNK holders vote on:

-

Creation of new courts

-

Protocol parameter changes

-

Incentive adjustments

-

Smart contract upgrades

These decisions are binding and directly impact how the protocol functions.

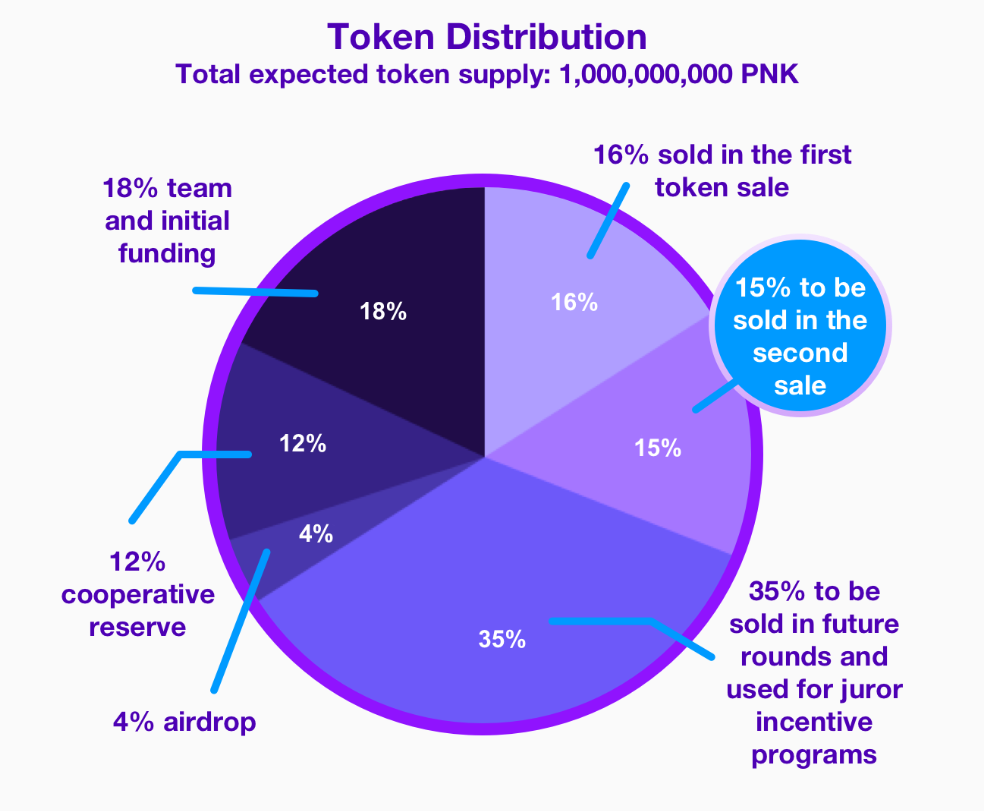

PNK Token Distribution

-

35% – Future Sales & Juror Incentives

-

18% – Team & Early Operations

-

16% – Initial Token Sale

-

15% – Second Token Sale

-

12% – Cooperative Reserve

-

4% – Airdrop

Token Details

-

Token: PNK (Pinakion)

-

Standard: ERC-20

-

Total Supply: 764,626,704 PNK

-

Supply Changes: DAO-controlled only

The name “Pinakion” references the bronze plates used for jury selection in Ancient Athens.

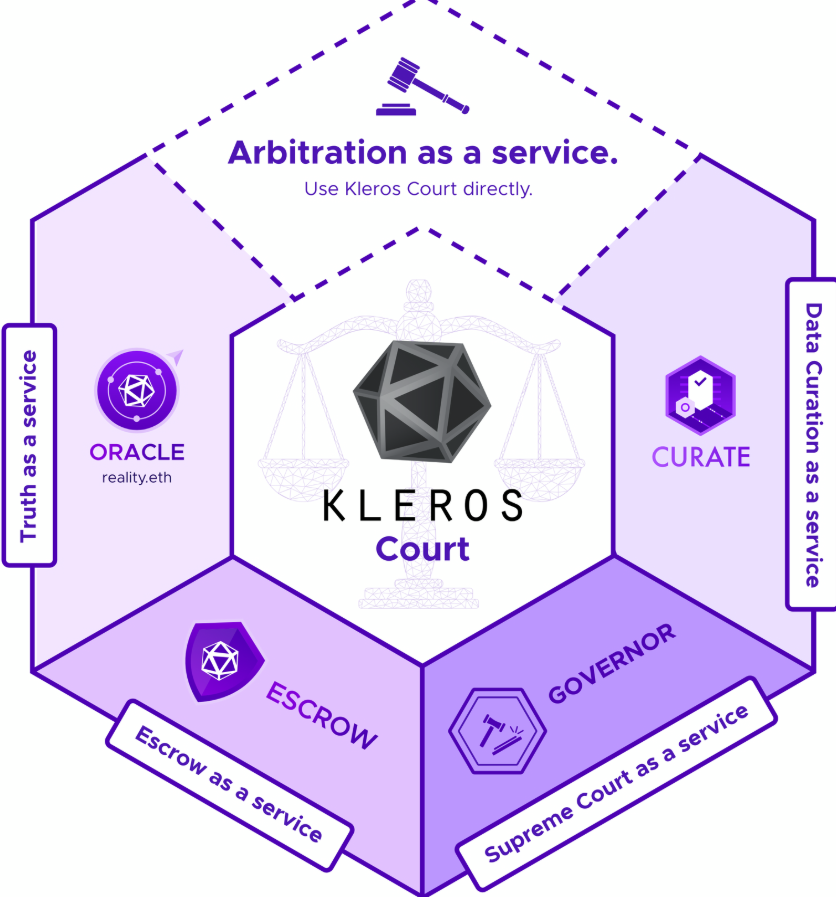

Ecosystem and Use Cases

Kleros is designed to support:

-

DeFi escrow disputes

-

NFT copyright conflicts

-

DAO governance cases

-

Social platform moderation

-

Oracle data challenges

It functions as an arbitration layer rather than a standalone product.

Roadmap: From 2018 to the 2026 Vision

Since its 2018 ICO, Kleros has passed several key milestones, including the launch of token-curated lists and real-world judicial integrations. The 2024 migration to Arbitrum addressed scalability constraints.

As of late 2025, upcoming goals include:

-

Court V2 full launch (January 2026)

-

Curate V2 and Scout V2 upgrades

-

Cross-chain arbitration via VEA integrations

-

Expanded juror incentive programs (KIP-46)

Key Strengths of Kleros

-

Decentralized and tamper-resistant

-

Faster and cheaper than traditional arbitration

-

Incentive-driven honesty

-

Security-focused with ongoing audits and bug bounties

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.