Crypto markets are inherently characterized by high volatility, intense information flow, and constantly shifting narratives. On-chain data, technical indicators, social media sentiment, macroeconomic developments, and project-specific token economics create dozens of different data layers that investors and researchers must track simultaneously. This complex structure is increasingly highlighting the limitations of classic analysis tools and general-purpose AI models.

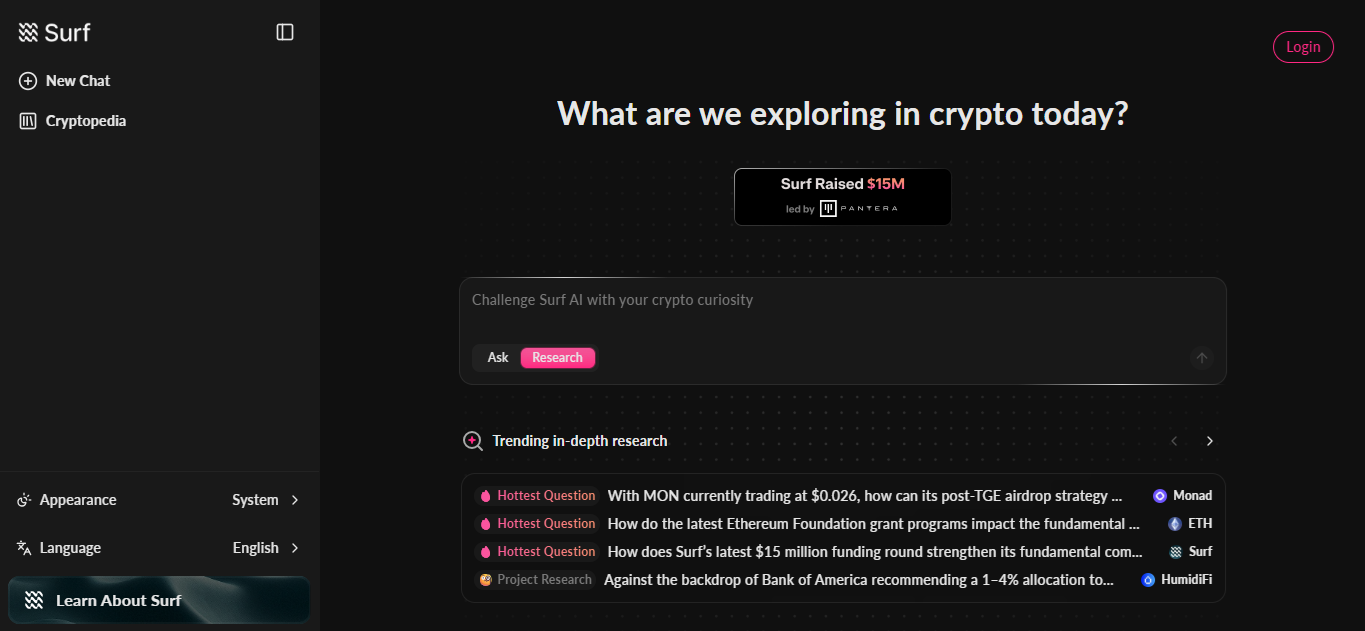

Surf AI is positioned exactly at this point as an AI research copilot specifically trained for crypto markets. Unlike general LLMs, Surf focuses solely on the crypto and blockchain ecosystem, generating real-time, actionable insights across a broad spectrum—from on-chain data to social sentiment, technical analysis to in-depth research reports.

In this article, we examine in detail what is Surf AI, what it offers, the use cases where it stands out, and the technical capabilities that set it apart from similar tools.

What is Surf AI?

Surf AI can be defined as an AI research copilot developed specifically for crypto markets. Its core purpose is to aggregate data scattered across different platforms into a single hub and deliver meaningful, readable, and actionable outputs for crypto investors and researchers.

In simple terms, Surf:

- Analyzes on-chain data

- Tracks social media and KOL (Key Opinion Leader) sentiment

- Interprets technical analysis indicators

- Scans crypto-focused content on the web

- Combines all this data to provide users with clear insights

It does this without forcing users to navigate dozens of different tabs, charting tools, and data platforms. Surf positions itself as a 24/7 crypto research team focused exclusively on crypto markets.

What Does Surf AI Do?

Surf AI’s use cases are not limited to price tracking. The platform offers a wide research scope for both individual investors and professional crypto teams.

Market Analysis and Trading Insights

Surf evaluates short-term price movements for BTC, ETH, and trending altcoins using:

- Real-time on-chain data

- Social sentiment analysis

- Derivatives markets (open interest, funding rates, etc.)

This allows it to answer not only “what happened?” but also “why did it happen and what might happen next?” The goal is to provide users with clear signals for capturing alpha.

DeFi Protocol Research

In the DeFi ecosystem, interpreting data correctly is as critical as accessing it. Surf AI analyzes:

- TVL (Total Value Locked) movements

- Annualized yield rates

- Liquidity flows

- Airdrop potentials

on a protocol-by-protocol basis. It delivers detailed summaries for areas like Uniswap, Aave, restaking protocols, and LRT structures, freeing users from raw data.

On-Chain Intelligence and Risk Detection

One of Surf AI’s strongest features is its on-chain intelligence capability. The platform can track:

- “Smart money” wallets

- Whale inflows and outflows

- New contract deployments

- Project treasury movements

It also analyzes potential rug-pull risks, abnormal token movements, and supply circulation signals, serving as an early warning system.

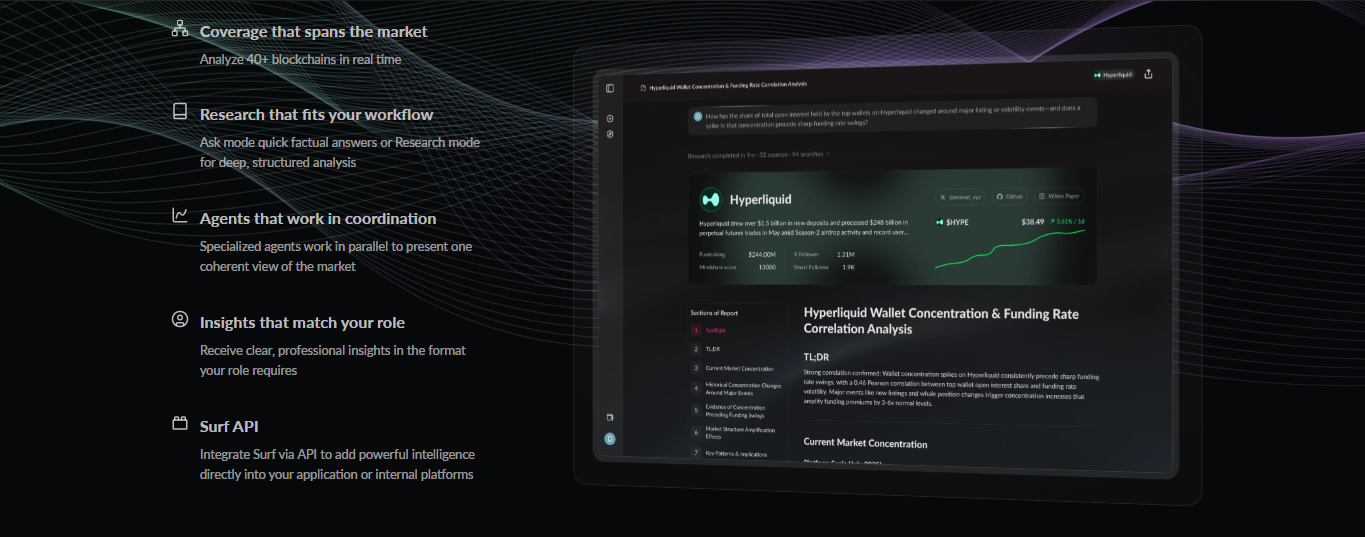

Cross-Chain Ecosystem Tracking

The crypto ecosystem is no longer centered around a single chain. Surf AI simultaneously monitors over 40 blockchains, including:

- Ethereum and its L2s

- Solana

- Base

- TON

- BNB Chain

Its AI agents also evaluate narratives like meme coins, gaming, and DePIN from a cross-chain perspective.

Whitepaper and Tokenomics Summaries

Surf summarizes long and technical documents in an accessible way, converting:

- Whitepapers

- Airdrop rules

- Token distribution models

- Vesting schedules

into short, clear, timeline-focused reports. This feature provides significant time savings for investors who need to make quick decisions.

Macroeconomic and Regulatory Impacts

Crypto markets are no longer independent of macro developments. Surf AI analyzes correlations between crypto price movements and:

- Fed policies

- ETF inflows/outflows

- Stablecoin supply changes

- Global liquidity trends

to offer a broader perspective.

Technical Features That Make Surf AI Unique

Social Sentiment Analysis

Surf monitors over 100,000 crypto KOLs and key social accounts in real time. This enables early detection of:

- Shifts in market narratives

- Breaks in community sentiment

- Hype and FUD cycles

Advanced Technical Analysis Infrastructure

The platform interprets over 200 technical indicators and derivatives market data in an integrated manner. It goes beyond classic “RSI high/low” approaches, taking into account crypto-specific 24/7 market dynamics.

On-Chain Tracker

Detailed analysis across over 40 blockchains, covering:

- Wallet behaviors

- Token flows

- Supply changes

Whale movements and project-internal transfers are presented with context.

Deep Search Agent

Every query in Surf scans:

- Over 200 crypto-focused websites

- The platform’s own database

This produces deep, contextual research outputs rather than surface-level ones.

Difference Between Ask Mode and Research Mode

Surf AI offers two main usage modes:

Ask Mode

- Fast and direct answers

- Single question – single response logic

- Ideal for current prices, short news, and simple checks

Research Mode

- Multi-sourced, structured analysis

- Combination of social, on-chain, and technical data

- Charts, summaries, and conclusion sections

- Suitable for strategy development and in-depth analysis

This distinction makes Surf a flexible tool for both daily use and professional research.

Where Can Surf AI Be Used?

Surf AI is accessible via:

- Web application

- iOS mobile app

- Android mobile app

The web app is optimized for desktop use, while the mobile apps provide a tailored experience.

Subscription Model and NFT Structure

Surf AI offers free and paid plans.

- Free users can use Ask and Research modes with limited quotas

- Paid members have higher usage limits and priority support

- Annual subscriptions include exclusive Surf NFTs

These NFTs are positioned not as tokens but as membership badges and long-term supporter identifiers.

Will Surf AI Launch a Token?

As of now, Surf AI has no plans for a token launch. The project prioritizes product development and user experience. Any potential changes will only be announced through official channels.

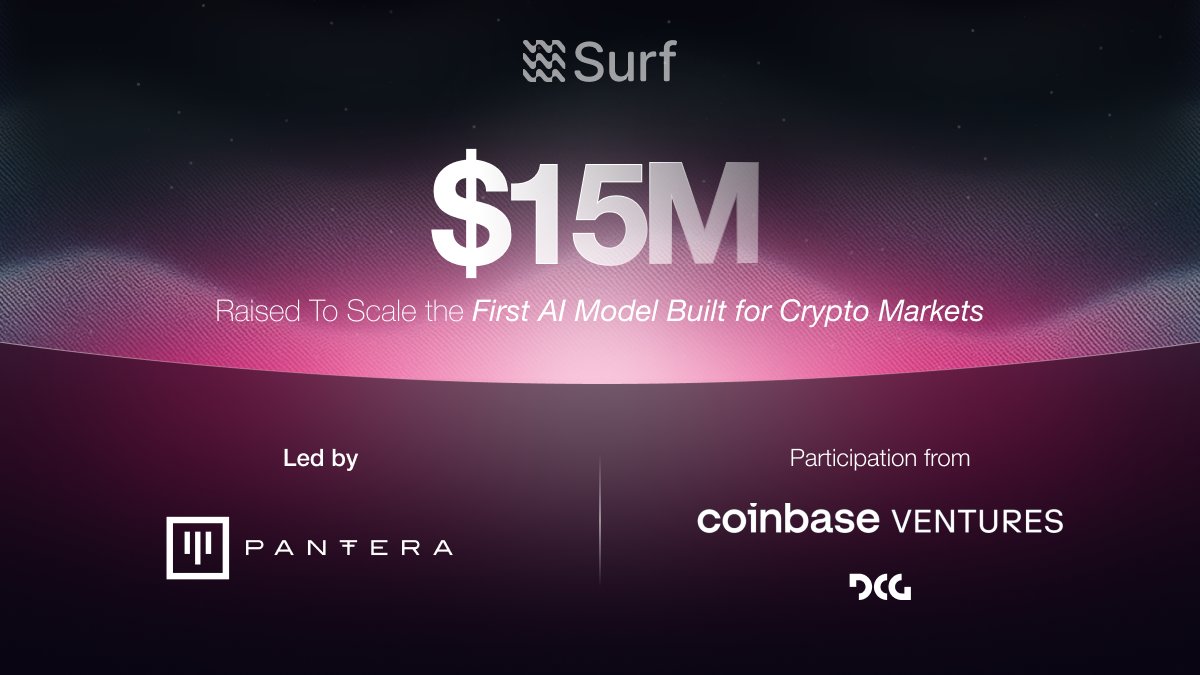

Surf AI Investors

Surf AI stands out not only for its technical capabilities but also for its strong investor backing. The platform is supported by some of the most respected funds in the crypto and tech ecosystems with long-standing involvement.

Leading investors in Surf AI include:

- Pantera Capital

- Coinbase Ventures

- Digital Currency Group (DCG)

These funds have previously participated in the early stages of many major crypto and blockchain projects, making investments that shaped the ecosystem.

The company successfully completed a $15 million funding round to scale the first AI model developed specifically for crypto markets. The round was led by Pantera Capital, with participation from Coinbase Ventures and Digital Currency Group.

Additionally, Surf AI is recognized as a trusted research infrastructure by leading Web3 institutions such as Pantera, DCG, HASHED, IOSG Ventures, and YZi Labs.

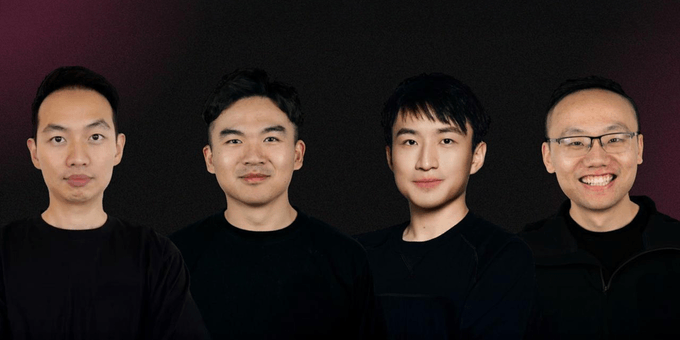

Surf AI Team

The founding team of Surf AI consists of individuals with many years of experience in AI and crypto. The co-founders are:

- Wilson Wei

- Ryan Li

- Shiyu Zhang

- Zhimao Liu

In particular, Ryan Li has nearly a decade of experience in artificial intelligence and has previously been involved in multiple ventures in the crypto sector. The team describes their core motivation in building Surf AI as minimizing common AI “hallucinations” in crypto markets and developing a system that produces analyst-level reliable outputs.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.