Superp (SUP) is an innovative on-chain trading platform designed to provide traders with unparalleled flexibility and unique financial products as a DeFi solution. Offering high-leverage trading opportunities for Bitcoin, Ethereum, and other altcoins, Superp introduces industry-leading products such as Meme Perp (TRS), NoLiquidation Perp (PSC), and Alpha Perp. These products stand out with features like up to 10,000x leverage, trading without liquidation risk, and the ability to take short or long positions on new tokens just seconds after their launch. Superp delivers a capital-efficient and risk-managed trading experience for both individual and institutional investors.

What Is Superp (SUP)?

Superp is a decentralized derivatives trading platform that enables users to open high-leverage positions on Bitcoin, Ethereum, and hundreds of altcoins. The platform’s Meme Perp (TRS) allows users to take long or short positions on new tokens as early as 10 minutes after their market launch. The NoLiquidation Perp (PSC) product offers up to 10,000x leverage without liquidation risk, allowing users to earn returns by paying only a fixed fee. Alpha Perp provides an optimized trading experience for high-growth potential tokens listed on Binance. By creating an innovative ecosystem for liquidity providers and traders, Superp sets itself apart in the DeFi space.

What Is Superp’s Profit Swap Contract (PSC)?

Superp’s Profit Swap Contract (PSC) is a revolutionary financial instrument that allows users to pay a fixed fee to access the potential returns of an asset over a specified period. For example, by paying just 10 USDT, users can gain 100% of the returns from a price increase in 1 BTC. This product is the first in the industry to offer up to 10,000x leverage while completely eliminating liquidation risk. Users can access yields from over 100 assets, including BTC, ETH, and other altcoins. Inspired by traditional finance, the contract has been standardized for the crypto market, ensuring fast, transparent, and cost-effective transactions.

What Is a Profit Swap Contract in Traditional Finance?

In traditional finance, a Profit Swap Contract is a derivative agreement where two parties agree to share the profits generated by an asset or project over a defined period. One party makes a fixed payment in exchange for receiving variable profit-based payments. The contract typically revolves around a profit-generating asset, such as a real estate project, energy plant, or business unit. The parties agree on key terms like the profit-sharing ratio (e.g., 70%-30%) and the contract duration. Superp adapts this structure to the crypto market, offering an innovative approach.

Innovative Features of Superp’s Profit Swap Contract

- Crypto Market Standardization: Superp standardizes complex traditional finance Profit Swap Contracts for crypto, simplifying transactions, enhancing liquidity, and ensuring transparency.

- Over 100 Assets: Offers trading opportunities with BTC, ETH, and over 100 other altcoins.

- 10,000x Leverage: Provides liquidation-free leverage from 1,000x to 10,000x, enabling users to achieve high returns with low costs.

Key Features

- Low Cost: Users can access the returns of high-value assets, like 1 BTC, for as little as 10 USDT, making high-value investments affordable.

- Unlimited Leverage: As the contract nears expiration, costs decrease, boosting leverage up to 10,000x.

- No Liquidation: Losses are limited to the fixed fee paid, eliminating liquidation risk.

- Zero Slippage: Trades are executed at fixed prices, unaffected by market liquidity fluctuations.

- No Transaction Fees: Users pay only the fixed product cost, with no additional fees.

Mark Price and Price Index

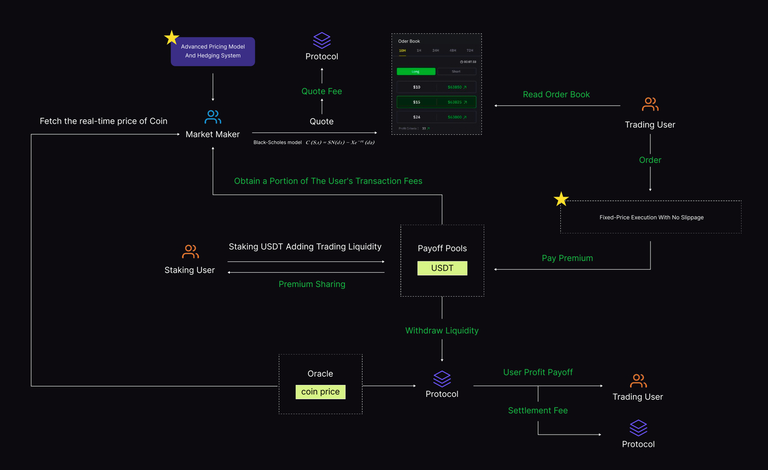

Superp’s Profit Swap Contract uses Mark Price and Price Index to prevent price manipulation. The Price Index is calculated as a weighted average of prices from multiple exchanges, reducing volatility risk. For instance, if an exchange’s price deviates by more than 5% from the median, it is capped at 1.05 or 0.95 times the median price.

Pricing (Cost)

Superp’s Profit Swap Contract is priced using the Longstaff-Schwartz Method, which employs Monte Carlo simulations and least-squares regression to value American-style options. This allows users to make optimal trading decisions based on an asset’s future price movements. The method determines the contract’s cost, dynamically reducing it as expiration approaches to increase leverage.

Market Makers

Market makers ensure liquidity on the Superp platform, enabling fast and slippage-free trading for users. By continuously providing bid and ask prices, they support market stability and hedge their risks to manage volatility. Superp is grateful for its market makers’ support and welcomes new partnerships.

Trading and Settlement Fees

Superp offers a transparent fee structure:

- Transaction Fee: Currently waived, with future fees to be determined by the Superp DAO.

- Settlement Fee: Set at 10% of profits but currently free for a limited time.

This fee-free period is made possible by community support and contributions from leading institutional investors.

Risk Management: Risk Limits

To ensure a secure trading environment in the volatile crypto market, Superp implements the following risk control measures:

- Position limits per user.

- Platform-wide aggregate position limits.

- Order frequency limits.

These measures prevent market manipulation and promote a fair trading environment.

Risk Management: Automatic Deleveraging (ADL)

Superp uses an Automatic Deleveraging (ADL) mechanism to protect users during extreme market volatility. This system reduces the most profitable positions in liquidity shortage scenarios, ensuring platform stability. ADL safeguards user profits while maintaining fair settlements. Users are encouraged to diversify their portfolios to mitigate risk.

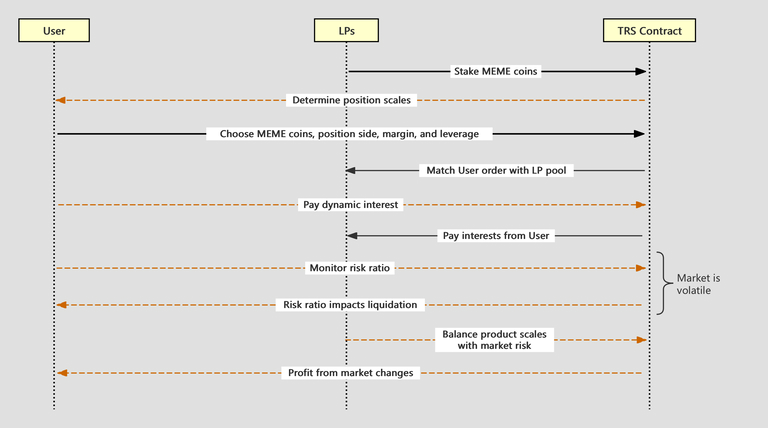

What Is Superp TRS (Total Return Swap)?

Superp TRS (Total Return Swap) is a decentralized derivatives service that allows users to take long or short positions on new tokens as early as 10 minutes after their launch. Users can open positions by paying a dynamic interest rate without borrowing tokens. Liquidity providers (LPs) stake tokens to earn interest and liquidation profits. Initially, tokens are listed based on popularity and liquidity, with permissionless listings planned for the future.

Risks

- Liquidation Risk: Positions may be liquidated if the market moves against you.

- Oracle Risk: Incorrect oracle pricing could trigger unwarranted liquidations.

- Squeeze Risk: Mass liquidation of short positions may drive rapid price increases.

- Risks for LPs: Utilization risk (tokens fully lent out) and bad debt risk (post-liquidation debt exceeding collateral).

Leverage Level

Up to 10x leverage is offered, adjusted based on token volatility.

Key Features

- Staking (Liquidity Providers): Users stake assets in the TRS liquidity pool to earn yields from traders’ fees.

- Long Positions: Users borrow assets from the pool for leveraged positions, with real-time price tracking for risk management.

- Short Positions: Assets are borrowed and sold, with profits realized by repurchasing at a lower price.

- Liquidation Mechanism: Automated liquidation triggers when the collateral ratio falls below the threshold, pausing during abnormal market conditions.

What Is Alpha Perp?

Alpha Perp is tailored for high-growth potential tokens listed on Binance. It offers tighter risk controls, a curated asset list, and dynamic interest bands for a secure and optimized trading experience. Each token has a specific LTV ratio, interest ceiling, and liquidation tolerance.

Superp Airdrop and Points System

Superp’s points system gamifies the platform, rewarding users for participation. Users earn Sugar to level up their Ice Cream Cart, unlocking greater airdrop rewards. Higher levels yield larger rewards, boosting user engagement.

Superp (SUP) Roadmap

2025

- Q1: Participation in Token2049 Dubai, seed round closure (led by Pluto Studios, Sei Network), expansion to South Korea and Japan, BNB Chain launch, Meme Perp test version.

- Q2: Integration with DAppbay and DefiLlama, Alpha Perp testnet launch, airdrop campaigns, rebranding to Superp.

- Q3: Tokenomics announcement, Alpha and Meme Perp limited beta testing, CEX/DEX listings, $37 billion USDT trading volume, and 6 million users.

- Q4: Solana integration, new trading pairs, crypto-stock leveraged product launch, introduction of standard perpetual products.

2026

- Q1: Official launch of standard perpetual contracts, risk management system upgrades, Trade-to-Earn incentives, liquidity mining campaigns, token burn or buyback schedule.

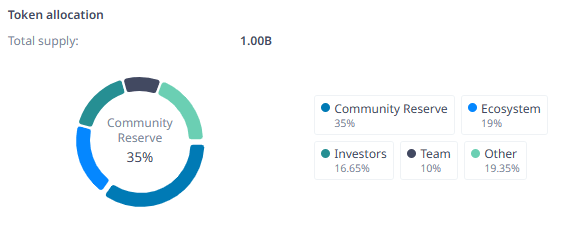

Superp (SUP) Tokenomics

- Token Name: $SUP

- Total Supply: 1,000,000,000 $SUP

- Circulating Supply: 175,000,000 $SUP

Distribution:

- Team: 10% (1-year cliff, 3-year linear vesting)

- Advisors: 3.35% (1-year cliff, 3-year linear vesting)

- Investors: 16.65% (6-month cliff, 2-year linear vesting)

- Airdrop: 5% (Distributed at TGE)

- Community Reserve: 35% (From month 2, 4-year linear vesting)

- Marketing: 6% (2% at TGE, 4-year linear vesting)

- Ecosystem: 19% (10% at TGE, 4-year linear vesting)

- Liquidity: 5% (Deployed at TGE)

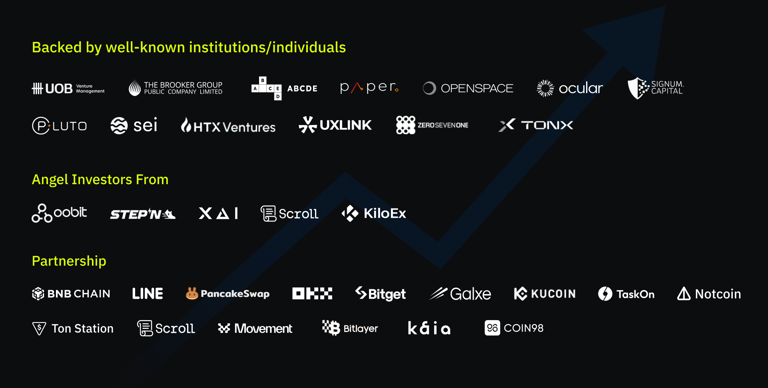

Superp (SUP) Investors and Backers

Backers: Pluto, Sei, UOB, HTX Ventures, UXLink, ZeroSevenOne, TONX, Ocular, Signum Capital, Openspace, Paper, ABCDE, The Brooker Group. Angel Investors: Oobit, STEPN, xAI, Scroll, Kiloex.

Superp (SUP) Team

Superp’s team comprises experts in developing innovative financial solutions. Led by Michael Cameron in marketing, the team drives the platform’s global growth. With deep expertise in DeFi and derivatives trading, they aim to build a user-centric trading platform. Supported by a strong community and prominent investors, Superp plays a pioneering role in the crypto ecosystem.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.