Numeraire is more than a crypto asset; it fuels the world’s first AI-driven decentralized hedge fund based in San Francisco. Founded by Richard Craib in 2015, the platform now aggregates predictions from thousands of data scientists into a massive “Meta Model” that operates across global financial markets.

Numeraire (NMR) is the native token of the Numerai platform. It is used in competitions where data scientists worldwide create financial market predictions. The token serves as an economic incentive to ensure model quality and support the reward mechanism. Numerai integrates AI and statistical models into hedge fund strategies, bridging traditional finance with cutting-edge technology.

Note: To date, over $23.4 million in rewards have been distributed to data scientists.

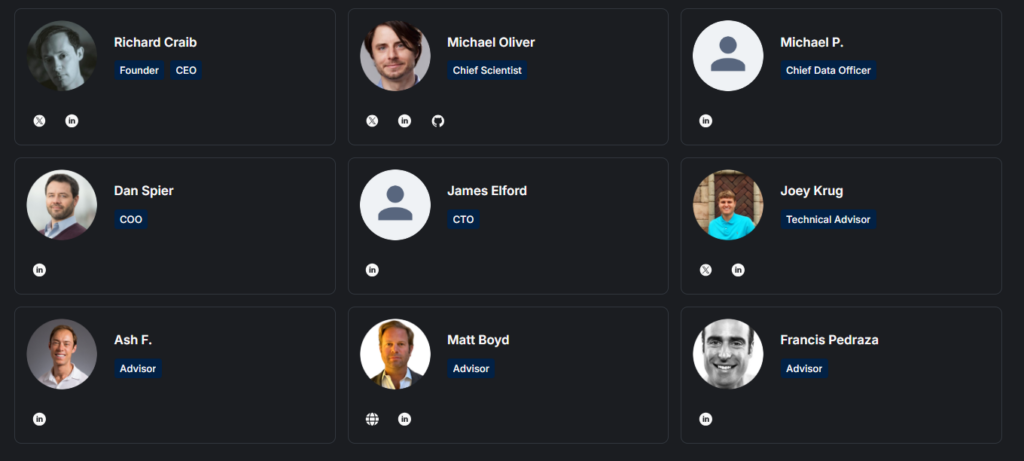

Leadership and Founders

Richard Craib (Founder & CEO) leads Numerai with the vision of combining financial prediction models with a global data science community. He holds a mathematics degree from Cornell University and founded Numerai in 2015 to introduce obfuscation of financial data.

Executive Team

-

Dan Spier (COO / President): Oversees operations. With 20 years of experience at Morgan Stanley and Standard Pacific Capital, he manages Numerai’s corporate growth since 2021.

-

Michael Oliver (Chief Scientist): Leads the science team and develops the Meta Model. A neuroscientist from Berkeley, he directs research strategies and ensures system accuracy.

The core team consists of experts in data science, machine learning, and blockchain. External advisors and investors support technological and strategic development.

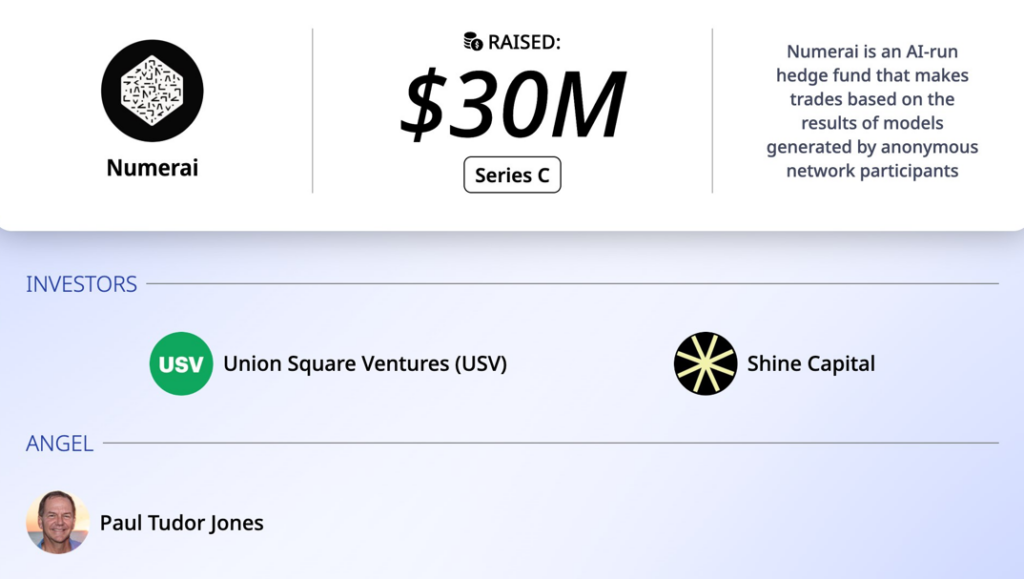

Investors and Key Partners

Numerai has worked with prominent investors:

-

Union Square Ventures – Lead investor

-

Paradigm – Series B lead

-

CoinFund – Series C

-

Placeholder Ventures – Early stage

-

Dragonfly Capital – Series C

-

Shine Capital

-

Paul Tudor Jones – Macro investor

-

Howard Morgan – Founder of Renaissance Technologies

-

Naval Ravikant – Early supporter

-

University endowments – Series C lead

Notable partnership: JPMorgan Asset Management committed $500M in August 2025, bringing AUM to around $550M and advancing the $1B target, strengthening Wall Street integration with crypto-AI.

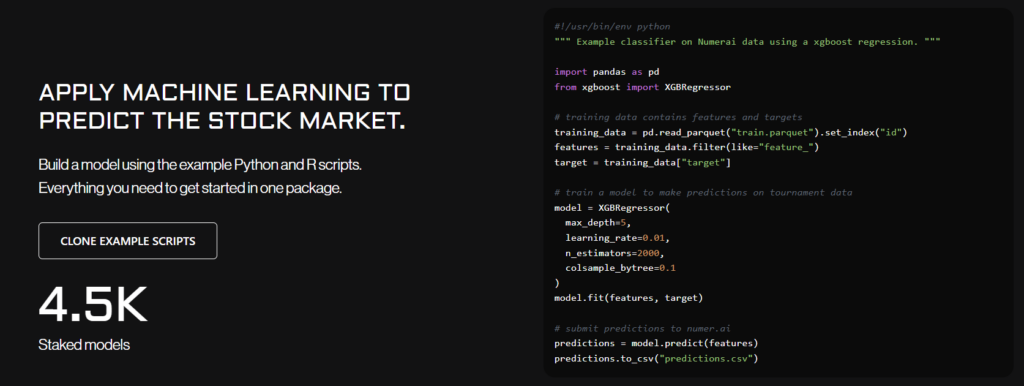

Core Purpose of Numerai

Numerai provides anonymized financial data to a global network of data scientists. Participants build models and stake NMR tokens. Successful models are rewarded, while failed stakes are burned, incentivizing high-quality predictions and strengthening hedge fund investment decisions.

-

Thousands of independent data scientists develop models using obfuscated data.

-

Poorly performing models lose staked tokens, while high-performing models earn rewards.

-

The goal is to create the best Meta Model in a decentralized manner and apply it to live hedge fund operations.

How the Project Works

Numerai operates on three main components:

-

Data Preparation & Sharing: Clean, anonymized financial data is provided to participants.

-

Tournament: Participants submit weekly predictions and stake NMR tokens.

-

Meta Model: Aggregated predictions form a Meta Model used for hedge fund strategies.

Governance & Decision-Making

Numerai does not have a direct DAO-style governance system. Staked models influence the Meta Model, with underperforming stakes burned. Token holders do not vote directly; decisions are led by the founding team and investors. Community feedback informs future updates. Stakers may potentially gain indirect influence in the future.

2026 Vision & Roadmap

-

NumerCon 2026 (Jan 30): AI agents will now design models.

-

Numerai Skills: AI agents conduct research, design experiments, and measure success. Full videos to be released on YouTube.

-

Share Buyback: Second $1M NMR buyback started on Feb 3, 2026 (first was July 2025) to maintain treasury balance and reduce circulating supply.

-

Flexible Staking: From July 4, 2026, new system allows wallet selection, flexible stake management, and USDC staking.

NMR Token Use Cases

-

Staking & Incentives: Ensures model quality.

-

Rewards: Successful models earn NMR.

-

Liquidity & Trading: Ethereum-based, tradable on exchanges.

-

Future Governance: Token holders may gain indirect influence over platform decisions.

Token Details & Distribution

-

Symbol: NMR

-

Blockchain: Ethereum (ERC-20)

-

Max Supply: 11M

-

Circulating Supply: 7.5M

-

Burn Mechanism: Failed stakes are burned

-

Distribution: Initially allocated to active users, later via rewards and staking.

Ecosystem & Community

Numerai is a global platform with data scientists from 50+ countries. For the 2026 season, active participants total 373; Grandmasters dominate competitions.

-

Stake/Reward System: Stake tokens for models; high performance rewarded, failure burned.

-

Deflationary Mechanism: Reduces supply and protects token value.

-

Community: Discord for discussions; GitHub provides open-source tools.

-

Community Marketplace: Buy/sell models. Hedge fund trades with the Meta Model; AUM ~550M USD (approaching $1B with JPMorgan).

Key Features

-

Crowdsourced AI: Models combined into a Meta Model.

-

Stake for Quality Control: Participants pledge NMR on their models.

-

Erasure Protocol: Manages staking, rewards, and burning via smart contracts.

-

Global Community: Active data scientists from multiple countries participate.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.