As the decentralized finance (DeFi) ecosystem grew, core issues such as speed, cost, and liquidity became more visible. In particular, first-generation Ethereum-based DeFi applications created significant constraints for both users and developers due to high gas fees and slow transaction times. Serum (SRM) emerged at this point, positioning itself as a protocol aiming to redefine the concept of decentralized exchanges.

Built on the Solana blockchain, Serum offers a different approach in the DeFi world with its fully on-chain Central Limit Order Book (CLOB) architecture. Targeting both individual and institutional users, this structure aims to combine speed and cost advantages without compromising decentralization.

What Does Serum (SRM) Aim For?

Serum is a permissionless decentralized exchange protocol and ecosystem operating on the Solana blockchain. Its primary goal is to provide DeFi applications with high speed, low transaction costs, and advanced market structures. At the heart of Serum is a fully on-chain central limit order book and matching engine.

This structure sets Serum apart from many DEXs based on the automated market maker (AMM) model. Instead of liquidity pools, it brings the classic exchange model—where buy and sell orders are matched based on price-time priority—onto the chain. Users can determine the price, quantity, and direction of their trades themselves.

Serum’s Origin Purpose and History

With the popularization of DeFi, DEXs on Ethereum grew rapidly. However, issues such as high gas fees, slow transaction confirmations, liquidity fragmentation, and capital inefficiency made scaling the ecosystem difficult. Serum was developed to solve these problems.

The project was launched on August 31, 2020, and became one of the first major open-source DeFi projects developed on Solana. Serum’s development and growth are supported by the Serum Foundation. The project was shaped with contributions from a consortium experienced in cryptocurrency trading and DeFi.

How Does Serum Work?

Serum’s technical architecture offers a rare structure in the decentralized finance world. The platform’s core components are as follows:

On-Chain Central Limit Order Book

Serum’s most distinctive feature is its fully on-chain central limit order book. In this system, all buy and sell orders are recorded on the Solana blockchain, and matching is performed through smart contracts.

Price-Time Priority

Orders are matched based on price and time priority, just like in traditional financial markets. This approach creates a fairer and more transparent market structure.

Asset-Agnostic Structure

Serum’s order book is designed to support nearly any financial product based on Solana. It offers a wide range of uses, from spot trading to derivatives, lending protocols, and various financial instruments.

Serum as an Alternative to the AMM Model

The AMM model, widely used in the DeFi world, relies on liquidity pools. While this structure is simple and accessible, it can create disadvantages such as slippage in large trades and capital inefficiency.

Serum, as an alternative to this model, combines the order book system from traditional exchanges with a decentralized structure. This enables:

- More precise pricing

- Large trades to be executed at lower costs

- A familiar trading experience for institutional traders

Advantages Provided by Solana Infrastructure

Serum’s operation on Solana is one of the most important factors directly affecting the platform’s performance. Solana stands out with its ability to process tens of thousands of transactions per second and very low transaction fees.

- Transaction times are at the millisecond level

- Average transaction costs are extremely low

- Complex structures like on-chain order books become possible

Thanks to this infrastructure, Serum aims to offer speed and user experience close to centralized exchanges.

Serum Ecosystem and Components

Serum positions itself as a central liquidity layer that many different applications can connect to, rather than a single application. Any application connected to Serum’s order book infrastructure can share existing liquidity.

This structure allows:

- Different dApps to place orders in the same market

- An order placed in one application to match with an order in another

- Liquidity to be pooled in one place, preventing fragmentation

Retail traders, algorithmic traders, and developers can benefit from this shared liquidity pool offered by Serum.

What is Serum Token (SRM)?

SRM is the utility and governance token of the Serum ecosystem. It provides various advantages in transactions on the platform and plays a central role in the ecosystem’s long-term sustainability.

SRM operates as an SPL token on Solana and also has an ERC-20 version on Ethereum, enabling cross-chain usage.

Use Cases of SRM Token

The main use cases of the SRM token are as follows:

Transaction Fees

When SRM is used in transactions on Serum, users can receive discounts on transaction fees.

Governance

SRM provides participation in governance processes within the Serum ecosystem. The community can vote on decisions regarding the platform’s future.

Buy & Burn Mechanism

All transaction fees earned on Serum return to SRM. These revenues can be used for token buybacks and burns, staking rewards, or ecosystem incentives.

What is MegaSerum (MSRM)?

In addition to SRM in the Serum ecosystem, there is a second token called MegaSerum (MSRM). MSRM is created by locking 1,000,000 SRM.

- Total MSRM supply is limited

- MSRM holders benefit from higher advantages compared to SRM

- Node operators wishing to contribute to network security must hold MSRM

This structure is designed as a mechanism to incentivize long-term participants.

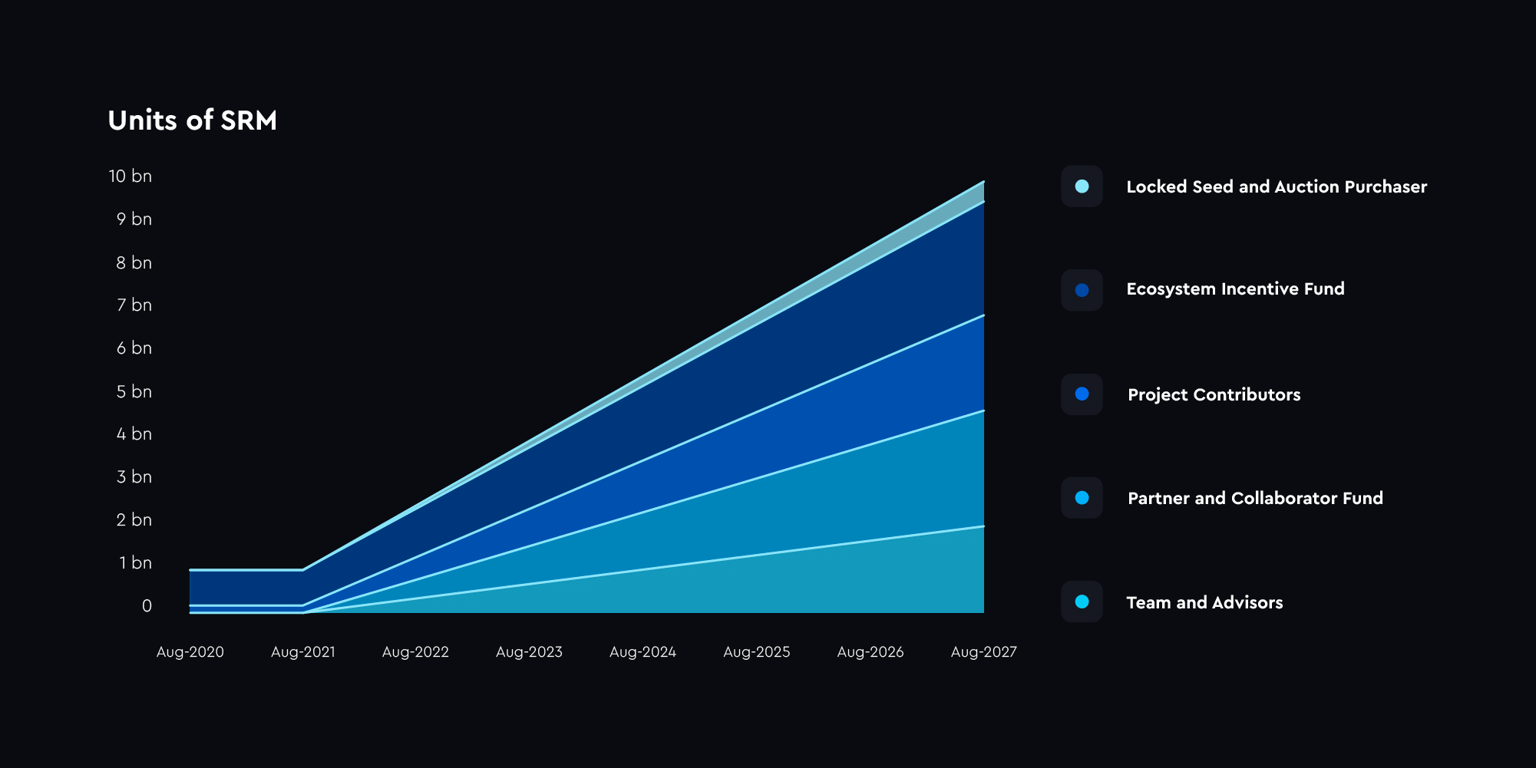

Serum (SRM) Tokenomics

Only 10% of the SRM token supply is initially unlocked. The remaining 90% is released according to a specific vesting schedule.

- Tokens are locked for the first year

- Then unlocked linearly over approximately 6 years

- Seed sales were conducted entirely locked

This distribution model aims to prevent sudden supply shocks and ensure long-term stability.

Serum’s Vision

Serum’s long-term goal is to accelerate the global adoption of decentralized finance. This vision encompasses building a DeFi infrastructure capable of reaching billions of users and trillions of dollars in on-chain value.

Principles of speed, usability, interoperability, and true decentralization form the foundation of this vision.

Serum’s Key Strengths

- Fully on-chain operating order book

- High speed and low transaction costs

- Composable structure that pools liquidity in one center

- Open and modular infrastructure for developers

- Design that does not compromise decentralization

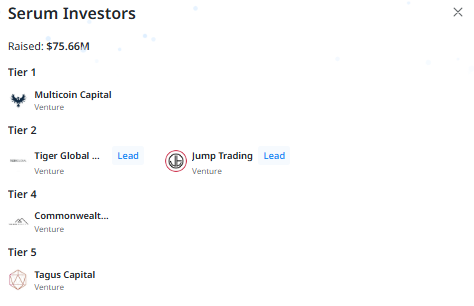

Serum (SRM) Investors

Serum is among the projects that have attracted attention from prominent institutional investors in both the cryptocurrency ecosystem and the traditional finance world. The project has raised approximately $75.66 million to date, demonstrating confidence in its long-term vision, technical infrastructure, and strategic position in the Solana-based DeFi ecosystem. These investors played a significant role in Serum’s early growth and ecosystem development.

Prominent Investors:

- Multicoin Capital (Tier 1)

- Tiger Global Management (Tier 2)

- Jump Trading (Tier 2)

- Commonwealth Asset Management (Tier 4)

- Tagus Capital (Tier 5)

Serum (SRM) Team

Serum is an open-source project developed with the joint contributions of many industry leaders operating in cryptocurrency, trading, and decentralized finance. Instead of a traditional centralized company structure, a consortium model based on knowledge sharing, open innovation, and ecosystem-focused growth has been adopted.

The protocol’s development and sustainability are managed by the Serum Foundation, supported by professionals with extensive experience in crypto markets, financial infrastructure, and decentralized systems. This structure aims to ensure Serum’s long-term technical development and ecosystem coordination.

Core Contributors and Supporting Organizations:

- FTX

- Alameda Research

- Solana Foundation

- Serum Foundation

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.