The decentralized finance (DeFi) ecosystem continues to offer increasingly sophisticated financial products beyond mere spot trading and classic staking models. One of the most recent examples of this transformation is RateX (RTX), an innovative multi-chain structure that enables leveraged yield trading by putting yield at the center. RateX positions itself as the world’s first “Universal Structured Finance Layer” solution.

What is RateX (RTX)?

RateX offers an advanced financial infrastructure that aims to radically change the way yield is priced in DeFi. By separating yield from principal, enabling leveraged yield trading, and offering fixed-yield alternatives, it clearly distinguishes itself from classic DEX and lending protocols.

Especially for professional users and investors developing yield-based strategies, RateX stands out as one of the projects signaling the next phase of DeFi.

Its core goal is to enable yield-bearing assets to be bought and sold in a more efficient, flexible, and capital-optimized way. Unlike classic DeFi protocols, RateX makes it possible to price, separate, and trade yield in a leveraged manner.

What Does RateX Do?

RateX is a multi-chain margin and spot yield trading protocol. It allows users to trade not only on asset prices but directly on the yield itself. The platform’s core functions can be summarized under the following headings:

- Yield tokenization

- Separation of yield and principal

- Leveraged yield trading

- Earning fixed yield

- Yield-focused liquidity provision

Thanks to this structure, users can directly profit from changes in yield rates or lock in future yields today.

Yield-Bearing Asset (YBA) Concept

The foundational building block of RateX is yield-bearing assets (YBA), which are tokens that generate passive income through staking, lending, or liquidity provision. Examples include:

- mSOL

- JitoSOL

- stETH

- GLP

YBA are divided into three main groups based on their yield distribution method:

- Rebase tokens: Yield is reflected by increasing token count

- Accumulate tokens: Yield is reflected by increasing token price

- Distribute tokens: Yield is distributed as separate rewards

- RateX makes all these different structures tradable under a single standard.

RateX’s Unified Yield Tokenization Model

RateX splits yield into three main token structures to make it tradable:

What is Standard Token (ST)?

Standard Token (ST) is the standardized form of the YBA. The price of ST is always fixed to the reference asset (quoting asset); yield is reflected by an increase in token count.

For example, while JitoSOL normally provides yield through price appreciation, in the ST-JitoSOL structure the price stays fixed and the token count increases. This separates yield from price fluctuations.

Key advantages of ST:

- 1:1 pricing with the reference asset

- Transparent and predictable yield reflection

- Accurate pricing of yield tokens

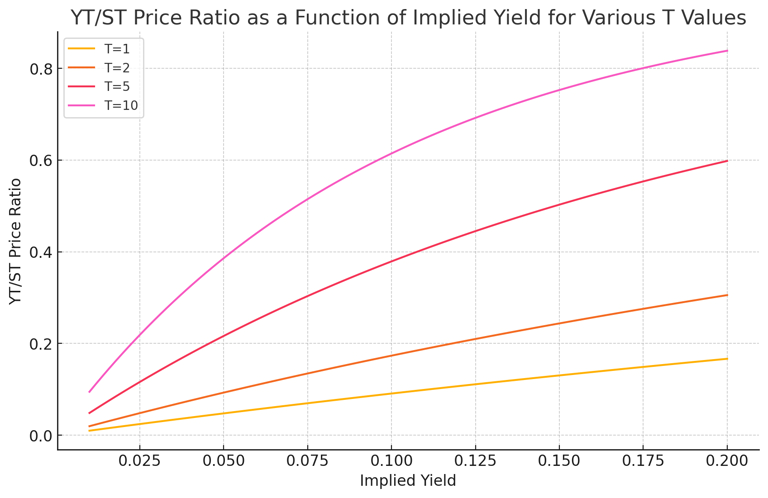

What is Yield Token (YT)?

Yield Token (YT) represents the yield that a ST will produce over a specific maturity period. The YT holder has the right to receive all yield generated until maturity.

The most important feature of YT:

They naturally decay in value over time

As maturity approaches, the value of YT approaches zero because less future yield remains. This makes YT naturally volatile and speculative.

What is Principal Token (PT)?

Principal Token (PT) represents only the principal portion of the YBA. Since the yield component is separated, holding PT until maturity provides fixed yield.

Core logic of PT:

- Bought at a discounted price today

- Converts 1:1 back to ST at maturity

- Yield is locked in advance

This structure stands out especially for users who want to avoid yield uncertainty.

Leveraged Yield Trading

The most distinctive feature of RateX is that Yield Tokens can be traded with leverage. Users can open long or short positions on YT by depositing only margin.

- Users expecting yield to increase → long YT

- Users expecting yield to decrease → short YT

The platform offers up to 10x leverage, significantly increasing capital efficiency.

Earn Fixed Yield: Fixed Yield Mechanism

RateX also provides solutions for users who want fixed yield, not just speculation. With the Earn Fixed Yield feature, users can:

- Deposit YBA

- Sell the yield component

- Lock principal and earn fixed APY

This mechanism offers a traditional-finance-like experience for investors who want to lock in variable yield.

Liquidity Provision and AMM Structure

RateX has a specially designed Automated Market Maker (AMM) infrastructure for yield trading. This structure features:

- Uniswap v3-style concentrated liquidity

- Model compatible with time-decaying YT

- Impermanent loss that decreases over time

LPs deposit YBA to produce ST and YT and earn from three sources:

- YBA yield

- Trading fee rebates

- PnL from counterparty positions

Liquidation and Risk Management

Due to leveraged trading, RateX has a strong liquidation mechanism. The system monitors position health using the Collateral Ratio (CR) metric.

The liquidation process has three stages:

- Insurance Fund steps in

- Auto-Deleveraging (ADL) is applied

- If necessary, LPs become the last line of defense

This structure aims to keep the protocol resilient against systemic risks.

RTX Tokenomics

RTX is the native token of the RateX ecosystem.

RTX Token Information

- Maximum supply: 100,000,000

- Initial circulating supply: 16,660,000

- Multi-chain: Solana and BSC

What Does RTX Do?

- Buyback with protocol revenue

- Staking to gain rights to create new markets

- Ecosystem incentives

RateX plans to use up to 30% of total ecosystem revenue for RTX buybacks.

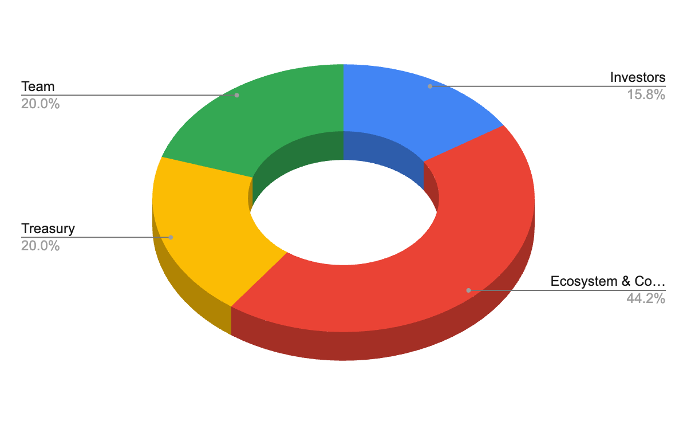

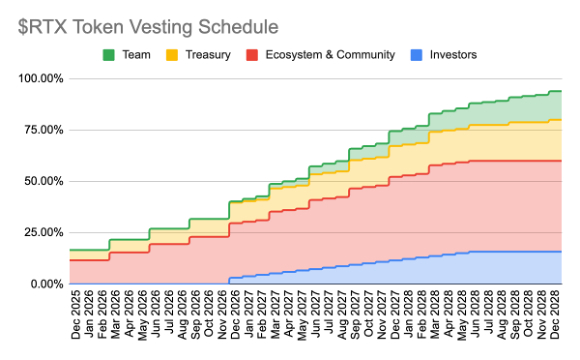

Token Distribution and Vesting

- Team: 20% – 12-month cliff, 36-month vesting

- Treasury: 20% – 5% at TGE, 36-month vesting

- Investors: 15.82% – unlock at month 12 • Ecosystem & Community: 44.18%

- 6.66% of total supply is allocated for Season 1 airdrop.

RTX Vesting

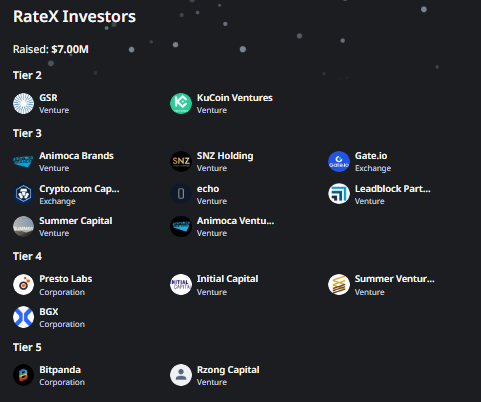

RateX Investors

RateX has raised a total of $7 million. Among the backers are:

- GSR

- Animoca Brands

- KuCoin Ventures

- Gate.io

- Crypto.com Capital

- SNZ Holding

- Bitpanda

and other well-known institutions in the DeFi and crypto space.

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.