In the crypto world, staking has become one of the most popular ways for investors to earn passive income. However, traditional staking methods often limit flexibility due to asset lock-ups. This is exactly where Stader (SD) comes in. Standing out with its multi-chain liquid staking solutions, Stader offers investors both flexibility and security.

What is Stader?

Stader is a liquid and modular staking protocol that simplifies staking across multiple blockchains. Its main goal is to make the staking process more accessible, secure, and efficient.

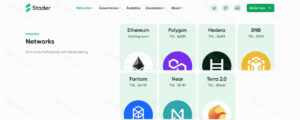

- Multi-Chain Support: Provides staking services on Ethereum, BNB Chain, Hedera, Terra 2.0, and other networks.

- Modular Structure: Users can choose validator pools that match their risk profiles and yield goals.

- Liquidity Advantage: Stakers receive liquid staking tokens in return, which they can continue to use within the DeFi ecosystem.

Stader’s Staking Performance

Stader has become the largest decentralized liquid staking platform on the Hedera network. Since August 2022, it has provided liquidity staking solutions for BNB Chain and emerged as one of the top three widely adopted staking platforms there.

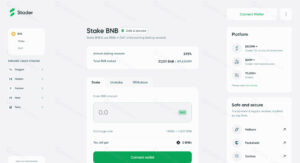

The liquidity staking solution offered by Stader Labs on BNB Chain allows users to stake BNB and receive an equivalent amount of BNBx liquid tokens. Stader Labs also collaborates with DeFi projects on BNB Chain, enabling BNBx to interact with multiple DeFi protocols within the BNB Chain ecosystem.

- Staking and BNBx Tokens

When users stake BNB on Stader Labs, a smart contract is automatically created and the corresponding BNBx tokens are issued. For example, a user staking 100 BNB receives 100 BNBx. - Yield and Value Growth

Stader Labs stakes the deposited BNB via network validation and collects the rewards. These rewards are added to the pool, causing the value and share of BNBx tokens to increase over time.

For example, with a monthly yield of 1.5%, 100 BNBx → 101.5 BNBx. - Control and Smart Contracts

The platform operates via decentralized smart contracts. Users have full control over their funds without requiring permission. - Governance and Transparency

Nodes are selected through a publicly verifiable decentralized governance list. All nodes and accounts can be verified on-chain. - Security and Auditing

Thanks to its decentralized and transparent structure, the risk of malicious activity is low. The platform ensures user fund security through on-chain auditing tools. The Stader team has not misused the platform.

Stader’s Multi-Chain Deployment

- Multi-Chain Support

Stader Labs provides intermediate infrastructure for staking, offering scalable and liquid assets across multiple blockchains. - New Value Creation

While increasing users’ staking rewards, the platform also explores new value opportunities across different ecosystems. - Decentralization

To address centralization issues in PoS networks, Stader adjusts staking ratios based on operational parameters. - Ethereum Example

After the Merge, Stader provides an alternative model to balance Lido’s dominance, which exceeds 30%. - Future Vision

Stader aims to support more public blockchains and ensure a more balanced distribution of validator nodes. - Layer-1 Support

Provides staking solutions on chains like ETH, BNB, and MATIC. - Liquid Staking

Offers chain-specific tokens such as ETHx and BNBx, giving users greater flexibility. - Unified Design Principle

Even if naming rules differ across blockchains, Stader adheres to a unified and subdivided design framework.

Stader’s Core Vision

Stader is not just a protocol that simplifies staking—it also aims to serve as a bridge between blockchains. Actively operating on Ethereum, BNB Chain, Hedera, and Terra 2.0, Stader allows users to stake across multiple networks from a single platform. This brings significant convenience for both individual investors and institutional players.

Stader’s vision is to make staking accessible to everyone. While traditional staking locks assets for long periods, Stader’s liquid staking tokens allow these assets to continue circulating in the DeFi ecosystem. Users can earn staking rewards while simultaneously lending, providing liquidity, or utilizing these tokens in other financial products.

Stader Labs Token – SD

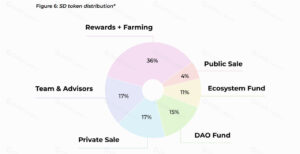

- The act of staking to mint governance tokens is designed to support the platform’s long-term development while also facilitating fundraising.

- In the first two quarters of 2022, Stader Labs conducted public token sales through auctions, issuing the platform’s SD token. Following the sale, the platform introduced a governance plan incorporating DAOs and foundations to enable comprehensive governance.

In the next SD staking rollout, a 5–10% staking commission will be rewarded.

The total supply of SD will be 150 million tokens, and the unlocking schedule will proceed according to the timelines and distribution specified in the official whitepaper.

Stader Partners and Collaborators

Stader’s partners include industry leaders:

-

Pantera Capital – a renowned global blockchain investment fund.

-

Coinbase Ventures – a leading investment firm supporting innovative blockchain projects.

-

Jump Crypto – specialized in high-tech blockchain solutions.

-

Blockchain.com – a globally recognized blockchain platform.

-

True Ventures – an investment group financing technology startups.

Stader Labs builds a strong ecosystem with its partners, offering users reliable staking opportunities and liquidity solutions. These partnerships help the platform continue growing and strengthen its leading position in the crypto ecosystem.

Market Data and Recent Developments

As of August 26, 2025, the SD token is experiencing significant market activity. The price is trading at $0.8898, with a market capitalization of $47.41 million. The 24-hour trading volume has surged to $22.98 million, marking a notable increase.

The total value locked (TVL) has reached $856.55 million, with 53.28 million SD tokens in circulation and a total supply of 120 million. In particular, following its listing on the Bithumb exchange, SD has seen a significant price increase. This development indicates growing interest in Stader in Asian markets, especially in South Korea.

Roadmap and Future Plans

Stader Labs plans to provide liquid staking solutions not only on existing blockchains but also on new networks in the future. Additionally, they aim to develop specialized solutions for institutional investors, such as banks and custodians.

Increasing DeFi integrations is one of the most important elements of Stader’s strategic plans. This will allow SD and other liquid staking tokens to be used in lending, liquidity mining, and various other applications. In the long term, these integrations are expected to boost both token demand and the overall protocol volume