Polymarket is one of the world’s largest blockchain-based prediction market platforms, functioning as a decentralized prediction market protocol. Users can trade on future outcomes across politics, sports, crypto, and cultural events, profiting from their knowledge and insights.

The platform’s core principle is simple: price = probability.

News, polls, and expert opinions converge into a single market price. This mechanism leverages the “wisdom of crowds” principle, and studies show prediction markets often outperform traditional expert forecasts in accuracy.

As of February 2026, Polymarket’s monthly trading volume exceeds billions of dollars. High-profile markets, including Super Bowl, US politics, and major legal cases (e.g., Epstein files), individually generate millions of dollars in trades.

Team and Founders

Polymarket was founded in 2020 by entrepreneur Shayne Coplan, who dropped out of New York University (NYU) and currently serves as CEO.

At 27, Coplan’s estimated net worth is around $1–2 billion (unofficial). The company is headquartered in New York and has a team of 100+ members.

The advisory board is led by former CFTC Commissioner J. Christopher Giancarlo, while Donald Trump Jr. contributes via 1789 Capital.

The team focuses on user experience and regulatory compliance.

Investors and Key Partnerships

Polymarket has attracted high-profile investors, explaining its significant market hype.

Key investors include:

-

Founders Fund (Peter Thiel)

-

Blockchain Capital

-

Vitalik Buterin

-

Ribbit Capital

-

Dragonfly

-

Point72 Ventures

-

SV Angel

-

Coinbase

-

Valor

-

1789 Capital

A milestone was ICE’s $2 billion strategic investment in October 2025, raising Polymarket’s valuation to $9 billion.

ICE partnership extends beyond finance to:

-

Enterprise market infrastructure

-

Data distribution

-

Tokenization

Total funding has surpassed $2.26 billion. Circle integration enables the platform to use native USDC (USDC.e migration completed).

Core Idea: Building a Market for Truth

Polymarket aims to generate real-time, accurate probabilities using economic incentives.

Users trade peer-to-peer, not against a “house.” Market prices reflect collective intelligence.

In the 2024 US elections, Polymarket markets achieved ~99% accuracy, establishing the platform as an alternative data source for institutional participants.

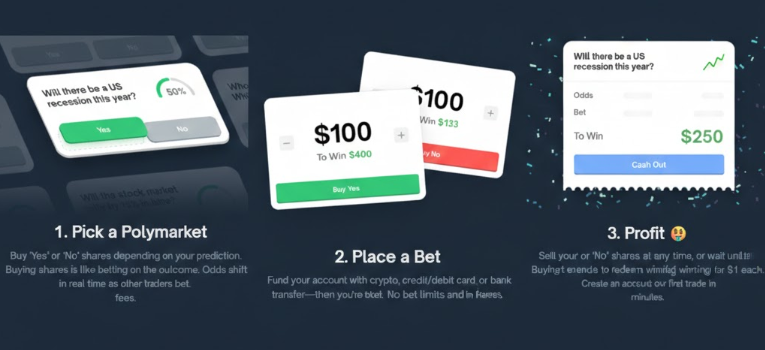

How It Works

Each market is based on a question. Users buy “Yes” shares if they believe an event will occur, “No” if they do not. Prices range from 0–1 USDC, representing the probability of the outcome. For example, a $0.60 “Yes” share implies a 60% chance.

Example:

“Will TikTok be banned in the US this year?”

-

YES share

-

NO share

Each pair is fully collateralized with 1 USDC.

0.18 USDC = 18% probability. Correct outcome shares pay 1 USDC at market resolution.

The platform runs on Polygon, with results verified via UMA Oracle. Trades are peer-to-peer; users can close positions before the event ends.

Governance

Currently centralized, governance will transition to a DAO-like model with POLY token.

Token holders will vote on:

-

Market categories

-

Fee structures

-

Oracle settings

-

Partnership decisions

The DAO will activate post-token launch.

Roadmap (Updated)

-

End of 2025: US relaunch

-

4 Feb 2026: Trademark filed for “POLY” and “$POLY”

-

2026: POLY token launch + retroactive airdrop

-

Governance & staking implementation

-

Expansion to enterprise markets

-

Tokenization projects

-

Global growth

POLY’s 2026 launch probability is currently ~70%, but exact timing remains flexible.

Regulatory Note

A temporary restraining order in Nevada (Jan 29 – Feb 12, 2026) temporarily restricts operations, slowing US expansion. The platform continues regulated reopening efforts.

POLY Token Utility

Planned use cases:

-

Governance voting

-

Staking rewards

-

Liquidity incentives

-

Market maker rights

-

Fee discounts

-

Community incentives

Detailed utility will be provided in the token whitepaper.

Token Info & Distribution

-

Total supply: TBD

-

Team allocation: TBD

-

Investor allocation: TBD

Confirmed: retroactive airdrop for active traders and market makers. Trademark filed 4 Feb 2026, timeline still flexible.

Ecosystem

When we examine the ecosystem, we see that Polymarket is not just a betting site—it has actually become a massive data source. Many news outlets now reference Polymarket data instead of traditional polls. In terms of features, its fast interface, low transaction costs, and wide range of markets make it several tiers above competitors.

Polymarket is not just a site; it is the center of a vast ecosystem. Combined with Circle’s USDC, Polygon’s speed, and ICE’s data power, this structure offers unmatched capabilities. Its peer-to-peer trading removes intermediaries, while Optimistic Oracle systems like UMA accurately bring real-world outcomes on-chain. Ultimately, Polymarket is not merely a betting platform—it is progressing toward becoming the internet’s next-generation truth verification hub.

Polymarket’s ecosystem includes:

-

Polygon

-

Circle (native USDC)

-

ICE infrastructure

-

UMA Oracle

-

Discord community

-

Media integrations (e.g., Unusual Whales)

-

Expanding DeFi connections

Key Features

-

Real-time probability pricing

-

Peer-to-peer trading

-

100% USDC collateralization

-

High-volume markets

-

Early exit for positions

-

Enterprise data integration

-

US regulatory compliance

Polymarket is not just a betting platform—it’s emerging as a next-generation online truth verification hub.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.