In cryptocurrency markets, access to information is no longer an advantage but a necessity. The real differentiating factor is how quickly, accurately, and directly this information can be turned into action. NOYA.ai (NOYA) plans to close this gap by combining onchain data with AI-powered analysis, creating a next-generation DeFi infrastructure that consolidates the entire process—from research to execution—into a single system.

NOYA positions itself not merely as an analysis tool or automation bot, but as an “always-on institutional research desk.” It transforms onchain noise into meaningful insights, connects these insights to user intent, and executes the necessary transactions trustlessly across multiple chains.

In short, NOYA’s core thesis is clear: Intelligence alone is not enough; it must be able to act.

What Does NOYA.ai Aim to Achieve?

The traditional DeFi experience requires constant manual operations across dashboards, analysis tools, bridges, DEXs, and different chains. This structure both wastes time and increases execution risk.

NOYA compresses this process into a single system:

Research → Thesis → Execution → Monitoring

These four steps are managed in the NOYA ecosystem by interconnected AI agents instead of fragmented tools. The user expresses “what they want to do”; NOYA plans how, where, and through which protocols it should be done.

NOYA System Architecture

NOYA is built on a holistic architecture consisting of three main layers:

-

Intelligence Layer This layer encompasses the analysis infrastructure fed by onchain data, prediction markets, and protocol fundamentals. NOYA does not merely provide data here; it generates context.

- Token fundamentals

- Market signals

- Risk factors

- Prediction market probabilities

- Wallet behaviors and capital flows

-

Execution Layer This is the layer where intelligence is turned into action. In accordance with the permissions given by the user:

- Swap

- Bridging

- Liquidity provision

- Borrowing optimization

- Vault investment

such operations are automatically executed across multiple chains.

-

Abstraction Layer It hides technical complexity. The user does not deal with the underlying chains, bridges, and protocols; control remains with the user while the operational burden is eliminated.

Trustless Omnichain AI Agents and ZKML

One of the most distinctive aspects of NOYA is that its AI agents operate in a verifiable manner using ZKML (Zero-Knowledge Machine Learning).

Thanks to this structure:

- AI models can be verified on-chain

- It can be proven that strategy decisions were actually executed

- Trust is provided without revealing the internal logic of the model

Agents perform tasks such as yield optimization, debt management, liquidity allocation, and collateral monitoring in a trustless manner.

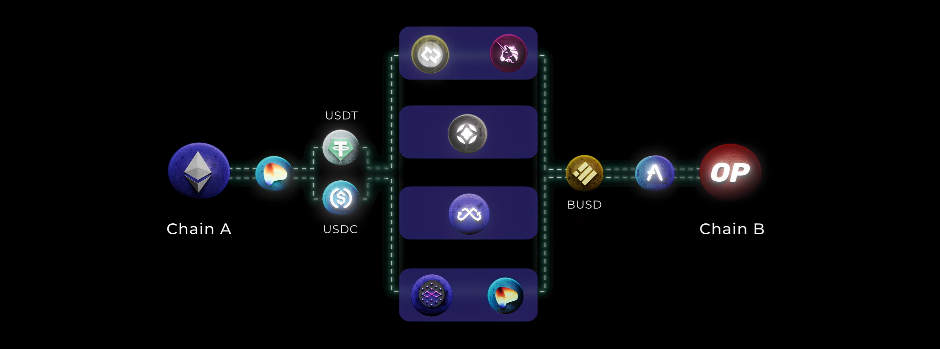

Omnichain Execution and Intent-Based Model

NOYA puts “what is intended to be done” at the center rather than “how it will be done.” This approach is called intent-based execution.

Users can express intent in the following ways:

- Via text

- Via voice command

For example: “Optimize stablecoin yield without increasing my risk.”

This intent is transformed by the AI agent into a cross-chain execution plan. The user approves and signs every step. NOYA never executes without permission.

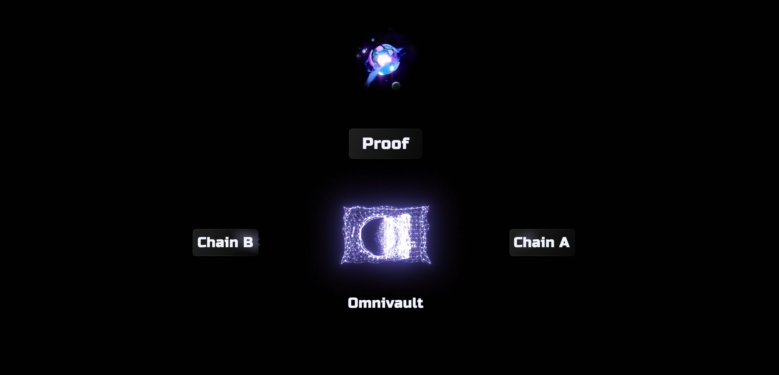

Omnivaults: Intelligent Capital Allocation

Omnivaults are NOYA’s capital distribution layer. The goal is not only high yield but risk-adjusted and sustainable performance.

Key Features of Omnivaults

- Multi-chain and multi-protocol support

- Automatic rebalancing

- Classification by risk categories

- Simple deposit/withdrawal experience

Vault Types

- Standard yield strategies

- Looped (leveraged) strategies

- BTC, ETH, stablecoin-based vaults

Users gain access to professionally designed structures without dealing with complex strategies.

Prediction Market Copilot

An important part of NOYA’s intelligence layer is the Prediction Market Copilot.

This module combines:

- Market probabilities

- Liquidity depth

- Wallet behaviors

- Historical resolution data

to provide probabilistic analysis.

Highlighted Features

- Expected Value (EV) analysis

- Scenario-based evaluation

- “Smart wallet” tracking

- Large position entries/exits

- Portfolio and performance analysis

The goal is not automated betting, but disciplined and contextual decision-making.

What is the NOYA Token (NOYA) Used For?

The NOYA token is not required for the system to function; however, it plays a role in strengthening participation and long-term alignment.

Core Use Cases

- Staking

- Governance

- Vault and report access

- Buyback & burn mechanism

- Incentive programs

A portion of protocol revenue is used for NOYA token buybacks and burns, aiming to create a direct link between usage and value.

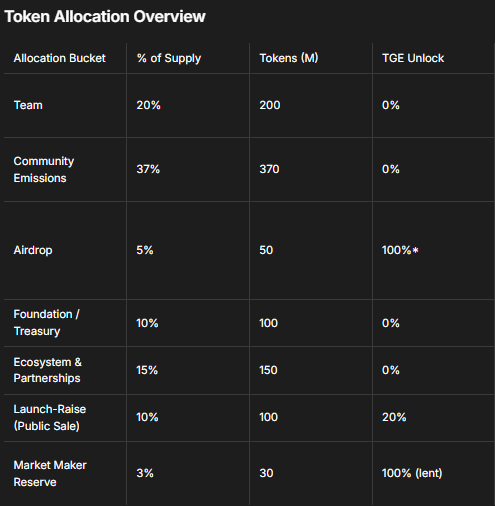

NOYA.ai (NOYA) Tokenomics

- Total Supply: 1,000,000,000 NOYA

- TGE Circulating Supply: Approximately 10%

- No team unlock at TGE

Distribution Summary

- Community emissions: 37%

- Team: 20% (long-term vesting)

- Ecosystem & partnerships: 15%

- Foundation / Treasury: 10%

- Public sale: 10%

- Airdrop: 5%

- Market maker reserve: 3%

On the airdrop side, offering penalty options to large holders in exchange for early liquidity stands out as a notable choice aimed at protecting ecosystem balance.

Fee Model

NOYA adopts a transparent and predictable fee structure instead of hidden costs.

- Execution fees (bridge, routing, etc.)

- Vault management and performance fees

- Token-based access for advanced features

All fees are clearly displayed before user approval.

NOYA.ai (NOYA) Team

NOYA.ai is being developed by a highly technical and research-focused team. The team consists of a core group specialized in artificial intelligence, DeFi infrastructure, and onchain systems.

Team:

- Hadi Esnaashari – Co-founder, Tech Lead

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.