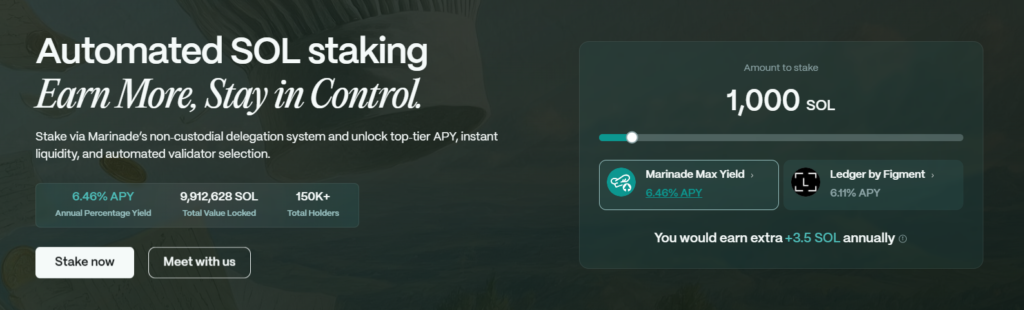

Marinade (MNDE) is a protocol built on the Solana blockchain designed to optimize the staking experience for SOL holders. It enables users to distribute their SOL across multiple validators automatically based on criteria defined by the Solana Foundation. This improves both decentralization and network security.

One of Marinade’s core strengths is its liquid staking mechanism. Users receive mSOL in exchange for staked SOL. mSOL represents staked SOL, maintains a value close to SOL, and enables participation in yield opportunities across the Solana DeFi ecosystem.

The protocol also includes a decentralized exchange (DEX) component, allowing users to execute swaps without unstaking SOL. This increases flexibility and efficiency within the ecosystem.

Marinade is governed by a decentralized autonomous organization (DAO), and the MNDE token serves as the governance token. MNDE holders can participate in decision-making, treasury management, and protocol direction.

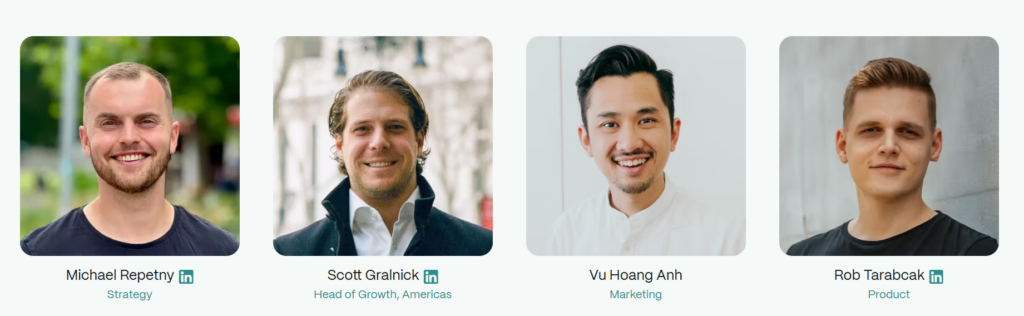

Team and Founders

Marinade was created in March 2021 following the Solana x Serum Hackathon. The founding members merged two separate projects to build a liquid staking solution. The project received grants from both the Solana Foundation and Serum, maintained a community-first development strategy, and did not raise venture capital.

The initially anonymous team later revealed several contributors, based on the provided visual:

-

Michael Repetny: Strategy

-

Scott Gralnick: Head of Growth, Americas

-

Vu Hoang Anh: Marketing

-

Rob Tarabcak: Product

Investors and Partnerships

Marinade developed through ecosystem grants and support programs rather than VC funding. Key supporters include:

-

Solana Foundation

-

Serum

Project Mechanics

Marinade operates through two main mechanisms:

Liquid Staking

-

Users deposit SOL into Marinade’s smart contract.

-

The contract mints mSOL based on the deposited SOL and accumulated rewards.

-

SOL is automatically delegated across more than 400 validators based on performance and decentralization factors.

-

The value of mSOL increases over time as rewards accumulate.

-

mSOL can be used freely in the Solana DeFi ecosystem for collateral, liquidity provision, or yield strategies.

Native Staking

-

Users stake SOL without receiving a liquid token.

-

Marinade delegates the SOL using its validator strategy.

-

This resembles traditional staking but benefits from automated validator optimization.

DAO Governance

Marinade is governed through Marinade DAO (mDAO). MNDE holders lock tokens in Realms to receive veMNDE and vote.

-

MNDE holders influence treasury and protocol decisions.

-

A seven-member Marinade Council manages operations.

-

All governance activity is fully on-chain.

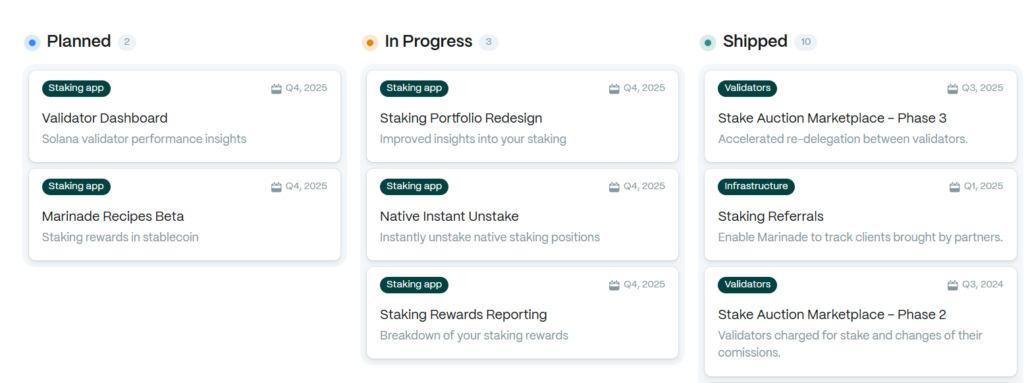

Roadmap

Marinade’s development timeline includes:

-

March 2021: Project inception

-

August 2021: Mainnet launch

-

October 2021: MNDE public launch and liquidity mining

-

April 2022: On-chain governance introduced

-

July 2023: Governance moved to Realms

-

September 2025: 300M MNDE burned, reducing supply to 700M

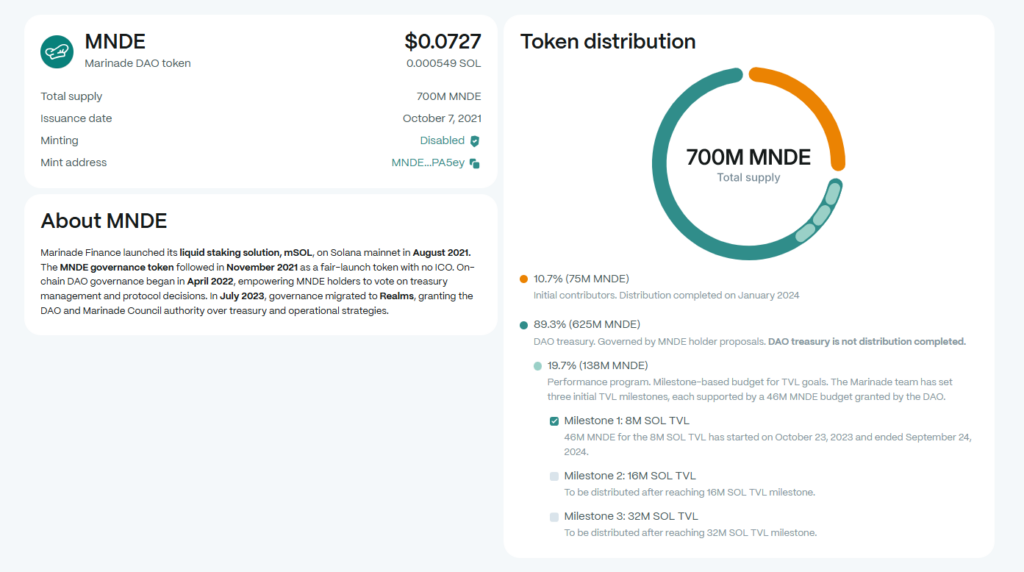

The roadmap focuses on TVL growth via a Performance Program tied to TVL milestones:

-

Milestone 1: 46M MNDE distributed at 8M SOL TVL (active Oct 23, 2023 – Sep 24, 2024)

-

Milestone 2: Distribution at 16M SOL TVL

-

Milestone 3: Distribution at 32M SOL TVL

Token Utility

-

Liquid staking with mSOL

-

Voting in DAO governance

-

Participating in treasury decisions

-

Yield strategies across the Solana DeFi ecosystem

MNDE Token Details

-

Total Supply: 700M MNDE

-

Maximum Supply: Not fixed

-

Circulating Supply: 552.25M MNDE (self-reported)

Token Distribution

-

DAO Treasury: 89.3% (625M MNDE)

-

Performance Program Allocation: 138M MNDE within the treasury

-

Early Contributors: 10.7% (75M MNDE), fully released January 2024

Ecosystem Capabilities

-

Liquid staking with mSOL

-

Flexible stake and unstake options

-

mSOL-based DeFi yield strategies

-

Validator redelegation

-

DAO participation

Core Features

-

Liquid staking for capital efficiency

-

Automatic validator delegation

-

Native staking option

-

DAO governance via MNDE

-

Audited security model

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.