SX Network (SX) is a blockchain initiative aiming to become the global liquidity hub for sports betting. It seeks to empower bettors by slashing the industry-standard 5% vig by 95%, bringing it below 0.25%. Additionally, it enhances access, security, and transparency. SX’s unique blockchain-powered protocol and application make this possible for the first time. This article explores what SX Network is, how it operates, and the opportunities it offers.

What is SX Network (SX)?

SX Network powers SX Bet, a decentralized, peer-to-peer betting exchange that delivers superior odds compared to traditional sports betting platforms. By reducing the vig from 5% to under 0.25%, it provides 7-10% higher payouts. SX Bet creates a dynamic marketplace where bettors wager against each other, free from odds dictated by a central authority. Users can set their own odds, accept others’ bets, or even develop custom quantitative betting strategies using SX API documentation. SX treats sports betting as a financial market, prioritizing winning over gambling.

Purpose of SX Network (SX)

SX Network aims to revolutionize sports betting by drastically lowering the vig, enabling bettors to maximize profits. It boosts accessibility, security, and transparency. Its decentralized, non-custodial structure ensures users retain full control over their funds. Every bet is recorded on-chain, creating a transparent and tamper-proof ledger. SX Bet does not ban or restrict winning bettors, offers open access, and keeps APIs publicly available to foster innovative betting tools.

How Does SX Network (SX) Work?

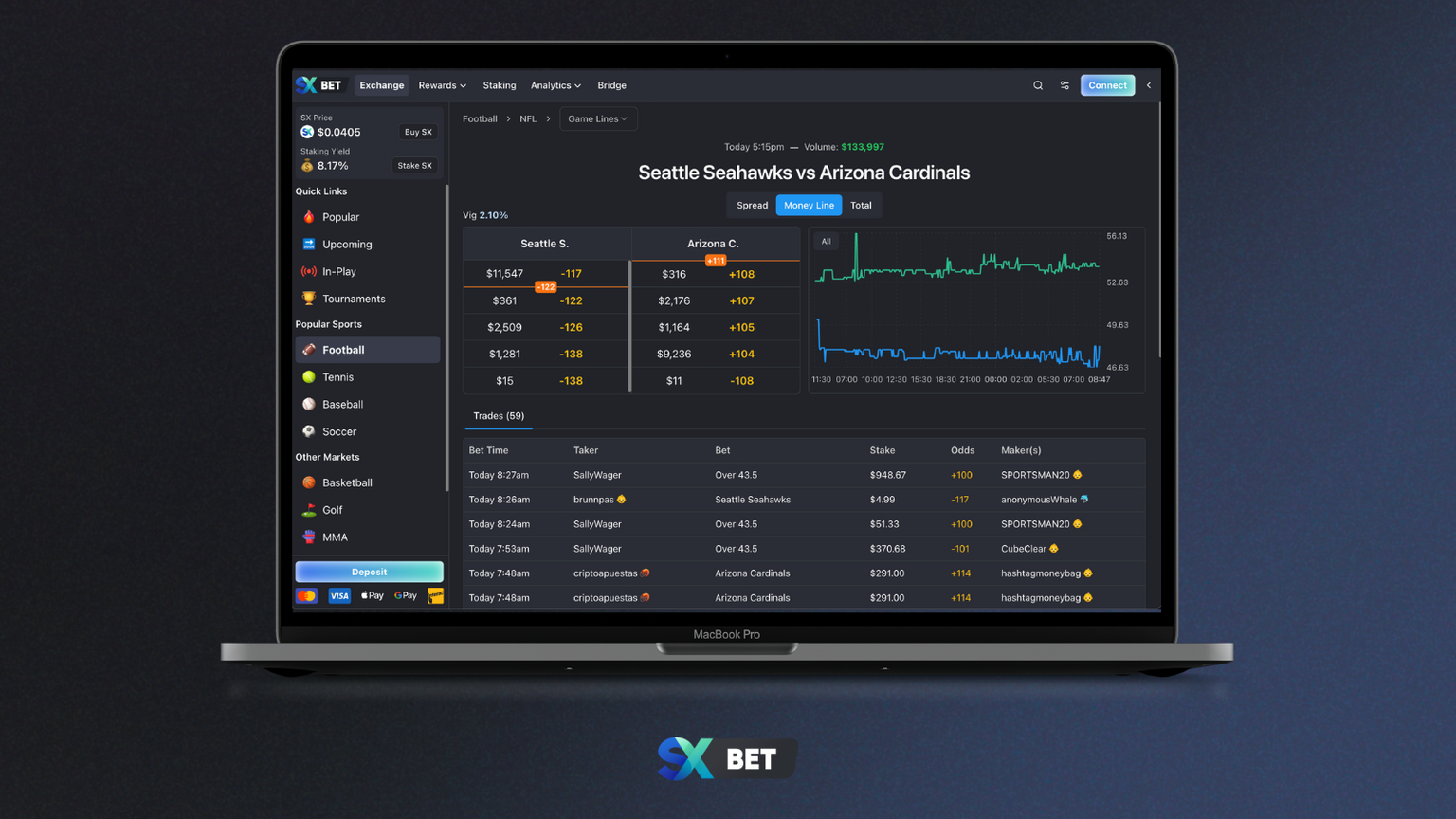

SX Bet operates as a peer-to-peer betting exchange, with users holding funds in their own wallets (e.g., MetaMask). Bets settle on-chain, ensuring transparency and trust. SX employs a hybrid off-chain order book and on-chain settlement infrastructure. Its custom data oracle delivers 99.97% accuracy in market creation and reporting.

Key Features:

-

Market Registry: Betting markets are defined by sport, league, team names, bet type (Moneyline, Spread, Total), and game time. A market hash is stored in the Registry.

-

Escrow Contract: When a bet is offered and accepted, funds are atomically transferred to the Escrow Contract, held until the market creator reports the outcome (Outcome1, Outcome2, or Void). Void bets are refunded without fees.

-

Market Makers: Provide diverse, deep liquidity to support SX’s competitive odds.

-

Whale and Syndicate VIP Service: Average bet size is ~$345, significantly larger than traditional platforms; VIP managers offer tailored opportunities.

-

Low Latency: Fast order book and reliable data reporting.

Traction:

-

Daily bets hit new peaks annually, with Q4 growth expected due to NFL, NBA, and NHL seasons.

-

Total betting volume exceeds $750 million, with the next $750 million anticipated soon.

SX Network (SX) Use Cases

SX is designed for sports betting, ideal for professional bettors, syndicates, and whales. Users can:

-

Place bets with better odds.

-

Offer their own bets.

-

Build custom betting bots using the SX API.

Usage Steps:

-

Connect a MetaMask wallet.

-

Deposit USDC to SX Bet.

-

Place bets or offer custom odds.

-

Develop strategies with the API.

Advantages of SX Network (SX)

-

Low Vig: Below 0.25%, yielding 7-10% higher payouts.

-

Transparency: On-chain bet records, order book, and market movements.

-

Security: Non-custodial wallets, full user control over funds.

-

Open Access: No bans on winning bettors, publicly accessible APIs.

Risks of SX Network (SX)

-

Market Scope: Limited to major sports (NFL, NBA, MLB, NHL).

-

Volatility: Crypto market risks.

-

Regulation: Sports betting regulations.

SX Network (SX) Tokenomics

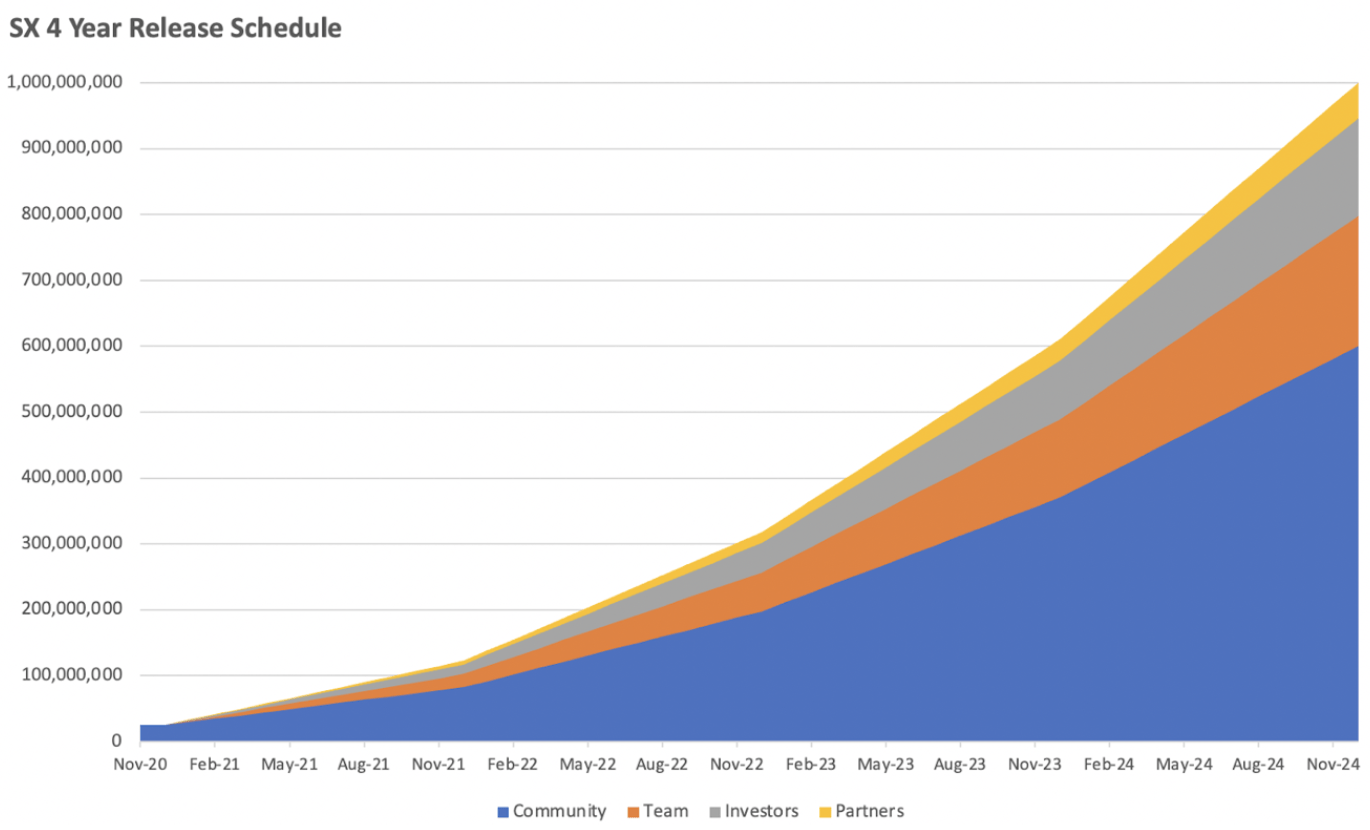

Total Supply: 1,000,000,000 SX (January 2021).

-

Initial Allocation:

-

Community Fund: 53% (4-year vesting)

-

Core Team: 22.86% (4-year vesting)

-

Early Backers: 10.31% (4-year vesting)

-

Marketing: 5% (4-year vesting)

-

Airdrop: 2% (available at TGE)

-

-

Current Allocation (January 1, 2025):

-

Community Fund: 46.52% (465,281,969 SX)

-

SX Holders: 53.39% (533,972,010 SX)

-

Staked SX: 318,378,110 SX

-

LP SX: 7,464,965 SX

-

Circulating SX: 208,128,973 SX

-

-

-

SX Utility: Staking (rewards in USDC, ETH, SX), governance, gas token.

SX Network (SX) Backers

CMCC Global, Nascent, Hack VC, FJ Labs, Draper Dragon, CMS.

SX Network (SX) Team

-

Andrew Young (Co-Founder & CEO): Focuses on strategy and SX promotion on Twitter; previously at BMO trading floor.

-

Julian Wilson (Co-Founder & CTO): Oversees technical architecture; worked on BMO’s ETF desk.

-

Jake Hannah (Co-Founder & COO): Manages operations and growth; previously at CIBC.

-

Lakshan Siva (Director of Engineering): Leads the tech team; formerly at Echoworx.

-

Dan Kostiuk (Lead Architect): Designs major roadmap items; previously at Clevertech.

This content is for informational purposes only and does not constitute investment advice.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.