Vision (VSN) is the cornerstone token of Bitpanda’s Web3 ecosystem, an ERC-20 token connecting 6.7 million users to decentralized finance (DeFi), cross-chain trading, and tokenized assets. By merging Bitpanda’s legacy tokens, BEST and Pantos, it simplifies access to services like the Bitpanda Broker (20% fee discounts), DeFi Wallet (staking rewards), and Launchpad (early project access). VSN fosters a user-centric ecosystem that promotes Web3 participation within a regulated framework.

What is Vision (VSN) and What Does It Offer?

VSN is designed as a unified token for Bitpanda’s Web3 vision. Minted on Ethereum with a fixed initial supply of 4.2 billion tokens, VSN delivers functionality at both application and protocol levels. On the Bitpanda Broker, users paying fees with VSN receive a 20% discount, with the same reduction applying to swap fees in the self-custodial Bitpanda DeFi Wallet. Within the wallet, users can stake VSN to earn emission-based yields, with parameters like emission rates, burn schedules, and protocol upgrades determined by token-holder governance. Staking operates on a non-custodial model with a 14-day cooldown period, encouraging long-term engagement.

Gamified on-chain missions integrated into the wallet reward users with VSN bonuses, and staking positions qualify for airdrops distributed via Bitpanda Spotlight. Planned liquidity mining campaigns will enhance base staking yields with partner-funded incentives. VSN unifies the Bitpanda Broker, DeFi Wallet, upcoming Launchpad, and Vision Chain Layer-2 network, aiming to serve as a gateway for regulated Web3 participation in Europe.

Technology and Ecosystem

VSN operates as an ERC-20 token on Ethereum’s Proof-of-Stake consensus mechanism, supporting cross-chain functionality. It integrates with Bitpanda’s ecosystem through:

- Vision Chain: An Ethereum Layer-2 network optimized for regulated assets like tokenized securities and commodities.

- Vision Protocol: Aggregates decentralized exchanges like 1inch, enabling cross-chain swaps within the Bitpanda DeFi Wallet.

- Cross-Chain Integration: Leverages Chainlink’s CCIP protocol for secure transfers across Ethereum, Arbitrum, and Hyperliquid.

VSN transactions are secured by Ethereum’s gas fees, where users set a gas limit (maximum work required) and gas price (ETH amount per gas unit). Higher gas prices prioritize transactions.

Offering and Conversion Process

VSN is offered to existing BEST and PAN token holders through a migration process. Conversion rates are based on the 30-day average closing prices ending March 25, 2025:

- 1 BEST = 4.91 VSN

- 1 PAN = 0.89 VSN

Each user’s VSN allocation is calculated by multiplying their BEST and PAN balances by these rates. The starting price is determined by dividing the combined fully diluted valuation (FDV) of BEST and PAN by the 4.2 billion VSN token supply. The Euro-equivalent price is displayed on the Bitpanda platform during the offer period. The offer occurs in two phases:

- First Phase (2025-07-09 to 2025-07-16): BEST and PAN holders have 8 calendar days to opt-in to exchange their tokens for VSN. Approved tokens are pooled in TrustVault and converted via the VSN migration smart contract.

- Second Phase (Late Migration): Late exchanges are processed in weekly batches directly from Bitpanda’s reserves.

Approximately 2.73 billion VSN (assuming 67% of BEST and 55% of PAN are converted) will enter circulation, with the remaining ~1.47 billion held in the Foundation’s treasury. Post-conversion, BEST and PAN tokens are burned and cease to exist. No fees are charged during the offer, and investors can exercise a withdrawal right within the 8-day period via electronic means (email, customer support), retaining their BEST/PAN balances if they opt out.

Trading and Access

At the end of the first offer phase, VSN aims to be listed for trading on Kraken, followed by other reputable centralized and decentralized exchanges. Access to exchanges requires account registration and KYC/AML verification. Transaction, withdrawal, and other fees are set by exchanges, not controlled by Bitpanda. VSN can be stored in ERC-20-compatible wallets and freely traded on secondary markets.

Governance and Usage

VSN holders can stake tokens via the VSN decentralized application (DApp) and participate in governance votes through snapshot.org, shaping parameters like burn rates and incentive distributions. Rights and obligations can only be modified through successful governance proposals. VSN does not confer claims to dividends, interest, or corporate voting rights against the Foundation or its affiliates, offering only staking and governance functionalities.

Sustainability

VSN operates on Ethereum’s Proof-of-Stake consensus, with low energy consumption (10,348 kWh annually). ESG data is transparently shared via Bitpanda’s third-party providers. Ethereum’s energy-efficient structure mitigates environmental concerns, though some investors may view crypto assets negatively from an ESG perspective.

Mitigation Measures

- Rigorous Selection: The Foundation applies strict standards for third-party providers.

- Liquidity Management: Buybacks and promotions reduce volatility.

- Security: Continuous threat monitoring and bug bounty programs minimize risks.

- Governance: On-chain voting enables adaptation to market conditions.

Vision (VSN) bridges regulated finance and decentralized ecosystems, leveraging Bitpanda’s regulatory expertise and user base to drive Web3 adoption. With staking, governance, and fee discounts, it aims to be a gateway to decentralized finance in Europe. Its success depends on balancing compliance with DeFi innovation.

Vision (VSN) Tokenomics and Governance

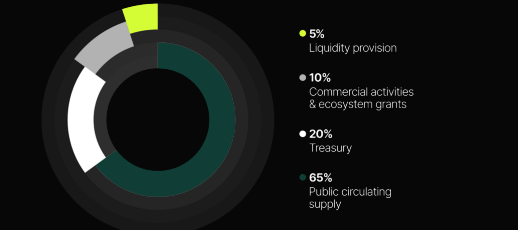

VSN’s fixed 4.2 billion token supply is managed by the Vision Web3 Foundation. Key mechanisms include:

- Burns: A portion of trading, swap, and Launchpad listing fees funds token buybacks and burns.

- Staking: Non-custodial staking with a 14-day cooldown encourages long-term participation, targeting a 5% annual emission rate (potentially decreasing over time).

- Governance: Quarterly on-chain votes determine emission rates, burns, and protocol upgrades.

The Foundation retains a portion of tokens for liquidity provisioning, staking rewards, promotional activities, and ecosystem grants. Token supply can be dynamically adjusted via governance, with unlimited minting controlled to balance reward distribution and prevent excessive dilution.

- Total Supply: 4.2 billion VSN

- Public Sale: 0.66% (27.55 million)

- Circulating Supply: 65%

- Treasury: 20%

- Commercial Activities and Ecosystem Grants: 10%

- Liquidity Provisioning: 5%

- Fully Diluted Valuation (FDV): $462 million USD

Vision (VSN) Partnerships

Vision (VSN), as a token powering the Web3 ecosystem, has established strategic partnerships with leading exchanges and organizations. It is listed on major centralized exchanges like KuCoin, Gate.io, MEXC, and Kraken, ensuring global accessibility. Additionally, collaborations with globally recognized sports clubs like AC Milan and Paris Saint-Germain connect sports enthusiasts with Web3. Partners such as Impossible Finance, IMC, Selini, Auros, and Da Vinci support Vision’s innovative projects, liquidity provisioning, and tokenized asset infrastructure, contributing to the ecosystem’s growth.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.