Velvet Capital (VELVET) is an AI-powered DeFi (decentralized finance) trading and portfolio management ecosystem that stands out in the crypto space. In this article, we will explore what Velvet Capital (VELVET) is, the problems it solves, its key features, and its use cases in detail.

What is Velvet Capital (VELVET)?

Founded by a team with extensive experience in the crypto world since 2016, Velvet Capital is a platform equipped with innovative technologies, offering a user-friendly interface that provides comprehensive solutions for both individual and institutional investors.

The VELVET token serves as the cornerstone of this ecosystem, used for platform governance, transaction fee discounts, and staking rewards.

What Problems Does Velvet Capital Solve?

The decentralized finance (DeFi) ecosystem, despite its opportunities, faces several challenges. Velvet Capital addresses these issues with innovative solutions:

DeFi Complexity and Fragmentation

Navigating different protocols, interfaces, and blockchain networks in the DeFi world is both time-consuming and complex. Users often have to manage multiple wallets and platforms to handle their portfolios. Velvet Capital eliminates this complexity by consolidating all operations into a single platform.

Lack of Professional Tools

Traditional DeFi platforms typically offer basic swapping functionalities and lack the advanced tools professional investors require. Velvet bridges this gap by providing MEV protection, smart routing, and institutional-grade analytics tools.

Information Overload and Insufficient Analysis

DeFi users are bombarded with vast amounts of data, including price feeds, social media sentiment, and on-chain analytics. Processing this data meaningfully is challenging. Velvet’s AI-powered system analyzes this data to deliver actionable insights to users.

Inefficient Capital Management

Current DeFi solutions struggle to optimize capital allocation across multiple protocols. Velvet enables users to seize yield opportunities, easily rebalance portfolios, and automate complex strategies.

The Story Behind Velvet Capital

Velvet Capital was founded by a team active in the crypto space since 2016. The team’s diverse expertise spans developing digital investment platforms in traditional finance, managing Web3 incubators, and contributing to the Ethereum Foundation. This experience led to the creation of Velvet Capital to address the complexity of DeFi portfolio management. The platform adopts a DeFAI (AI-powered DeFi) approach, making sophisticated strategies accessible to both individual users and institutions. Additionally, through Velvet DAO, it offers a community-driven governance model with a vision of progressive decentralization.

Key Features of Velvet Capital

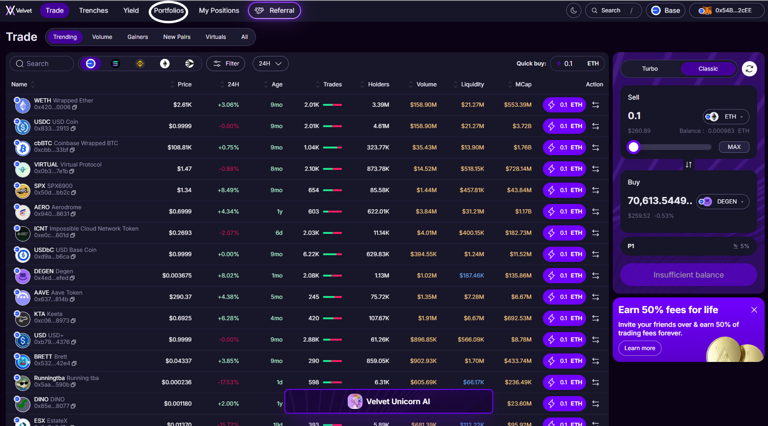

Velvet Capital stands out in the DeFi world with its innovative features. Here are the platform’s key features:

1. Smart and Intent-Based Trade Execution

Velvet’s intent-based transaction architecture intelligently routes trades across on-chain sources (AMMs, DEXes) and OTC-like platforms to ensure optimal execution. This system provides users with best price guarantees and MEV protection, delivering an institutional-grade trading experience.

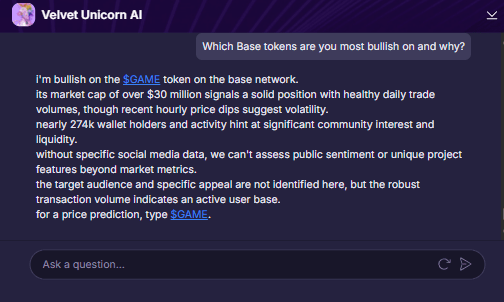

2. Velvet Unicorn: AI-Powered Assistant

Velvet Unicorn is the platform’s AI layer, drawing significant attention. This multi-agent system operates with specialized AI models, each assigned specific roles (CEO, Researcher, Analyst, Trader). Users can ask questions in natural language (e.g., “Which tokens are trending on Base?”) to receive insights on market trends, social sentiment analysis, and technical analysis. Moreover, Velvet Unicorn can automatically execute trades or strategies based on user instructions.

3. Seamless DeFi Yield Optimization

Velvet integrates with over 30 DeFi protocols, enabling users to access yield opportunities with a single click. Actions like trading, token approval, and staking are consolidated into a single transaction, allowing users to optimize their portfolios effortlessly.

4. Non-Custodial Portfolio Management

Velvet’s portfolio vaults operate through smart contracts, ensuring users maintain full control over their assets. Portfolio managers can implement strategies without holding user funds, while users can withdraw their assets by burning LP tokens at any time. Additionally, multi-signature (multi-sig) support caters to institutional needs.

5. Multi-Chain Infrastructure

Velvet operates on popular blockchain networks such as Base, Solana, Ethereum, BNB Chain, and Bitlayer. In the future, it will offer omni-chain strategies, allowing managers to execute trades across multiple ecosystems simultaneously.

Use Cases of Velvet Capital

Velvet Capital caters to a wide range of users with its versatile applications:

Professional Trading and Research

Crypto traders can use Velvet’s trading terminal to discover trending tokens, analyze high-volume pairs, and gain real-time insights through the AI assistant. Trading via natural language commands offers significant convenience for both experienced and novice traders.

Community Portfolio Management

Investment DAOs, influencers, and trading groups can leverage Velvet’s vault creation tools to build transparent performance records. Community members can join strategies at the same prices as managers, protected from front-running risks.

Institutional DeFi Solutions

Hedge funds and asset managers can use Velvet’s white-label infrastructure to launch DeFi products under their own brands. This eliminates costly and time-consuming development processes, enabling rapid market entry.

Automated Strategy Execution

Advanced users can utilize Velvet’s API layer to create custom trading algorithms and automate complex strategies. The AI framework can autonomously manage portfolios based on market conditions and predefined parameters.

The Future of Velvet Unicorn

Velvet Unicorn is at the core of the platform’s AI-driven vision, progressing through a three-phase roadmap:

Phase 1: On-Chain Research

This phase is complete, with Velvet Unicorn capable of discovering alpha and making price predictions using on-chain data.

Phase 2: Intent-Based Execution

Velvet Unicorn executes automated trades and DeFi actions based on user instructions.

Phase 3: Autonomous Trading and Portfolio Management

In the future, Velvet Unicorn will offer fully automated strategies, including trend token scanning, portfolio creation, volatility-based rebalancing, and treasury management.

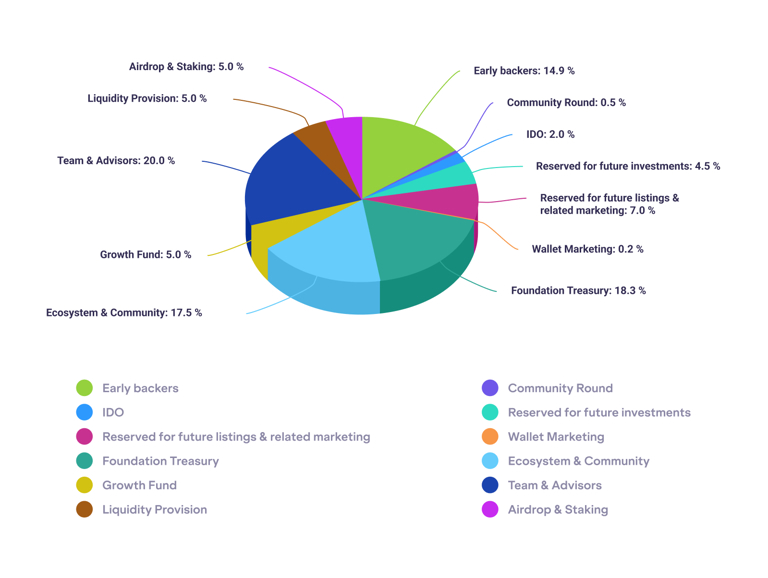

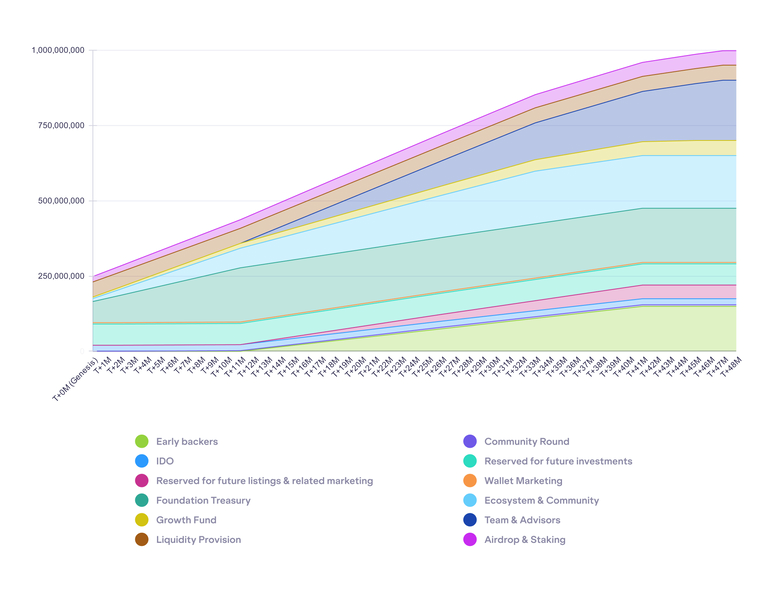

VELVET Token and Tokenomics

The VELVET token is a utility token that supports the platform’s operations and governance. The token distribution is as follows:

-

20% Team and Advisors (1-year lockup, 3-year linear vesting)

-

18.3% Foundation Treasury (DAO-managed for development and security)

-

17.5% Ecosystem and Community (grants for developers and projects)

-

14.9% Early Investors (Binance Labs, Selini Capital, etc.)

-

7% Exchange Listing and Marketing

-

5% Growth Fund (for referral programs)

-

5% Liquidity Provision (for DEX and CEX)

-

5% Airdrop and Staking Rewards

VELVET Vesting Schedule

Security and Audits

Velvet Capital places great emphasis on security. All smart contracts have been audited seven times by leading firms such as Peckshield, Softstack, and Resonance Security. Additionally, real-time threat monitoring is provided through Forta and Open Zeppelin Defender 2.0. Tenderly integration offers instant alerts for on-chain events.

VELVET Investors

Velvet Capital is backed by prominent investors, including YZi Labs (formerly Binance Labs), SkyVision Capital, Blockchain Founders Fund, Rarestone Capital, Arbitrum Foundation, and Cointelegraph.

Velvet Capital Founding Team

-

Vasily Nikonov: Founder and CEO

-

Ankit Raj: CTO

-

Michael Hage: VP of Business Development

-

Brendan Nestor: Head of Growth

Official Links

- Velvet Capital (VELVET) Website

- Velvet Capital (VELVET) X (Twitter)

- Velvet Capital (VELVET) Whitepaper

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.