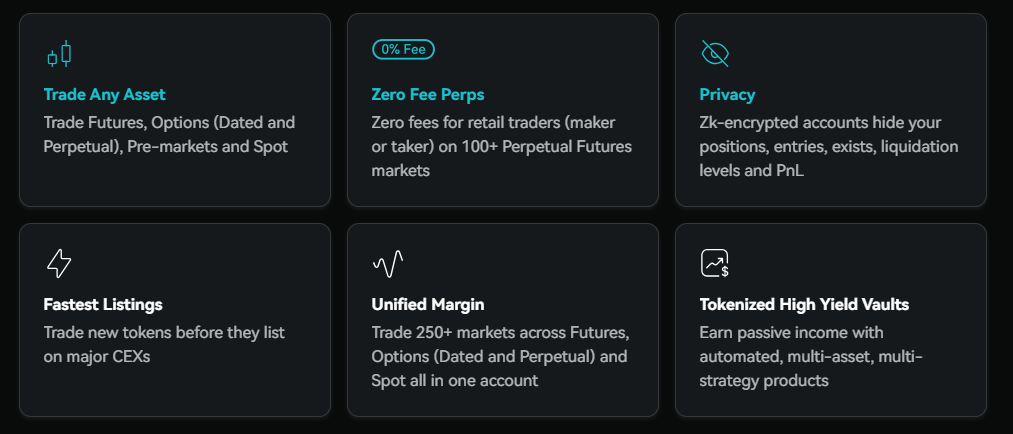

Paradex is a crypto derivatives exchange built on a Starknet-based appchain. It aims to erase the line between DeFi and CeFi. Its key differentiator: providing the speed of centralized exchanges on-chain while keeping position details, entry/exit levels, and liquidation information completely private through zk-encrypted accounts. Zero-fee perpetual futures across more than 250 markets create a strong attraction for retail traders.

This is not a single product. Today, Paradex has established a full ecosystem with three main components: Paradex Exchange, XUSD, and Paradex Chain. Trading, borrowing–lending, asset management, and blockchain infrastructure converge in a single architecture, aiming to simplify the fragmented DeFi user experience. Built as a high-performance Layer-2 on Starknet, the platform has already processed over $50 billion in trading volume during its beta phase.

Project Concept

Modern DeFi is tiring for users. Interfaces are complex. Paradex approaches this problem with its SuperDEX concept. Its core idea:

Current DeFi issues:

-

Complex user experience

-

Low capital efficiency

-

Scalability lagging behind CEX

SuperDEX approach:

-

Single account

-

All products

-

Any asset as collateral

-

Privacy + high liquidity

-

Zero-fee perpetuals

It aims to deliver a Binance-like experience entirely on-chain.

Who is in Charge?

Paradex was incubated by industry giant Paradigm. CEO Anand Gomes (fiddybps1), a former professional player and trader, leads the team. Core staff includes CCO @noncesensicalll and growth lead @PioGerard. Notably, core contributors are excluded from the airdrop, signaling long-term focus on project success over personal gain.

Investors & Key Partners

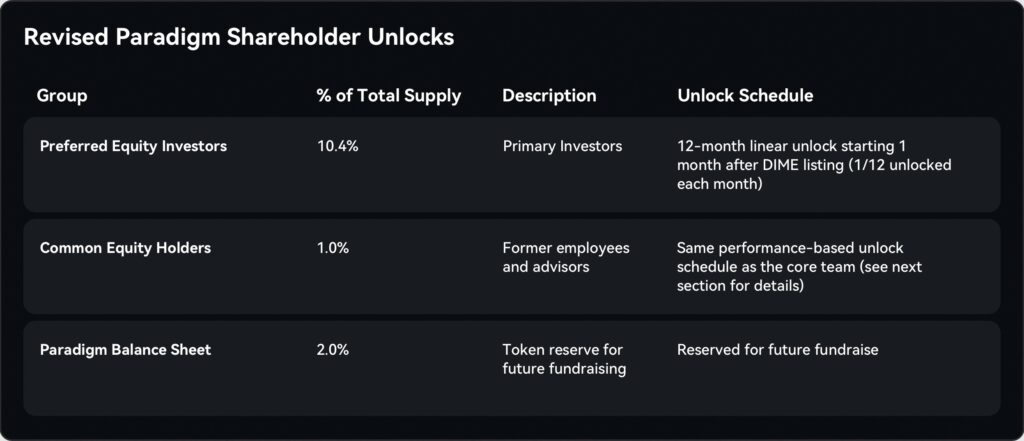

Primary support comes from Paradigm, whose shareholders hold 13.5% of total supply, including some of the largest trading firms globally. Additional technical partnerships include:

-

Starknet ecosystem

-

Hyperlane (cross-chain bridge)

-

Privy (social login infrastructure)

How Paradex Works

Paradex Exchange integrates three key financial layers:

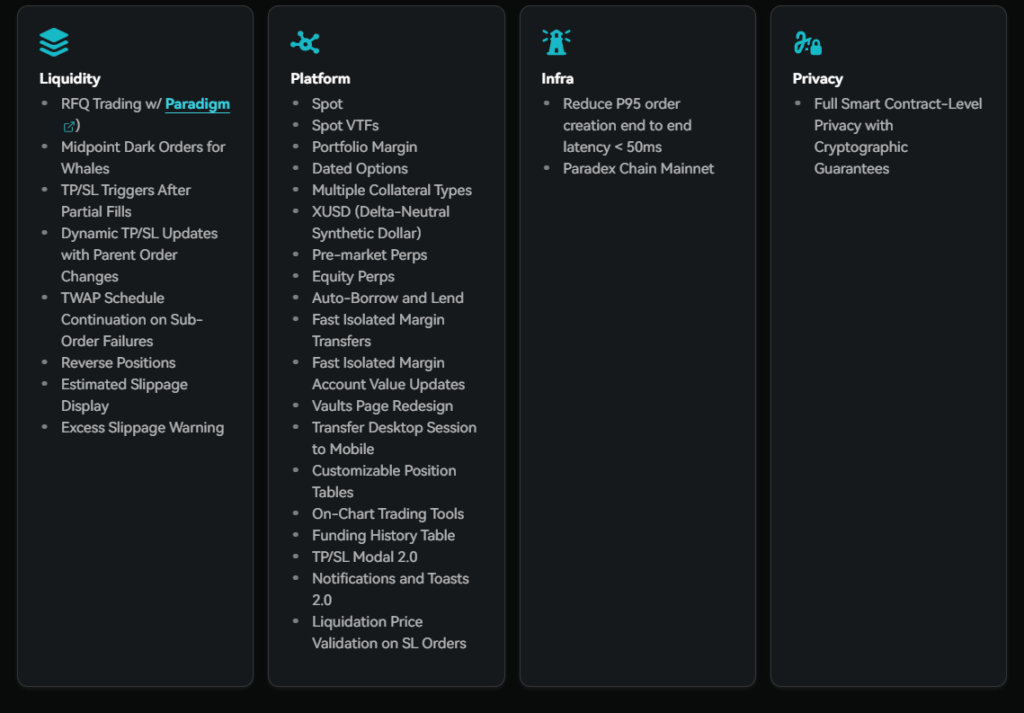

1. Trading Layer: Spot, perpetual futures, perpetual options, and assets not yet listed on CEXs can be traded through a single account. Users can switch instantly between cross, isolated, and portfolio margin modes. Over 100 markets offer zero fees for retail users.

2. Decentralized Asset Management: Paradex Vaults allow investments from active trading strategies to passive index products. Depositors receive LP tokens, usable with Aave, Morpho, or Pendle in the future.

3. Borrow/Lend Layer: Planned for 2025, users can borrow without closing positions, use their entire portfolio as collateral, and earn passive income from idle assets.

XUSD – Native Synthetic Dollar

XUSD is not a classic stablecoin. It is a delta-neutral synthetic dollar producing yield via futures basis. It can be used as collateral, deposited in vaults, or added to lending pools—preventing locked capital from being “dead.”

Paradex Chain

Paradex Chain is a zk-STARK-based Layer-2 on Ethereum, built on the Starknet Stack with the Cairo programming language. It processes ~1,000 TPS with 2–3 second block finality. Privacy is the key: zk encryption hides positions, entry/exit levels, and PnL. DIME serves as the native gas token. The chain will soon open to external developers connecting directly to Paradex liquidity.

DIME Token

DIME is more than a governance token; it powers the network. Gas fees on Paradex Chain are paid in DIME. Traders enjoy fee discounts, and holders can stake, participate in liquidity mining, and vote in governance.

Token Distribution & Unlocks

-

20% Community Airdrop

-

26.6% Ongoing Community Rewards

-

5% Liquidity Programs

-

6% Foundation

-

25.1% Core Contributors

-

3.8% Future Contributors & Advisors

-

13.5% Paradigm Shareholders

Community Airdrop is XP-based, multi-season, fully unlocked, excluding core contributors.

- Team Unlocks: 80% performance-based, 20% time-based. Tokens unlock only with product progress, ensuring long-term alignment.

- Governance: Full decentralization planned, Stage 2 Rollup, open-source stack, community governance. DIME holders have voting rights.

- 2026 Roadmap: Season 2 extended to 6 months. Spot trading, options, and pre-market launches planned. Weekly Season 3 XP drops starting Feb 18, 2026. Future: AI agent-managed vaults and full multichain integration.

Why does Paradex differ from traditional DEXs?

-

Zero-fee perpetuals

-

ZK privacy

-

Unified margin

-

250+ markets

-

Tokenized vaults

-

Pre-market trading

-

Whale dark orders

-

RFQ liquidity

DIME is not just a token—it powers the chain and connects the community. Paradex is building a multi-year financial infrastructure, not chasing short-term hype.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.