Provenance Blockchain (HASH) is a distributed, Proof-of-Stake blockchain crafted for the financial services industry, revolutionizing markets by replacing reliance on intermediaries with verifiable on-chain truth. It addresses inefficiencies in areas like loan origination, servicing, and securitization, offering stability and reliability through direct on-chain asset management. Let’s explore what Provenance Blockchain is, how it operates, and its potential in detail.

What is Provenance Blockchain (HASH)?

Provenance Blockchain is a platform designed to tackle inefficiencies in financial markets. Initially focused on loan origination, servicing, and securitization, it has evolved by incorporating lessons from early implementations. Unlike many RWA blockchains that deal in synthetic or wrapped assets, Provenance is built for real, on-chain assets. The HASH token powers network fees, staking, governance, and asset auctions, with a total supply of 100,000,000,000 HASH.

Purpose of Provenance Blockchain (HASH)

Provenance aims to transform financial systems by replacing trust in intermediaries with blockchain-verified truth. Its distributed and immutable structure enhances transaction transparency. By integrating Ledger, Registry, and Exchange functions, it reduces errors, boosts speed, and cuts costs by over 100 basis points. HASH ensures predictable fees via a USD-based model, while staking mitigates inflation, fostering a secure and efficient ecosystem.

How Does Provenance Blockchain (HASH) Work?

Provenance operates on a Proof-of-Stake model, with HASH used for fees. It integrates three core functions:

-

Ledger: A comprehensive, immutable record of all financial transactions, offering real-time visibility and eliminating reconciliation needs.

-

Registry: Determines asset ownership on-chain, merging record-keeping and transfer processes to enable T+0 pledging and sales.

-

Exchange: A decentralized marketplace for transparent price discovery, removing market-making intermediaries and enabling liquidity through tokenized assets.

HASH Token:

-

Fees: Network and settlement fees are USD-denominated, dynamically priced via a VWAP oracle for predictability.

-

Staking: With 60%+ of HASH staked, inflation drops to 1%; staking enhances airdrop rewards with a 21-day unbonding period.

-

Governance: Grants voting rights on protocol decisions.

-

Asset Acquisition: Used for bidding in HASH Market auctions.

HASH Market: Assets from fees are auctioned; HASH bids for assets (e.g., USDC) are burned, creating deflationary pressure.

YLDS Stablecoin: Issued by DART, YLDS is a yield-bearing digital security backed 1:1 by an FDIC-insured U.S. deposit account. It supports secondary trading via Figure Markets ATS, integrated with Provenance for on-chain settlement.

DApp Architecture: Comprises Frontend (React, Vue), Backend (Node.js, Python), BlockVault/EOS (encrypted storage), Provenance Blockchain, Smart Contracts (Rust), Wallet (WalletConnect), and External Services (KYC, oracles).

Custom Modules: Attribute (name-value registry), Exchange (on-chain trading), Hold (fund locking), IBC Hooks (cross-chain calls), IBC Crate Limit (transfer limits), Marker (token management), Metadata (off-chain references), Msg Fees (message fees), Name (address aliases), Oracle (ICQ queries), Quarantine (restricted accounts), Sanction (banned accounts), Trigger (automated transactions).

Provenance Blockchain (HASH) Use Cases

Provenance supports financial markets through:

-

Asset Tokenization: Real estate, insurance, stocks, loans, alternative assets.

-

Marketplaces: Buyer-seller platforms compatible with DART, Asset Manager, Marketplace, and Data Room.

-

Pledging/Sales: T+0 transactions.

Usage Steps:

-

Connect a wallet to the Provenance network.

-

Create fungible tokens with Marker or NFTs with Metadata.

-

Record transactions on the Ledger and trade via the Exchange.

Advantages of Provenance Blockchain (HASH)

-

Transparency: Distributed, immutable ledger.

-

Trust: Replaces intermediary reliance with on-chain verification.

-

Efficiency: Integrates three functions, reducing costs.

-

Security: Proof-of-Stake and HASH staking.

Risks of Provenance Blockchain (HASH)

-

Technical Risk: Smart contract vulnerabilities.

-

Regulation: Compliance with financial asset laws.

-

Market Volatility: HASH price fluctuations.

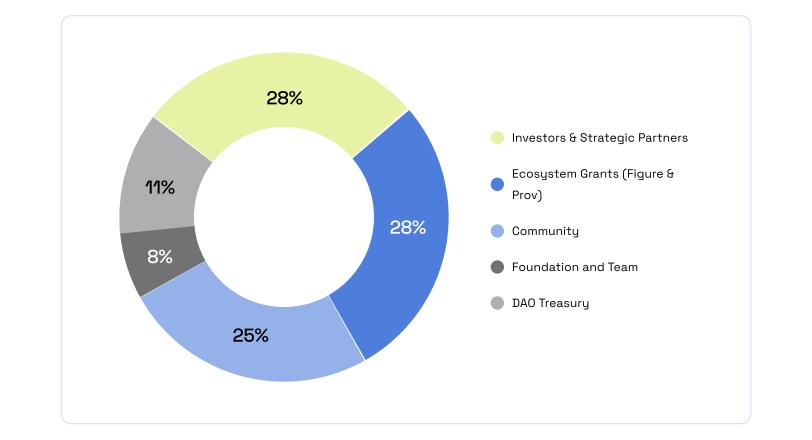

Provenance Blockchain (HASH) Tokenomics

Total Supply: 100,000,000,000 HASH.

-

Distribution:

-

Investors & Strategic Partners: 28%

-

Ecosystem Grants (Figure & Prov): 28%

-

Community: 25%

-

DAO Treasury: 11%

-

Foundation and Team: 8%

-

Inflation: 1% with 60%+ staking; up to 52.5% if staking drops to 0%.

-

Community Rewards: 17% (2% Milestone Airdrop, 15% Performance Airdrop) via the HASH Rank program, based on usage.

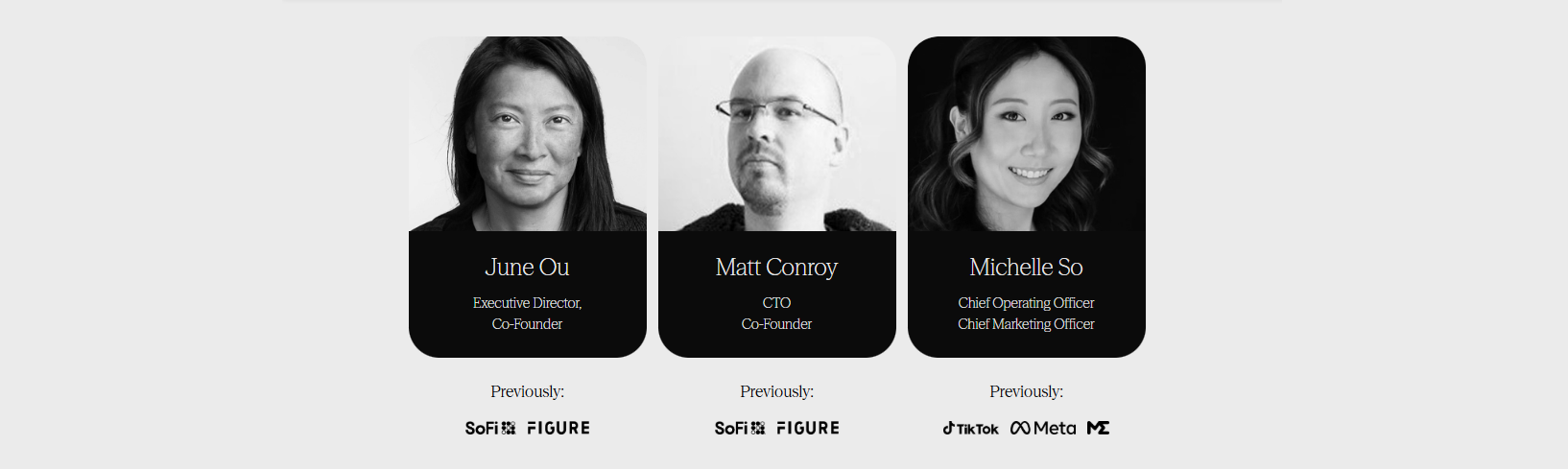

Provenance Blockchain (HASH) Team

-

June Ou (Executive Director, Co-Founder): Strategic leadership.

-

Matt Conroy (CTO, Co-Founder): Technical innovation.

-

Michelle So (COO/CMO): Operations and marketing.

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.