Mitosis (MITO) is a Layer 1 (L1) blockchain protocol that makes liquidity programmable in the decentralized finance (DeFi) ecosystem. Comprising the Mitosis L1 Ecosystem and Mitosis Vaults across multiple networks, it manages Ecosystem-Owned Liquidity (EOL), allowing participants to influence liquidity allocation decisions. The protocol enhances capital efficiency by addressing cross-chain DeFi demands.

What Is Mitosis (MITO)?

Mitosis transforms DeFi liquidity positions into programmable tokens, resolving market inefficiencies. Users deposit assets into Mitosis Vaults, receiving Hub Assets on the Mitosis Chain (e.g., depositing eETH yields meETH). These Hub Assets are directed to yield opportunities via Ecosystem-Owned Liquidity (EOL) or Matrix frameworks. EOL enables collective liquidity management through governance, while Matrix offers curated campaigns. Both produce tokenized positions—miAssets for EOL and maAssets for Matrix—that can be traded, used as collateral, or combined for new financial instruments, enabling novel DeFi strategies.

Mitosis aggregates individual deposits to democratize access to premium yields and ensure transparent price discovery. The Mitosis Chain provides infrastructure for advanced financial applications, with a settlement system synchronizing yields and rewards to support complex DeFi products.

Mitosis: Programmable Liquidity Network

Mitosis is a Layer 1 network designed to optimize liquidity and yield distribution through synthetic assets. It leverages collective bargaining to democratize access to exclusive yields and enhances capital efficiency via tokenized vault positions. Participants of all scales can employ advanced liquidity strategies.

Liquidity Challenges

DeFi, pioneered by Bitcoin’s decentralized trust and Ethereum’s smart contracts, faces liquidity issues: lack of price discovery, capital inefficiency, and unstable TVL. Current DeFi liquidity markets exhibit these structural inefficiencies:

- Lack of Price Discovery: Absence of standardized public data on liquidity provision creates information asymmetry, with large providers securing opaque high-yield deals.

- Capital Inefficiency: Liquidity mechanisms lock assets in pools, preventing alternative yield or collateral strategies.

- Unstable TVL: Short-term incentives lead to capital migration, undermining protocol sustainability.

Mitosis Solution

Liquidity provision mimics lending, where users lend capital for future rewards. Mitosis addresses these challenges with three core concepts:

- Democratized Yield Access: Aggregates individual providers for collective bargaining, unlocking exclusive yield opportunities.

- Tokenized LP Positions: miAssets and maAssets enable trading and utilization in DeFi applications.

- Liquidity Capital Markets: The Mitosis Chain supports financial product creation, enhancing capital efficiency and risk management.

Protocol Architecture

Mitosis establishes infrastructure to transform DeFi liquidity into programmable primitives through tokenization and sophisticated market structures. The protocol operates via Deposit, Supply, and Utilize processes.

Deposit Process

The Deposit process is the entry point to the Mitosis ecosystem. Users deposit assets into Mitosis Vaults, smart contracts on supported blockchain networks, and receive Hub Assets at a 1:1 ratio on the Mitosis Chain (e.g., eETH yields meETH). These Hub Assets enable composability for multi-chain positions.

Supply Process

The Supply process involves users committing Hub Assets to yield opportunities or liquidity campaigns with varying risk and reward profiles. Mitosis uses Vault Liquidity Frameworks (VLFs) to deploy capital, defining campaign terms like rewards and lockup periods.

Mitosis launches with two VLFs: Ecosystem-Owned Liquidity (EOL) and Matrix. EOL enables collective asset management via governance, granting miAsset holders voting rights on liquidity allocation. Matrix offers direct participation in curated campaigns, producing maAssets. Both provide standardized interfaces for position and yield management.

Ecosystem-Owned Liquidity (EOL)

EOL is a governance-driven liquidity allocation approach. Users supplying Hub Assets to EOL receive miAssets, which grant rights to underlying assets, yields, and governance over EOL decisions. miAsset holders vote via Initiation and Gauge processes to manage protocol selection and liquidity allocation.

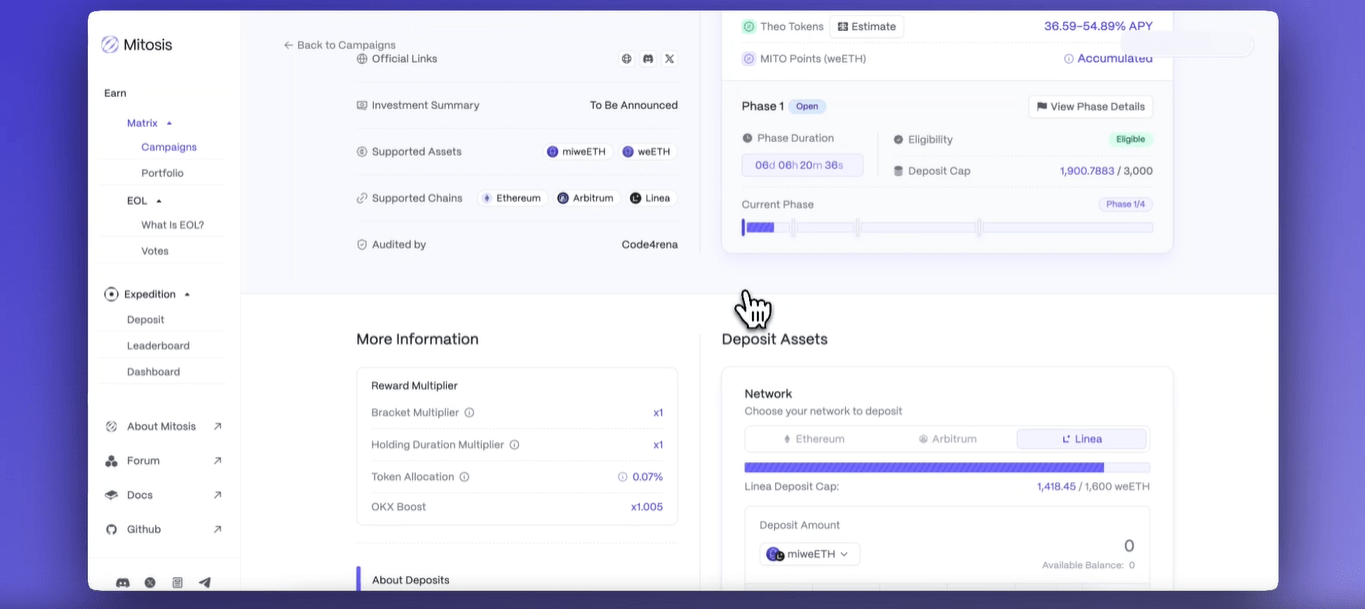

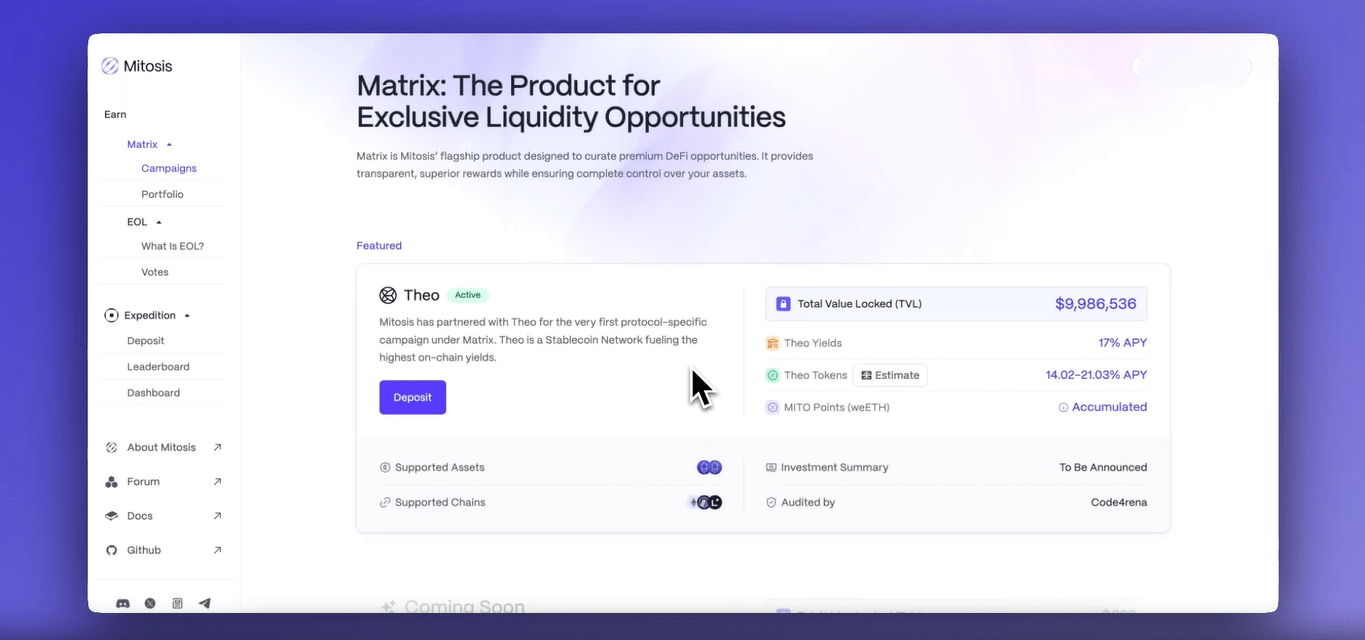

About Matrix

Matrix, Mitosis’ flagship product, curates premium DeFi opportunities with transparent rewards and user control. It enables DeFi protocols to offer higher yields. Users evaluate campaign details and receive maAssets as receipts.

Matrix Operations

Pre-Mitosis L1 mainnet, Matrix Vaults operate on supported networks (e.g., Ethereum, Arbitrum, Linea), with users receiving maAssets on the chosen network. Post-mainnet, users deposit into Mitosis Vaults, receive Hub Assets on Mitosis L1, and commit to Matrix Vaults for maAssets. Rewards are generated per vault.

Matrix: Curated Liquidity Campaigns

Matrix offers higher yields for providers locking capital for set periods. Users review lockup and reward details, commit assets, and receive maAssets tracking capital and rewards. Matrix enables protocols to engage directly with Mitosis users, ensuring long-term liquidity.

Utilize Process

The Utilize process transforms tokenized LP positions into components for sophisticated financial applications. miAssets and maAssets can be combined, traded, or optimized via smart contracts. The Mitosis Chain provides an execution environment for developers to create complex financial instruments.

Mitosis Chain Architecture

The Mitosis Chain, built on Cosmos SDK with CometBFT for consensus, features an EVM-compatible execution environment for smart contract applications. Its modular architecture optimizes security and performance, ensuring compatibility with Ethereum tools and accessibility for developers.

Liquidity Capital Market Infrastructure

The Mitosis Chain leverages EVM compatibility for sophisticated financial applications, including:

- Automated Market Making (AMM): Facilitates trading across ecosystem assets with efficient price discovery.

- Yield Tokenization: Separates yield-bearing tokens into principal and yield components for speculation.

- Lending Markets: Accepts tokenized liquidity as collateral for leveraged yield farming.

- Yield-Bearing Stablecoins: Offers stablecoins with stability and yield from diversified LP positions.

- Liquidity Indices: Provides passive investment vehicles via diversified LP position portfolios.

DNA Program

The Distributed Network Alignment (DNA) program allocates MITO tokens to Matrix campaigns, reducing protocols’ liquidity costs and ensuring competitive yields for users, driving ecosystem growth.

Theo Campaign

The Theo campaign offers miweETH or weETH holders additional Theo token and Straddle Vault rewards alongside existing MITO Point rewards.

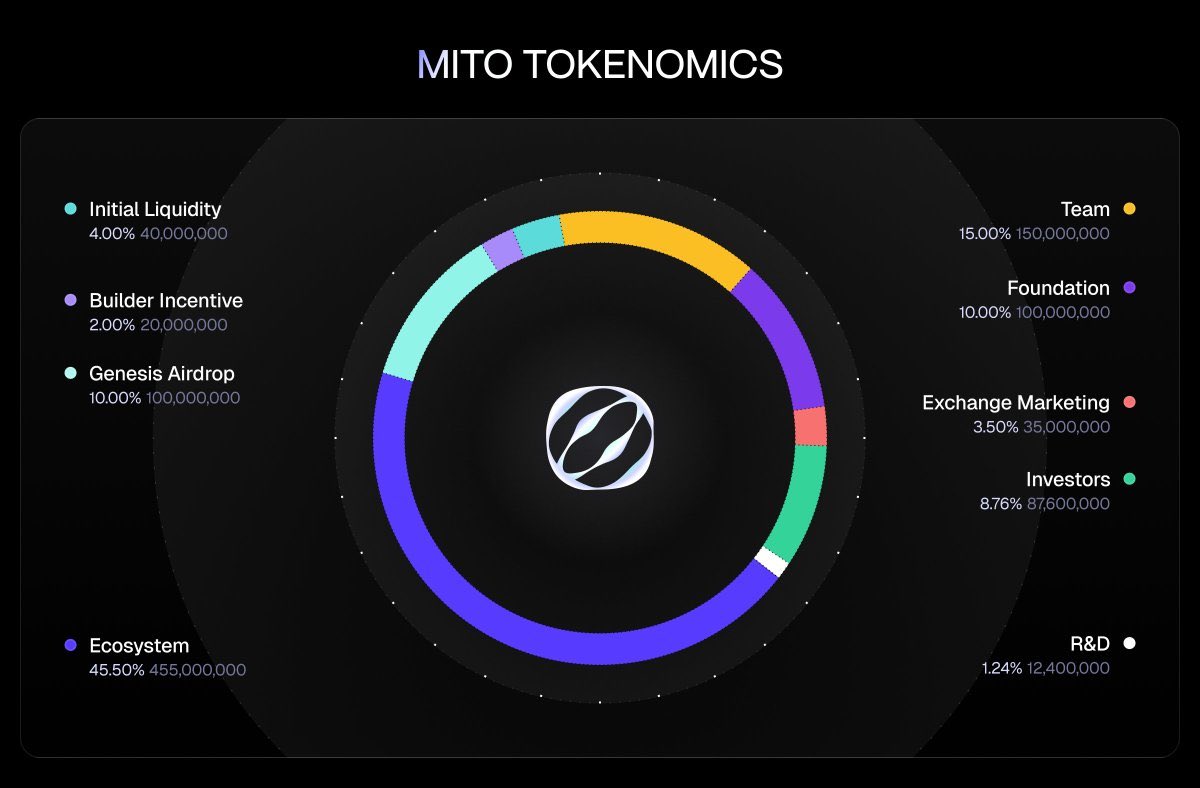

Mitosis (MITO) Tokenomics

- Ecosystem: 45%

- Initial Liquidity: 4%

- Builder Incentive: 2%

- Team: 15%

- Foundation: 10%

- Exchange Marketing: 3.5%

- Investors: 8.76%

- R&D: 1.24%

Mitosis (MITO) Investors

Mitosis raised $7 million in a seed round on May 2, 2024. Investors include Amber Group, GSR, Foresight Ventures, Big Brain Holdings, Folius Ventures, No Limit Holdings, Digital Asset Capital Management (DACM), Cogitent Ventures, CitizenX Crypto Ventures, TPC, Pivot Global, and Everstake Capital, supporting Mitosis’ innovative DeFi vision.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.