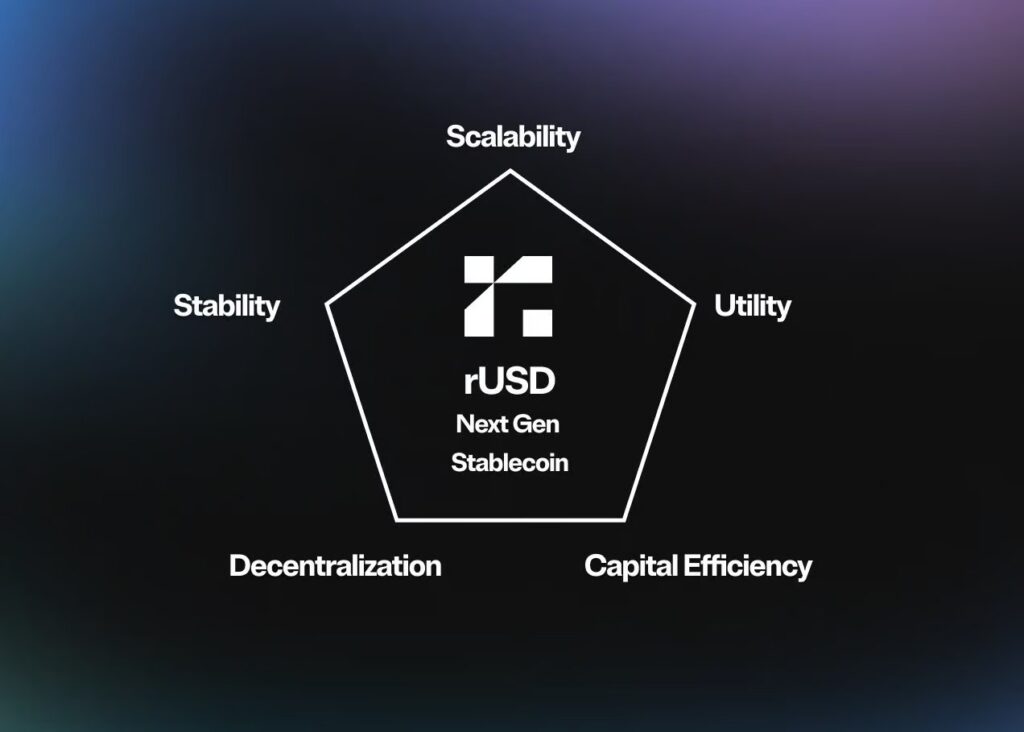

Reservoir is designed as a decentralized, scalable, and efficient stablecoin protocol. Its goal is to provide investors with secure and consistent returns through next-generation stablecoins backed by digital and real-world assets. It aims to combine stability, decentralization, and capital efficiency within the stablecoin ecosystem.

Who Created Reservoir (DAM)?

Reservoir was developed by experienced but pseudonymous blockchain engineers, a common practice in DeFi projects to emphasize decentralization.

Transparency is prioritized:

- Open-source code audited by reputable security firms.

- Governance is community-driven through DAM token holders.

- This model aligns with Web3 values of transparency and collective decision-making.

Project Idea and How It Works

Reservoir addresses limitations in the stablecoin market:

- Risks of single-asset-backed stablecoins

- Limited yield mechanisms of centralized stablecoins

- De-pegging and security risks of algorithmic stablecoins

Core Mechanisms:

- Peg Stability Module (PSM): Maintains rUSD peg with USDC reserves, managed by Credit Enforcer.

- Asset Adapters: Generate yield from on-chain and RWA assets under protocol oversight.

- Proof of Reserves (PoR): Real-time demonstration of liquidity and solvency.

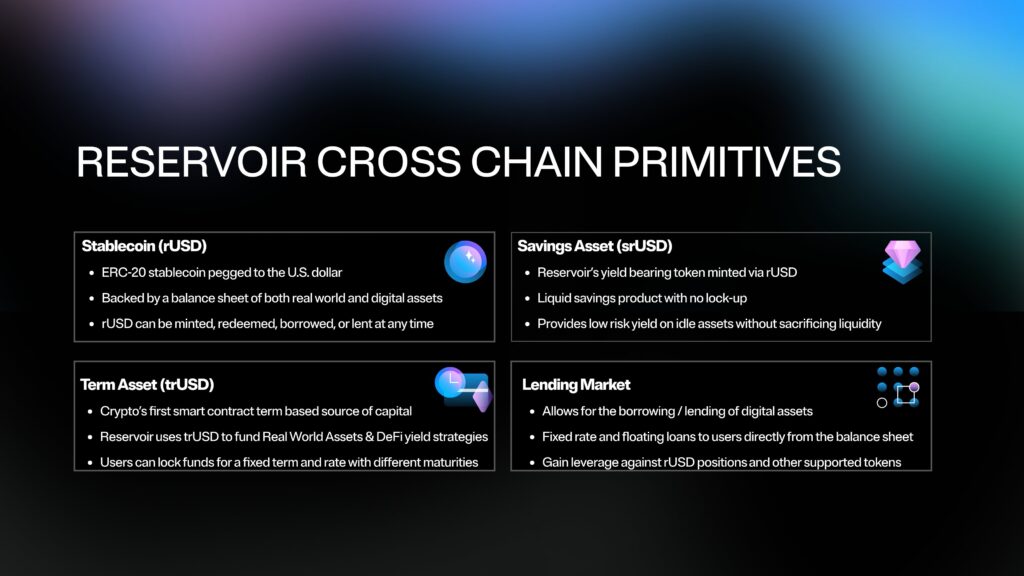

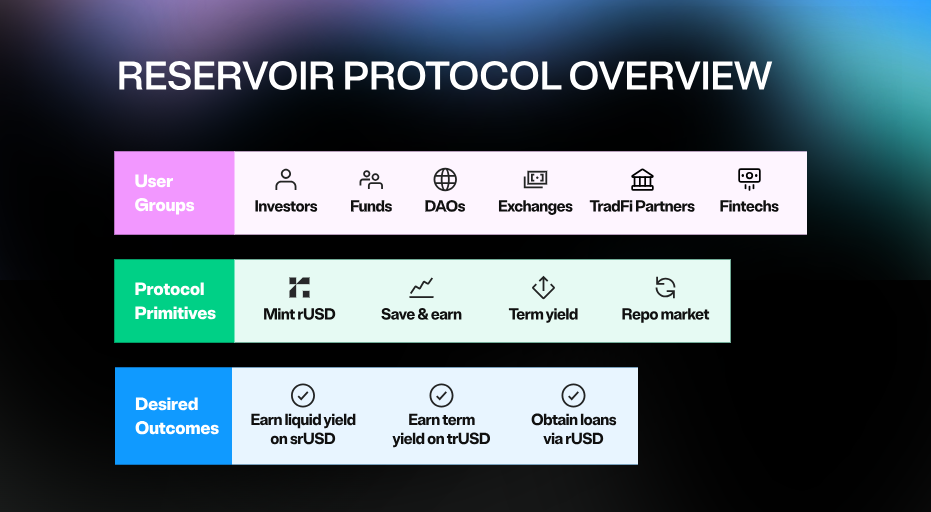

Products

- rUSD: Multi-collateral ERC-20 stablecoin

- srUSD: Yield-bearing liquid asset

- trUSD: Time-based yield product

- Permissionless Lending Markets: Users can borrow and lend rUSD and derivatives

Operating Model

- rUSD and stablecoins are backed by both digital and RWA assets

- Mint and redeem are 1:1 with USDC

- Credit Enforcer mechanism ensures collateral, asset, and liquidity ratios

Governance

DAM Token powers governance and incentives

Token holders:

- Vote on protocol upgrades

- Decide on collateral ratios and asset inclusion

- Users earn rewards through staking and liquidity programs

Roadmap

- 2024–2025: Launch on Ethereum, DeFi + RWA integration

- Mid-term: Multi-chain expansion (Solana, Avalanche), scalability improvements

- Long-term: Institutional adoption, global expansion, liquidity growth

How to Use Reservoir (DAM)?

Reservoir enables seamless cross-chain DeFi operations via rUSD. Users can trade, borrow, lend, and access other DeFi opportunities with rUSD.

DAM Token Use Cases

- Governance: Voting on upgrades, collateral, asset inclusion

- Staking: Earn rewards and support long-term growth

- Speculative Trading: DAM price depends on protocol success; listings (e.g., WEEX) boost liquidity and access

Key Features

- Cross-chain DeFi utility with rUSD

- Community-driven through staking and governance

- Growing liquidity and accessibility

Token Information

- Total Supply: 1,000,000,000 DAM

- Max Supply: 1,000,000,000 DAM

- Circulating Supply: 199.99M DAM

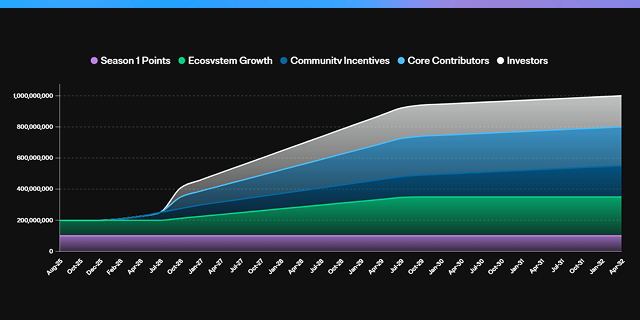

Vesting

- Season 1 Points: Gradual release starting from day one, peaking mid-2028.

- Community Incentives & Growth: Slow unlock in year one, accelerating by late 2026.

- Core Contributors & Investors: Unlock starts in 2026, major releases through 2032.

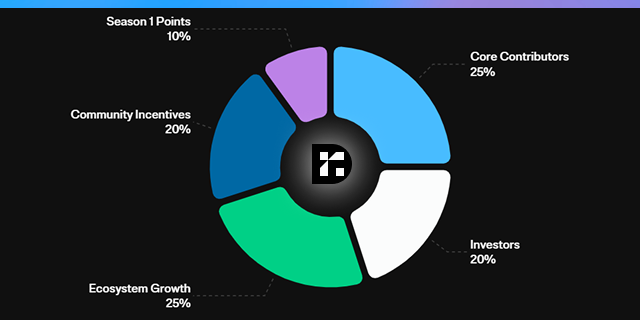

Distribution

- Core Contributors (25%)

- Investors (20%)

- Ecosystem Growth (25%)

- Community Incentives (20%)

- Season 1 Points (10%)

Ecosystem & Features

- Multi-chain infrastructure (Ethereum + expansion)

- RWA + digital asset hybrid model

- On-chain transparent balance sheet

- Meta-transactions & fast execution

- Censorship-resistant, transferable stablecoin

Investors and Partners

- Investors: Berachain, Dinero.xyz, Dolomite.io, FordefiHQ, Morpho Labs, Hilbert Capital

- Partners: Halborn Security, Jigsaw DeFi, Plume Network, SteakhouseFi, Odos Protocol

Future Plans

- Increase protocol liquidity & TVL

- Wider DeFi & CeFi distribution

- Cross-chain integrations

- Launch of full decentralized governance

Connections

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.