RollX (ROLL), launched in 2024 by a global team and operating on the Base network, is a Bitcoin-centric perpetual trading protocol. The platform aims to enable users to trade BTC and leading crypto assets with very high leverage fully on-chain and in a non-custodial structure.

What sets RollX apart from similar platforms is its combination of CEX-level trading performance with DeFi’s transparency and ownership model, delivered through a Bitcoin-native liquidity approach. The protocol positions itself not merely as a trading platform but as an infrastructure project aiming to become a global perpetual liquidity layer in the long term.

Core Vision of RollX (ROLL)

RollX targets three fundamental problems in decentralized derivatives markets:

- Liquidity fragmentation

- Capital inefficiency

- Lack of institutional-grade trading infrastructure

To this end, RollX is built with a single-pool liquidity model, high-leverage BTC products, multi-collateral support, and a community-owned economic structure. Transaction fees generated on the platform are shared directly with liquidity providers and stakers instead of flowing to a centralized entity.

How Does RollX (ROLL) Work?

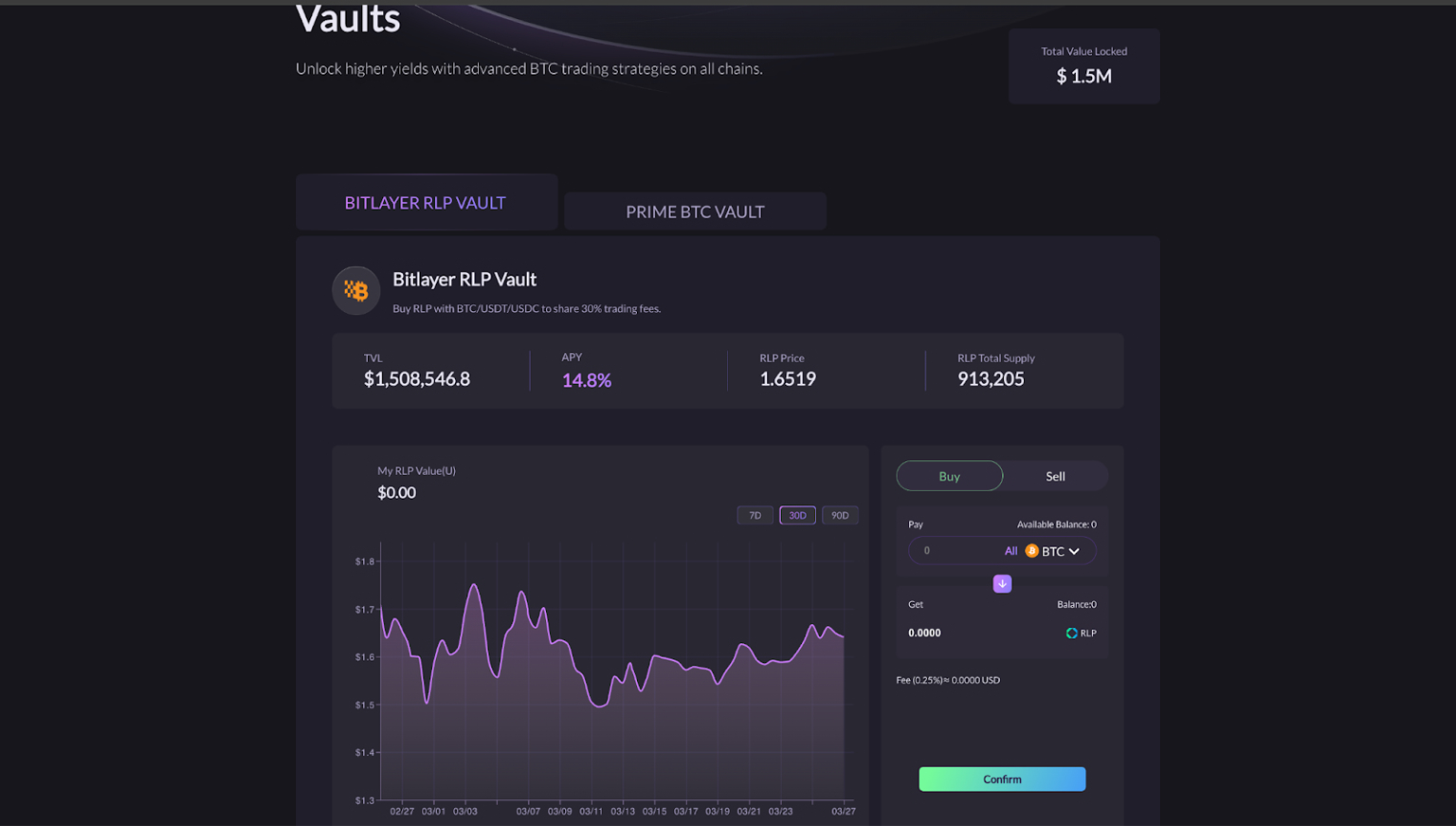

RLP Pool: The Liquidity Backbone of RollX

At the center of RollX V1 is the RLP Pool. This pool serves as a common liquidity layer for all perpetual trading pairs on the platform.

- Liquidity is not fragmented across specific trading pairs

- All trades are matched from the same pool

- Capital utilization is maximized

The RLP token is the liquidity provider token of this pool. Starting at a price of $1, the value of RLP dynamically changes based on factors such as:

- Traders’ profit/loss positions

- Trading fees

- Funding payments

- Liquidation revenues

In scenarios where traders incur losses, the net asset value of the RLP pool increases, while in cases where traders profit, this value decreases.

BRLP Pool: Emergency Liquidity Layer

RollX uses a secondary liquidity reserve called the BRLP Pool to balance market stress. This structure activates during:

- Sudden volume spikes

- Temporary pressure on the pool

to ensure necessary liquidity is provided. Once balance is restored, the system automatically reverts to its previous state. This mechanism supports both liquidity continuity and system security.

Trading Experience on RollX (ROLL)

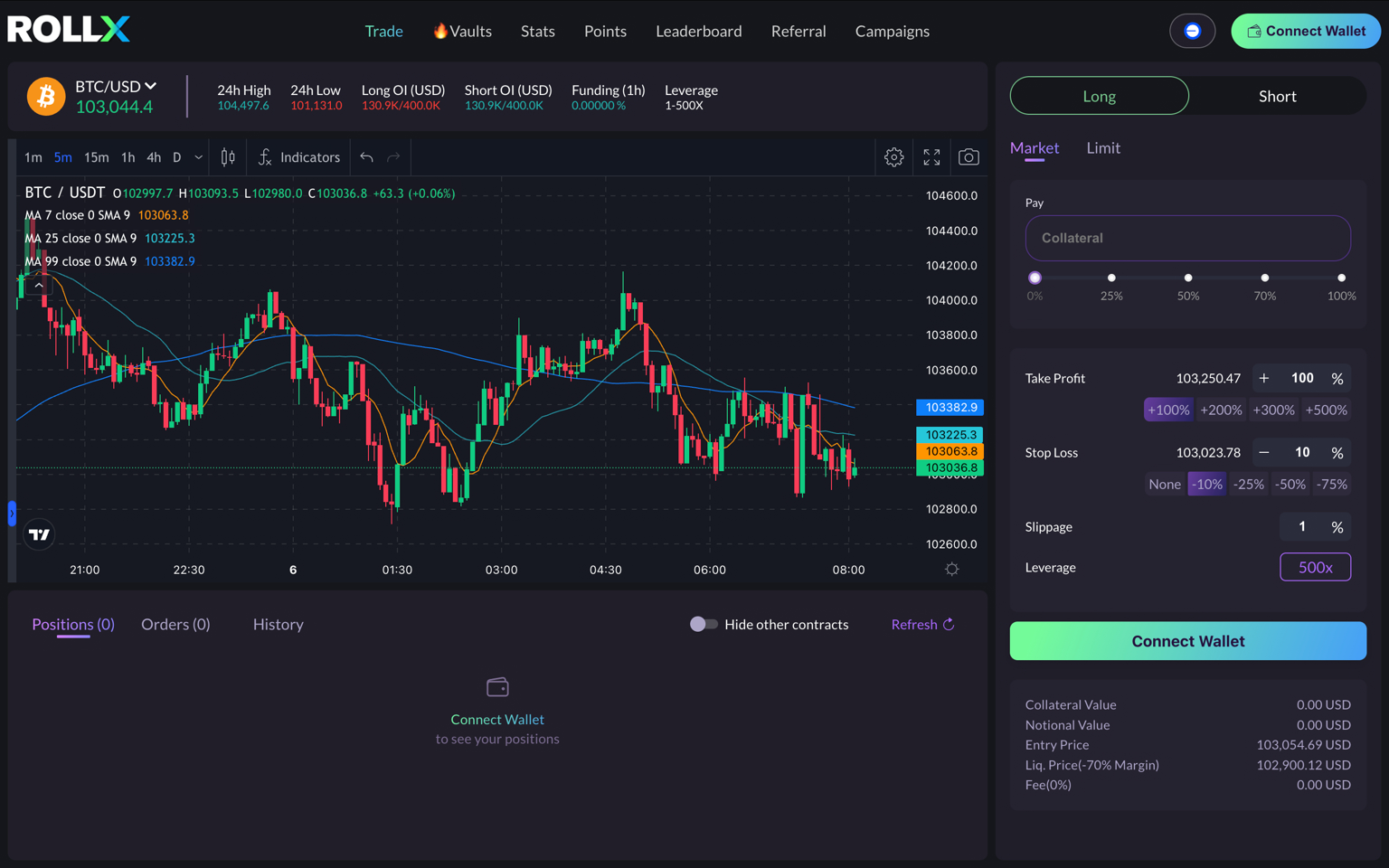

Leverage Structure

RollX offers some of the most aggressive leverage ratios in the industry:

- Standard crypto perpetuals: up to 100x

- BTCUSD perpetual: up to 500x

This structure is supported by optimized collateral ratios and advanced liquidation thresholds.

Classic and Pro Modes

Classic Mode: Designed for a broader user base, offering up to 100x leverage.

Pro Mode: Targeted at more experienced traders, providing up to 500x leverage.

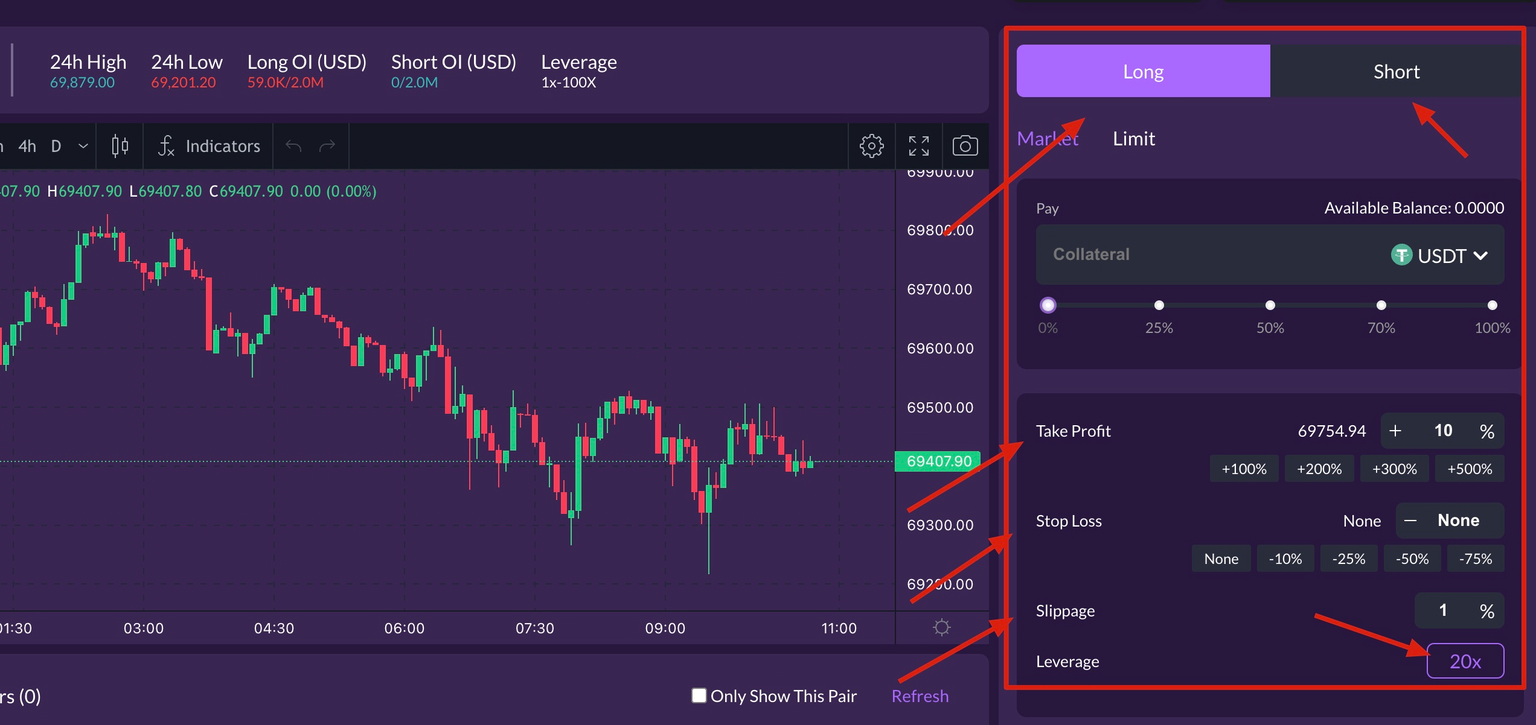

Degen Trading Mode

One of RollX’s most striking features is the Degen Trading Mode. Available exclusively for BTCUSD perpetuals, this mode includes:

- 500x leverage

- Zero trading fees on opening

- Zero slippage (guaranteed price)

- Dynamic PnL-based fees on closing

In this mode, additional margin cannot be added to positions. Users must manually monitor liquidation levels.

Oracle and Security Infrastructure

RollX uses a dual-oracle system to prevent price manipulation:

- Centralized exchange (CEX) price feeds

- Pyth Network price data

This setup:

- Filters out momentary price deviations

- Reduces liquidation risks from temporary “wicks”

- Activates automatic backup mechanisms in case of oracle outages

All trades are signed from the user’s wallet, and funds never come under platform control.

Bitcoin LST and DeFi Integration

RollX supports Bitcoin Liquid Staking Tokens (LSTs) as collateral. These include:

- solvBTC

- LBTC

- pumpBTC

This allows users to:

- Stake BTC assets

- Simultaneously open perpetual positions

- Create passive yield + active trading combinations

This structure makes RollX particularly attractive for delta-neutral strategies and low-risk yield models.

What is RollX Token (ROLL)?

$ROLL is the utility and governance token of the RollX ecosystem. The token’s main purpose is to create long-term incentive alignment between traders, liquidity providers, and developers.

What is $ROLL Used For?

- Trading fee discounts

- Access to VIP and professional trading features

- Increased referral and reward rates

- Incentives in RLP/BRLP pools

- Governance voting

In the future, when RollX App Chain is launched, $ROLL is also planned to serve as the validator staking asset.

RollX (ROLL) Tokenomics

Total supply: 1 billion ROLL (fixed)

Distribution Structure:

- Community and users: 54%

- Team: 10% (locked at TGE)

- Ecosystem and partners: 14%

- Treasury and insurance reserve: 16%

- Exchange liquidity and campaigns: 6%

A key detail about RollX:

- No private sale was conducted

- No VC or investor allocation was included

- No SAFT model was used

This structure makes RollX a fully community-owned perpetual protocol.

Roadmap: Where is RollX Heading?

RollX’s long-term goal is to go beyond being a single DEX and become a universal perpetual liquidity layer.

2025–2026

- RollX V2: Hybrid match engine + CLOB

- Portfolio-based cross-margin system

- Professional APIs

- Multi-Layer-2 integration

2026 and Beyond

- RollX App Chain

- Institutional risk management modules

- Dark orders and advanced order types

- Options and structured products

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.