Magna is a software company developing digital asset management and distribution infrastructure for networks and protocols operating in the web3 ecosystem. It specifically targets automating distribution processes for token-economy projects with investors, team members, and community participants. In short, Magna is building a “token operations system” for the web3 world.

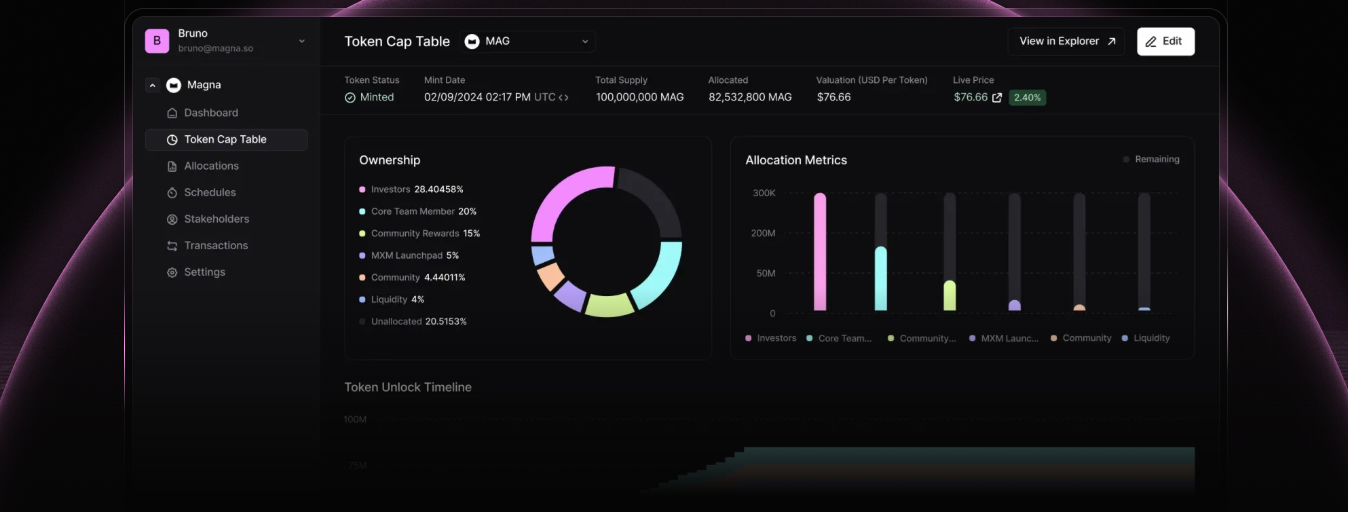

The company’s flagship product is a token management platform frequently described as “Carta for Web3.” Through this platform, projects can upload token allocations, track vesting processes, and automate digital asset distributions based on custom rules. Magna aims to bring token cap table management to an institutional standard, particularly for investors, founding teams, legal advisors, and finance managers.

What Does Magna Do?

Magna’s core focus is to simplify and secure the complex operations of token-based organizations. The platform consolidates processes such as token allocation, vesting schedules, airdrop distributions, grant management, custody, escrow, and staking under a single roof.

To date:

- Over $3.5 billion in total value has been processed through the platform.

- Over $2.4 billion in assets are locked in audited smart contracts.

- Over $10 billion in total value locked (TVL) has been managed across Solana, Ethereum, Aptos, Arbitrum, and other chains.

- More than 1 million users have interacted with the platform.

- Over 70 projects and institutional clients have chosen Magna.

- A total of $18 million in funding has been raised.

These figures demonstrate that Magna is not merely an early-stage startup but an infrastructure provider already managing significant volume.

What Does “Carta for Web3” Mean?

Magna’s most prominent product is its token cap table management platform. Just as Carta manages equity distributions, vesting plans, and investor tables in the traditional world, Magna performs a similar function on the token side for web3 projects.

Through the platform, companies can:

- Upload token allocations to the system

- Track investor and team shares

- Automate vesting and unlock schedules

- Execute large-scale airdrops to community members

- Create customized claim portals on their own domains

This structure reduces the risks of manual distributions while minimizing operational errors.

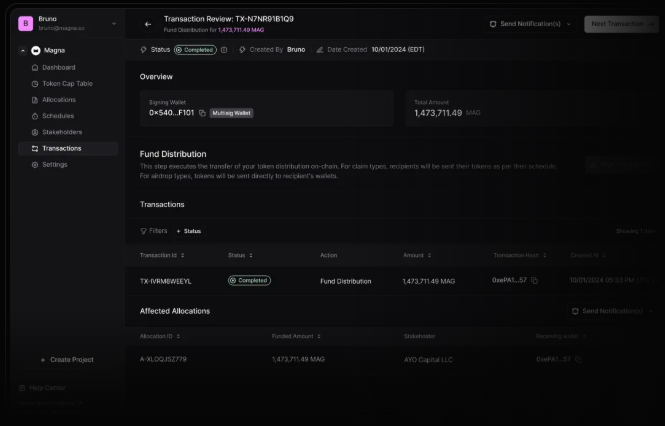

On-Chain Vesting: Automated Vesting Mechanism

One of Magna’s strongest features is its on-chain vesting infrastructure. Through audited smart contracts, token unlock processes can be fully automated.

This system:

- Tracks complex vesting schedules

- Allows cancellation or reclamation of allocations when needed

- Integrates with existing custody solutions such as Fireblocks, Anchorage, Safe, and Squads

- Enables gradual funding rather than transferring the entire token supply to the contract at once

This approach is particularly critical for investor agreements and employee incentive plans.

Off-Chain Vesting and Tax Management

Some projects prefer to handle token distributions through custody infrastructure rather than directly on-chain. Magna also supports an off-chain vesting model.

In this model:

- Vesting schedules are tracked within the system

- Distributions are made directly from custody wallets

- Test transfers may require manual approval

- Tax compliance and legal structures such as 83(b), RTA, and RTU are supported

In this regard, Magna provides not only technical but also legal and fiscal compliance advisory.

Whitelabel Claim Portals

Magna enables projects to create claim portals under their own brands. Customizable interfaces that require no coding allow token distributions to millions of users.

These portals:

- Operate on the project’s own domain

- Can be designed according to brand identity

- Display airdrop and vesting entitlements

- Provide gas-efficient distribution

- Offer advanced control through API integration

This allows projects to delegate backend operations to Magna while retaining control over the user experience.

Grant Management

Ecosystem funds and grant programs hold significant importance in the web3 ecosystem. Magna enables centralized grant management.

The platform:

- Tracks grant allocations

- Supports one-time or time-bound distribution models

- Facilitates vesting and milestone tracking

- Provides dedicated dashboards for recipients

- Enables centralized collection of completion proofs

This feature significantly reduces operational burden, especially for L1 and L2 networks.

Custody and Escrow Solutions

Magna also offers token custody and escrow services. Particularly in cases such as:

- Investor token lockups

- OTC transactions

- Liquidation processes

- Collateralized transactions

- Locked token sale plans

it can act as a third-party custody provider.

Additionally, it offers flexible solutions for earning yield on staked tokens and can structure reward distributions.

Staking Infrastructure

Magna enables the creation of customizable staking pools. This system:

- Supports permissionless staking

- Features a one-click claim-and-stake function

- Allows configuration of parameters such as minimum stake duration and maximum reward rate

- Provides on-chain visibility and reporting

This feature is an important tool for token economies that aim to incentivize community participation.

What Sets Magna Apart?

One of Magna’s standout aspects is its “white-glove” support model. The company provides active support throughout the process—from onboarding to distribution—and can even handle support requests from stakeholders.

Additionally:

- It has legal and tax expertise

- It is experienced in 83(b) and token contract structures

- It can develop fast integrations and custom workflows

- Its engineering team has backgrounds in traditional finance and distributed systems

The engineering team includes individuals who previously worked at companies such as Gemini, Morgan Stanley, and Palantir. They have experience in exchange matching engine development, AI publishing, and Fortune 500 exits.

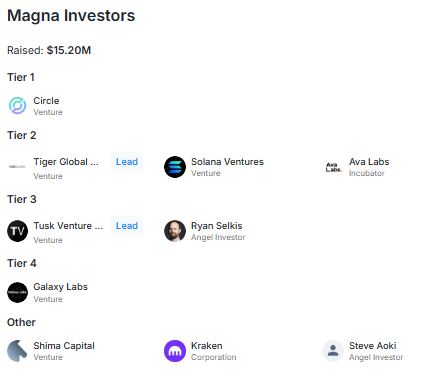

Magna Investors

Magna has raised approximately $15.20 million to date. Its investor base includes strong names from both crypto-native and traditional finance worlds.

Tier 1

- Circle (Venture)

Tier 2

- Tiger Global Management (Venture)

- Solana Ventures (Venture)

- Ava Labs (Incubator)

Tier 3

- Tusk Venture Partners (Venture)

- Ryan Selkis (Angel Investor)

Tier 4

- Galaxy Labs (Venture)

Others

- Shima Capital (Venture)

- Kraken (Corporation)

- Steve Aoki (Angel Investor)

This investor profile demonstrates that Magna has received both institutional and ecosystem-focused support.

Magna Team

Magna consists of an approximately 15-person team based in New York and Europe.

- Bruno Faviero – Co-Founder & CEO

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.